- Ontology’s price pump on Monday excited traders looking for opportunities

- ONT’s on-chain metrics did not show high activity and usability levels

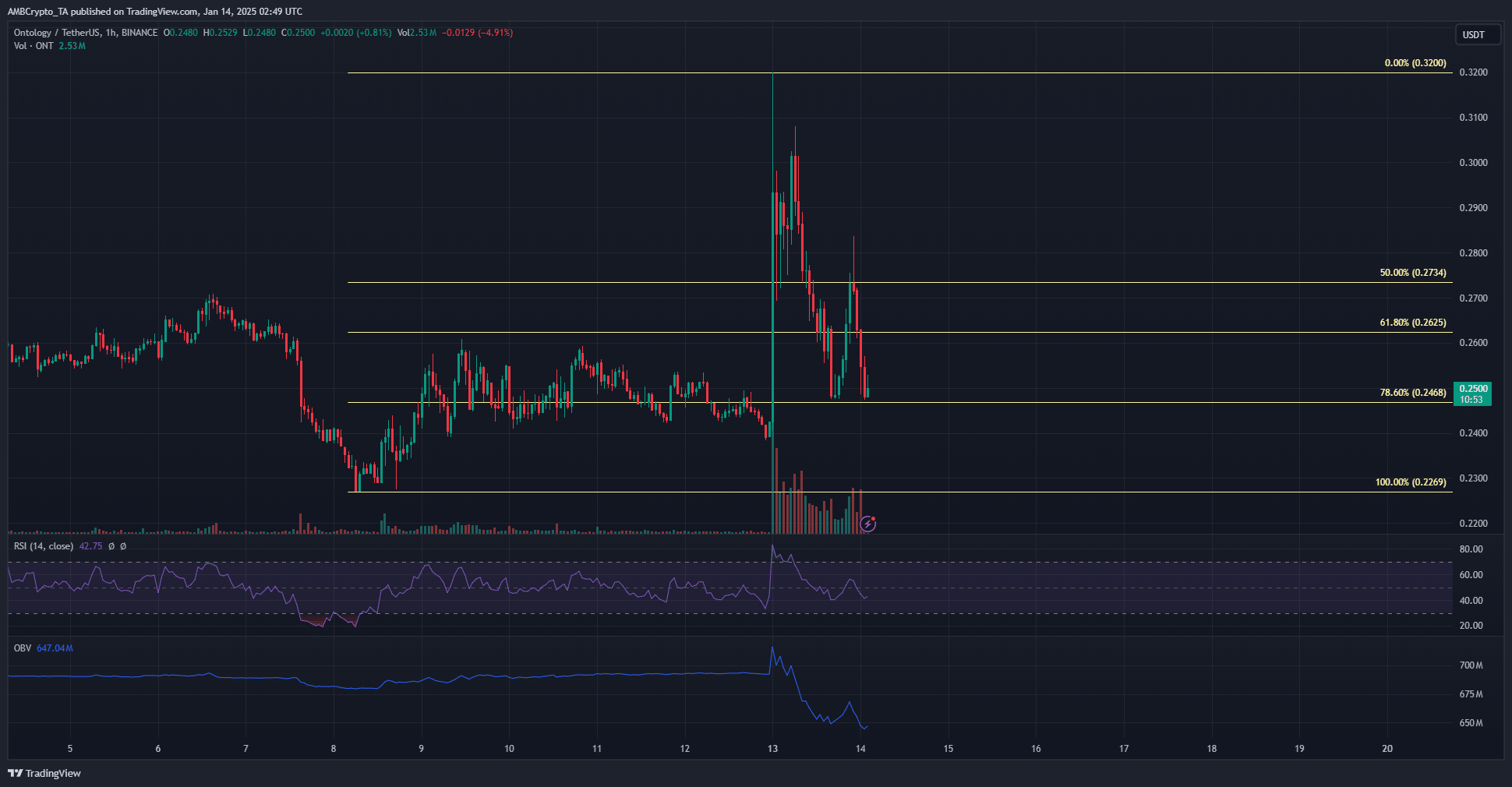

Ontology [ONT] on Monday, January 13, up 33.84% in two hours. Open Interest soared by more than 400% as speculators rushed to find profitable trades.

Source: ONT/USDT on TradingView

However, ONT quickly returned from its pump. It still has a bullish outlook for the coming days as the 78.6% retracement level at $0.246 has been defended on retests. However, the OBV suffered a major blow. The RSI was also below the neutral 50, indicating bearish momentum.

What are the chances of a steady upward trend for Ontology? Well, the data available at the time of writing was not encouraging.

Ontology metrics all have one thing in common

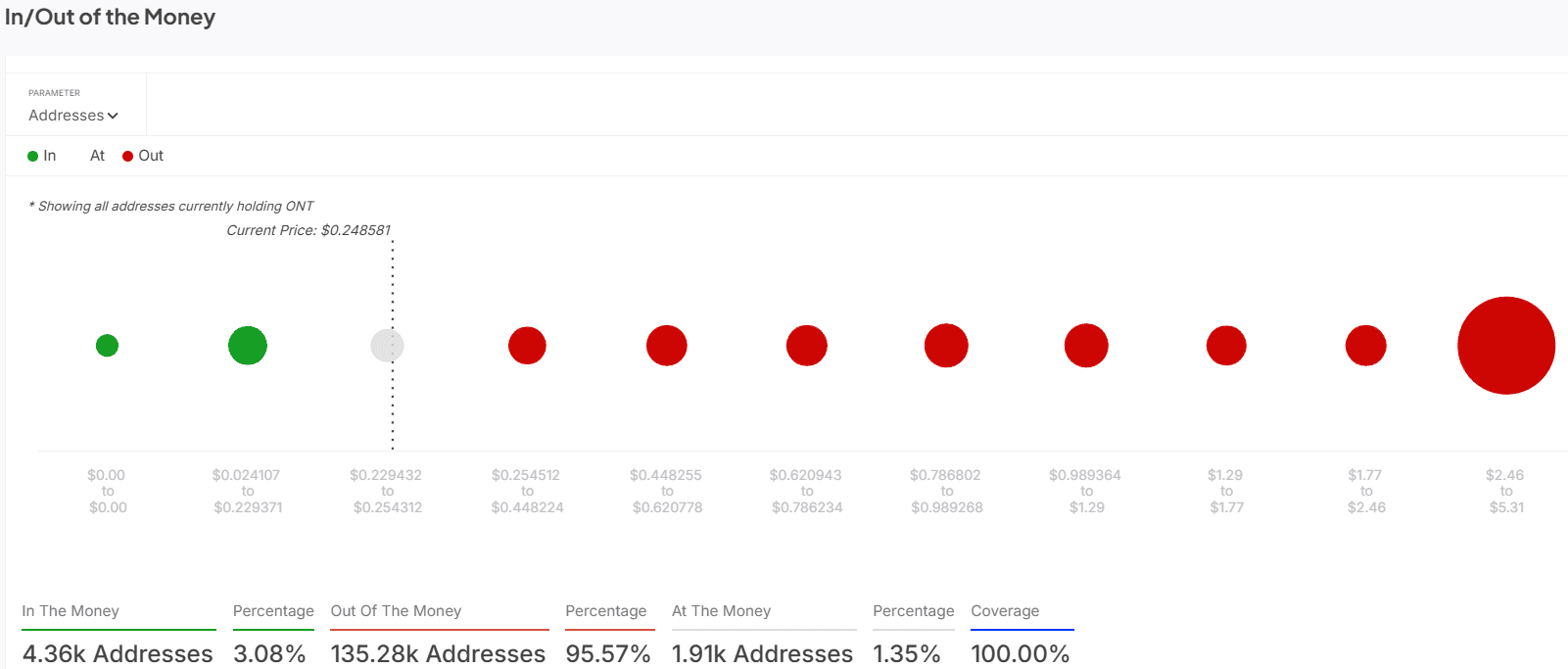

According to IntoTheBlock, 95.57% of all addresses with ONT were out of money. Just under 3.08% was in the money. This indicated that further price gains would be met with enormous selling pressure. This would be due to underwater holders trying to break even or make a small profit.

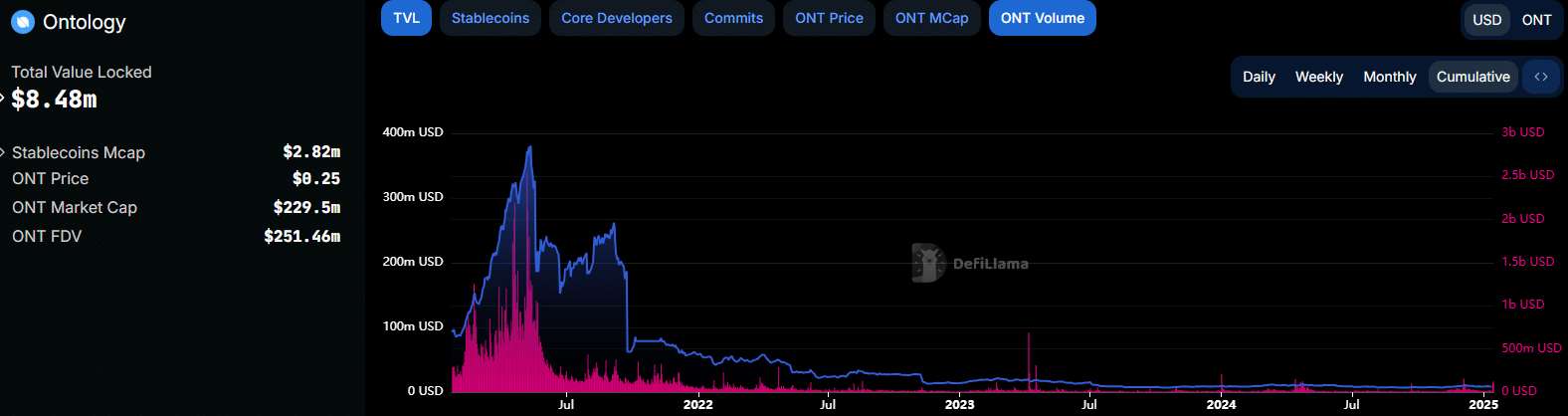

The total value locked (TVL) of the Ontology chain has been steadily moving south since May 2021. the TVL went from $379.09 million in May 2021 to $8.48 million at the time of writing. This was likely due to a loss of investor confidence.

The bear market conditions of previous years, combined with a decline in on-chain activity, have likely caused users to shift their funds to other options. Despite the bullish conditions of recent months, they have not reversed, as evidenced by ONT volume trends.

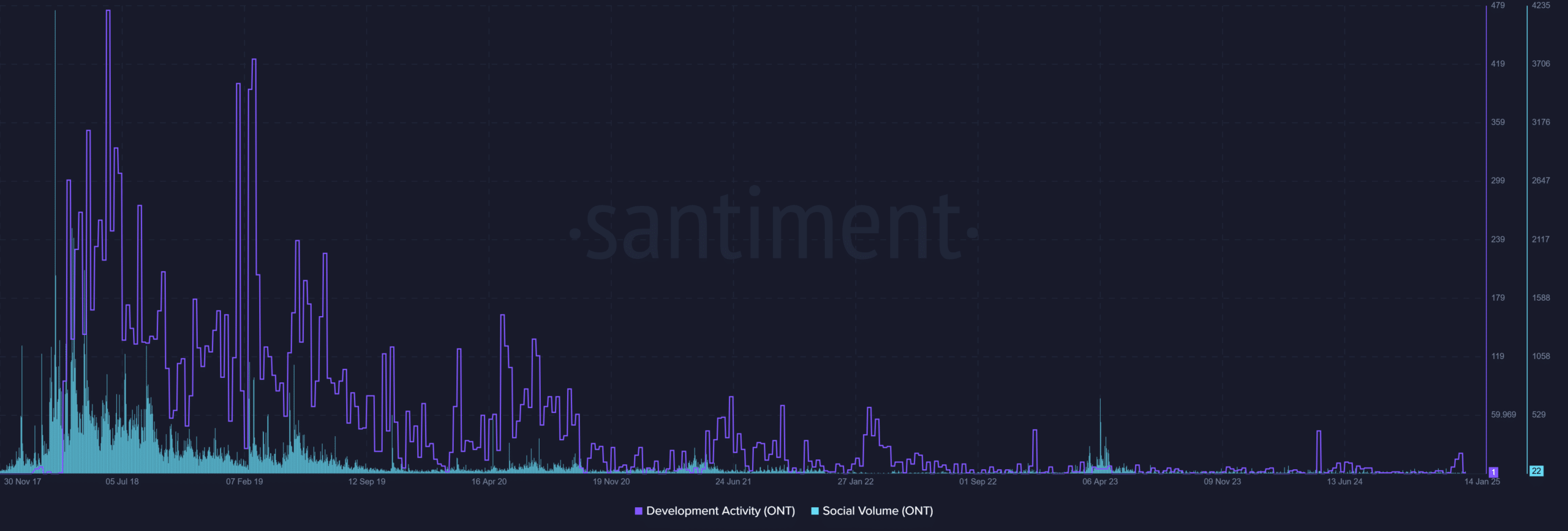

Another discouraging sight was the steady decline in development activities. From 2018 to 2022, the trend was southward. It has been consistently low since then. Social volume also reflected price action trends.

Read the one from Ontology [ONT] Price forecast 2025-26

The similarity between the statistics is that they all pointed to a fading L1 chain. Users have not returned to the chain and despite the short-term price increases, investors are likely to want to look elsewhere for better opportunities.