- BTC is up more than 10% in the past seven days.

- Statistics suggested selling pressure was low, and a number of indicators looked bullish.

Bitcoin [BTC] showed a bullish performance over the past week as its value increased by more than 10%. In the past 24 hours alone, the price of the king coin has risen by more than 2%.

At the time of writing, BTC was trading at $57,141.35 with a market cap of over $1.12 trillion. According to a recent tweet from IntoTheBlock, BTC’s recent uptrend made 95% of its investors profitable.

This increases the chance that holding companies will be liquidated. To check whether this assumption could become reality, AMBCrypto took a look at BTC’s statistics.

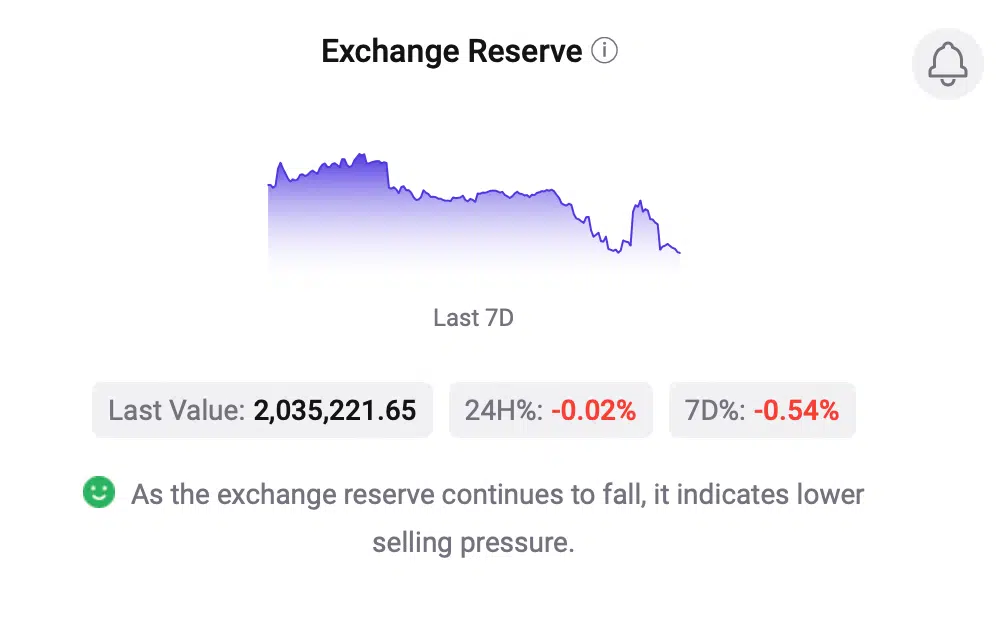

Our analysis of CryptoQuant’s facts revealed that Bitcoin’s foreign exchange reserve was declining at the time of writing. As a result, the sales pressure was not high.

The Coinbase premium was also in the green, meaning buying sentiment was dominant among US investors at the time of the report.

Things are looking bullish for Bitcoin

The chances of a Bitcoin downturn due to high selling pressure seemed unlikely, recent data showed. So there were higher chances that BTC would continue its bull rally.

Notably, the coin’s MVRV Z-score scored +2 for the first time this bull cycle, which has historically risen during bull rallies.

However, Philip Swift, the founder of LookintoBitcoin, tweeted that there was still a long way to go before this cycle overheated.

To better understand the possibility of a sustained price move north, AMBCrypto next checked Bitcoin’s daily chart. Our analysis showed that BTC’s MACD was showing a bullish crossover at the time of writing.

This suggested that the bull rally could last longer.

Read Bitcoins [BTC] Price prediction 2024-25

On the other hand, BTC’s Relative Strength Index (RSI) was in the overbought zone.

The Chaikin Money Flow (CMF) also registered a slight decline, indicating that the possibility of a near-term price correction cannot be ruled out.