The long-awaited arrival of spot Bitcoin ETFs has created a gold rush in the crypto world, attracting newcomers and seasoned investors alike. Although these new investment vehicles provide an easy and accessible way to gain exposure Bitcointheir impact on cryptocurrency core principles and long-term stability remains a complex question.

Bitcoin ETF: Initial Rise, But Ownership Shift a Concern

The data paints a fascinating picture. Following the SEC’s approval of 11 ETFs, the number of non-zero Bitcoin wallets initially soared, peaking at nearly 53 million in January. This rise was likely fueled by the accessibility and security that ETFs offer, attracting individuals who were previously hesitant to directly engage with the intricacies of crypto wallets and exchanges.

However, according to Santiment data, a worrying trend emerged 30 days later: Nearly 730,000 fewer wallets held Bitcoins, indicating a possible shift toward holding through ETFs rather than owning the tokens directly. This raises questions about the long-term impact on Bitcoin’s decentralized nature and the potential for reduced activity on the chain.

There are 729.4K fewer #Bitcoin wallets with more than 0 $BTC, compared to a month ago. After the #SEC approved 11 Spot Bitcoin #ETF‘s, this number of non-0 wallets peaked at 52.95 million on January 20. This is attributed to the increased interest in #hodlers

(Continued)

pic.twitter.com/FThtSDOmk0

— Santiment (@santimentfeed) February 21, 2024

ETF booming, but supply-demand dynamics unchanged

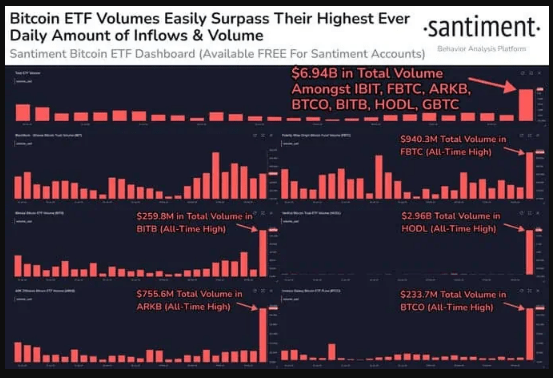

While the ETF market is flourishing, its impact on Bitcoin’s core principles is less clear. The recent record volume and inflows of more than $7 billion into the top seven ETFs highlight the strong market interest and potential for mainstream adoption.

Source: Santiment

However, it is crucial to remember that these ETFs can hold both actual Bitcoin and futures contracts. This means that investors gain exposure without directly impacting the underlying supply or demand of the cryptocurrency itself. This raises questions about whether ETFs actually drive adoption or simply create a derivatives-based market with its own risks and dynamics.

Speculation is rising and raising red flags

Perhaps the most worrying trend is the increase in speculative trading using derivatives. Open interest in centralized exchanges, especially Bitcoin, has reached unprecedented levels, surpassing $10 billion for the first time since July 2022.

BTC market cap remains in the $1 trillion region. Chart: TradingView.com

This indicates that investors are taking on more risk using derivatives, possibly fueled by the ‘public euphoria’ around Bitcoin and the lure of potentially quick profits. This mirrors the speculative frenzy we saw in 2017, raising concerns about potential market volatility and potential crashes. Ethereum, Solana, and Chainlink are also showing significant open interest, indicating broader market-wide trends beyond just Bitcoin.

The judgment: a double-edged sword

The advent of spot Bitcoin ETFs has undoubtedly opened doors to new investors, but it is important to recognize the potential downsides. While accessibility has increased, direct ownership could decline, and the rise of speculative trading using derivatives raises concerns about future market stability.

Going forward, it will be crucial to monitor how these trends develop and their long-term impact on the overall health of the crypto ecosystem. In addition, ongoing regulatory developments surrounding ETFs and derivatives could further shape the landscape.

Featured image by Nicola Barts/Pexels, chart from TradingView

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.