- Long-term BTC holders have continued to cash out.

- This has contributed to BTC’s struggle to break through its psychological resistance.

Bitcoins [BTC] Long-term investors have had a massive sell-off in the last thirty days, the biggest since April. This comes as Bitcoin hovers near $93,000, raising questions about whether these moves signal profit-taking or portend a possible market correction.

With major indicators such as the Fear & Greed Index and HODL Waves showing notable trends, this sell-off could impact Bitcoin’s trajectory in the near term.

Long-term holders dropped Bitcoin during a price surge

The unloading by long-term holders coincides with Bitcoin’s parabolic rise to $93,000 earlier this month, fueling speculation about the motivations behind such a massive sell-off.

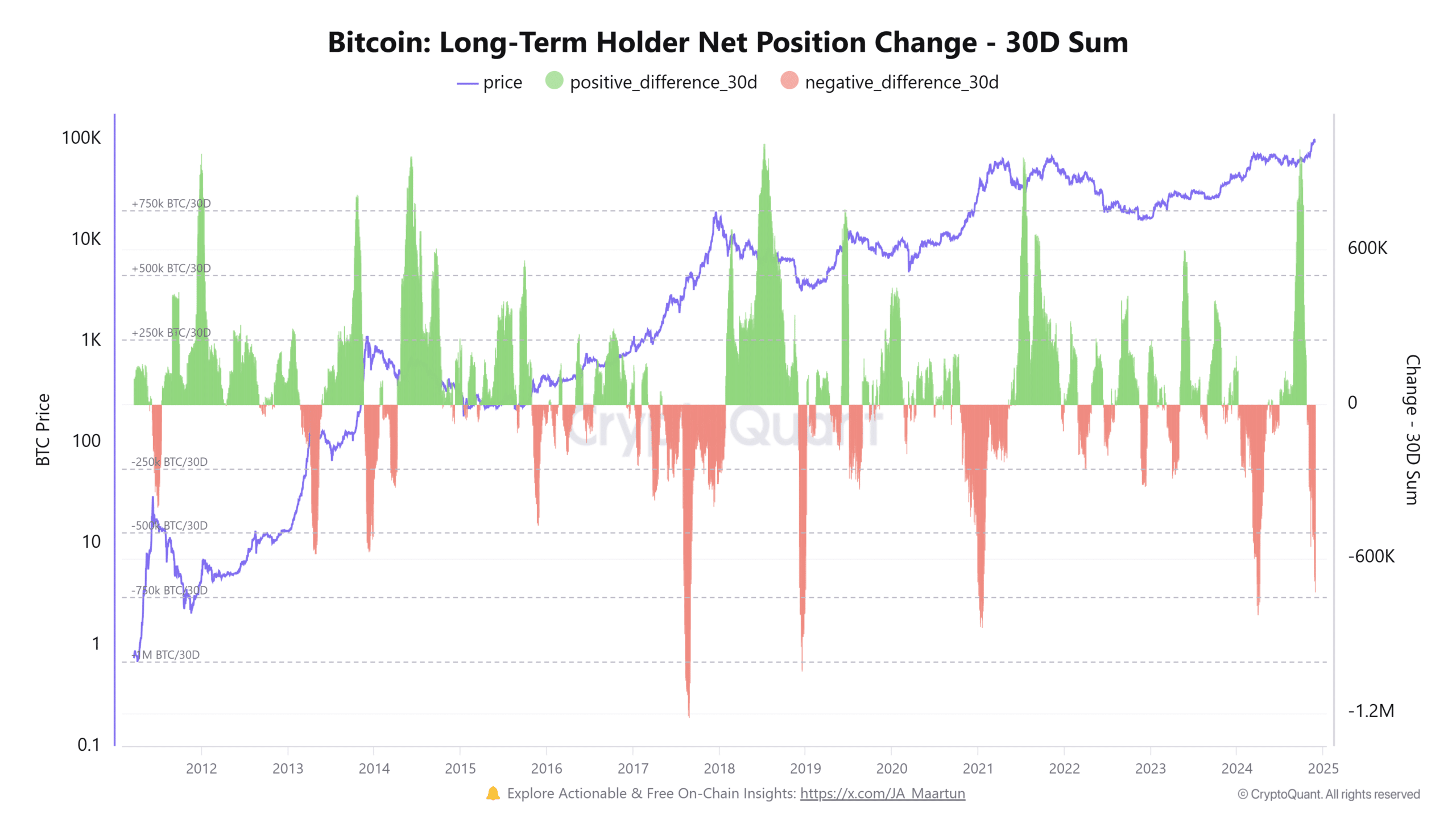

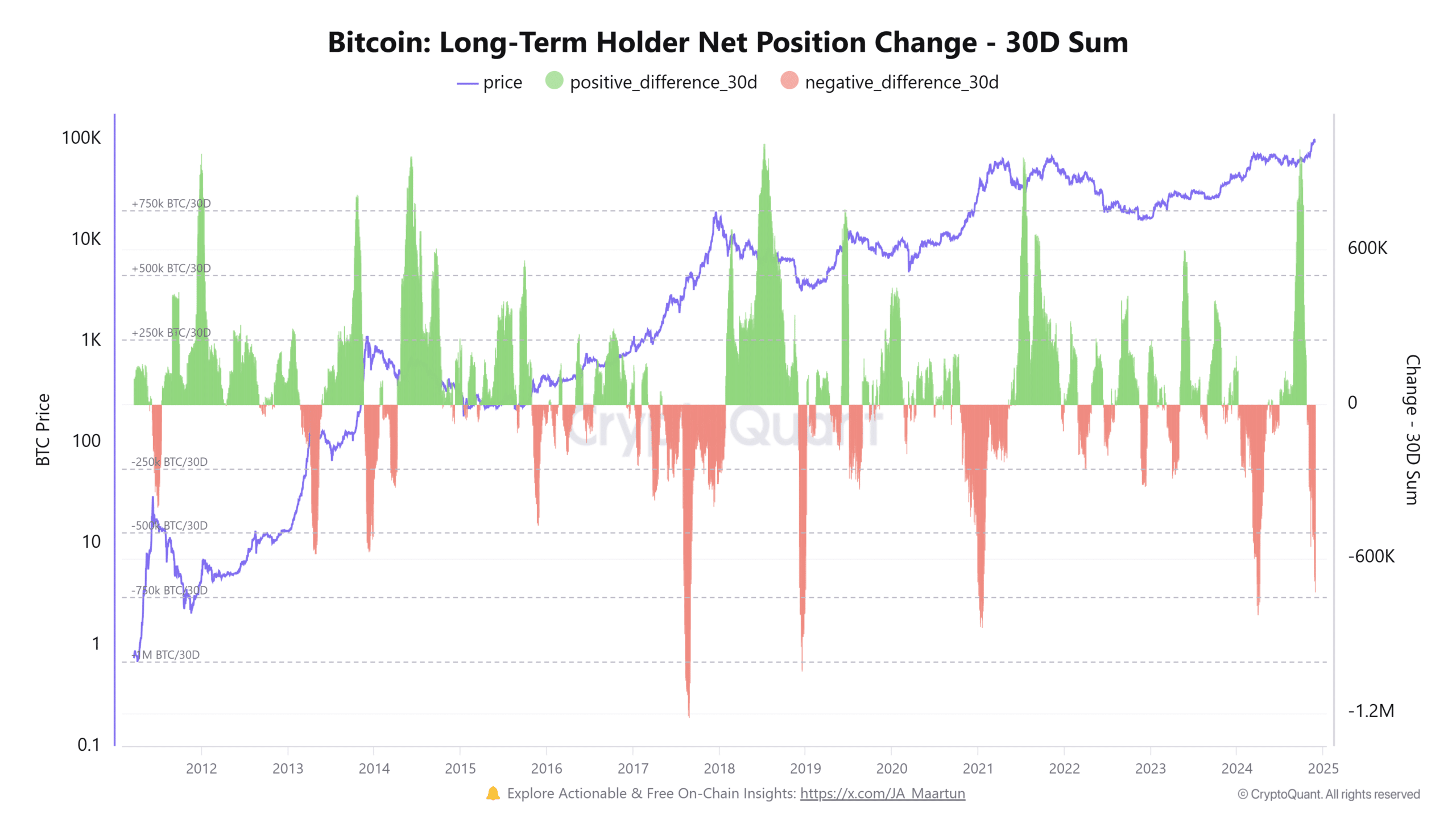

Long Term Holder Analysis Net Position Change Chart on CryptoQuant showed it was negative. More than 728,000 BTC have been sold in the past 30 days, marking the biggest sell-off since April.

Source: CryptoQuant

In April, a similar sell-off by long-term holders caused a short-term price correction, raising questions about whether history could repeat itself. With Bitcoin still holding over $90,000, the market’s resilience is being tested.

Bitcoin Fear & Greed Index Reaches Extreme Levels

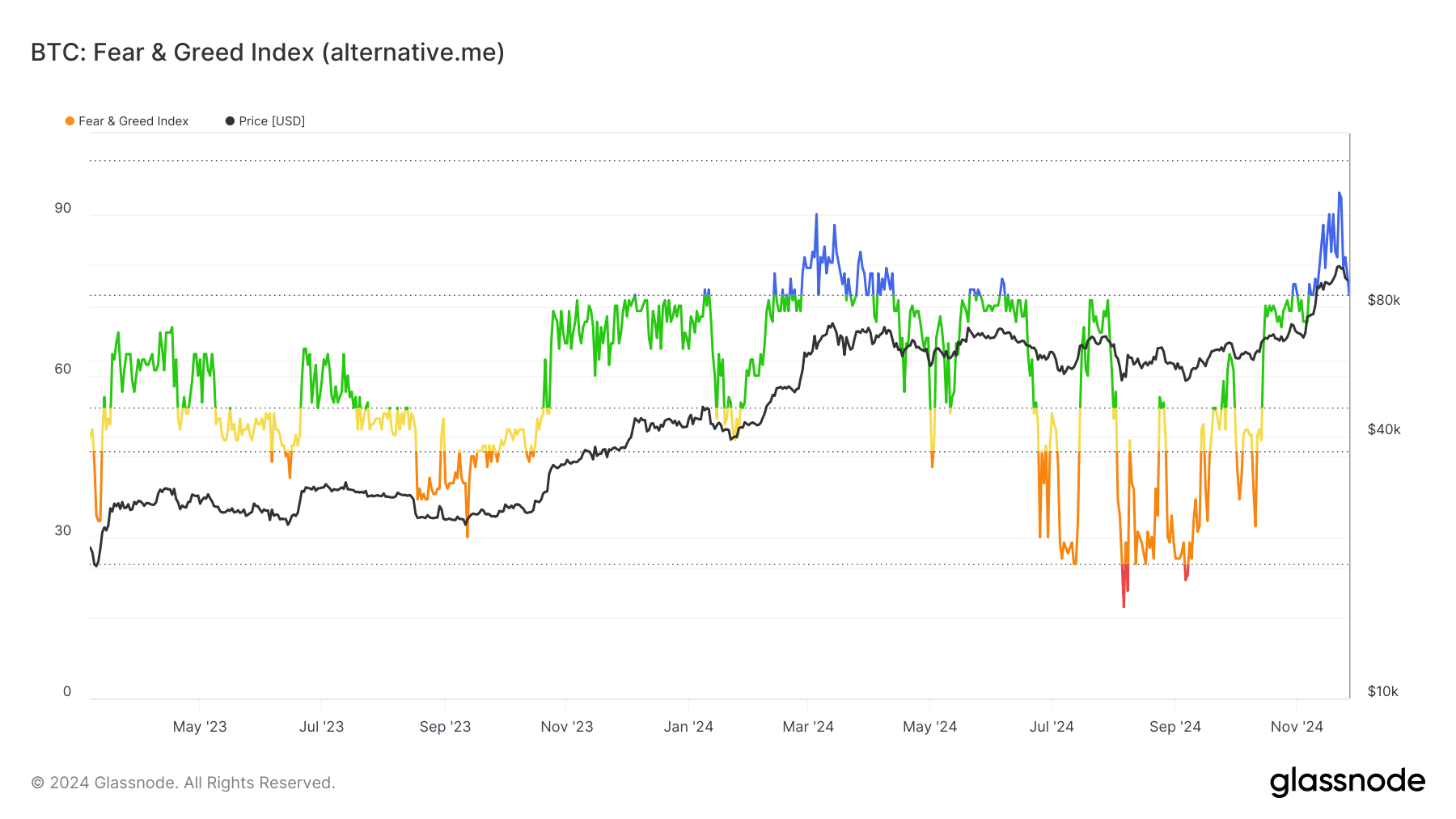

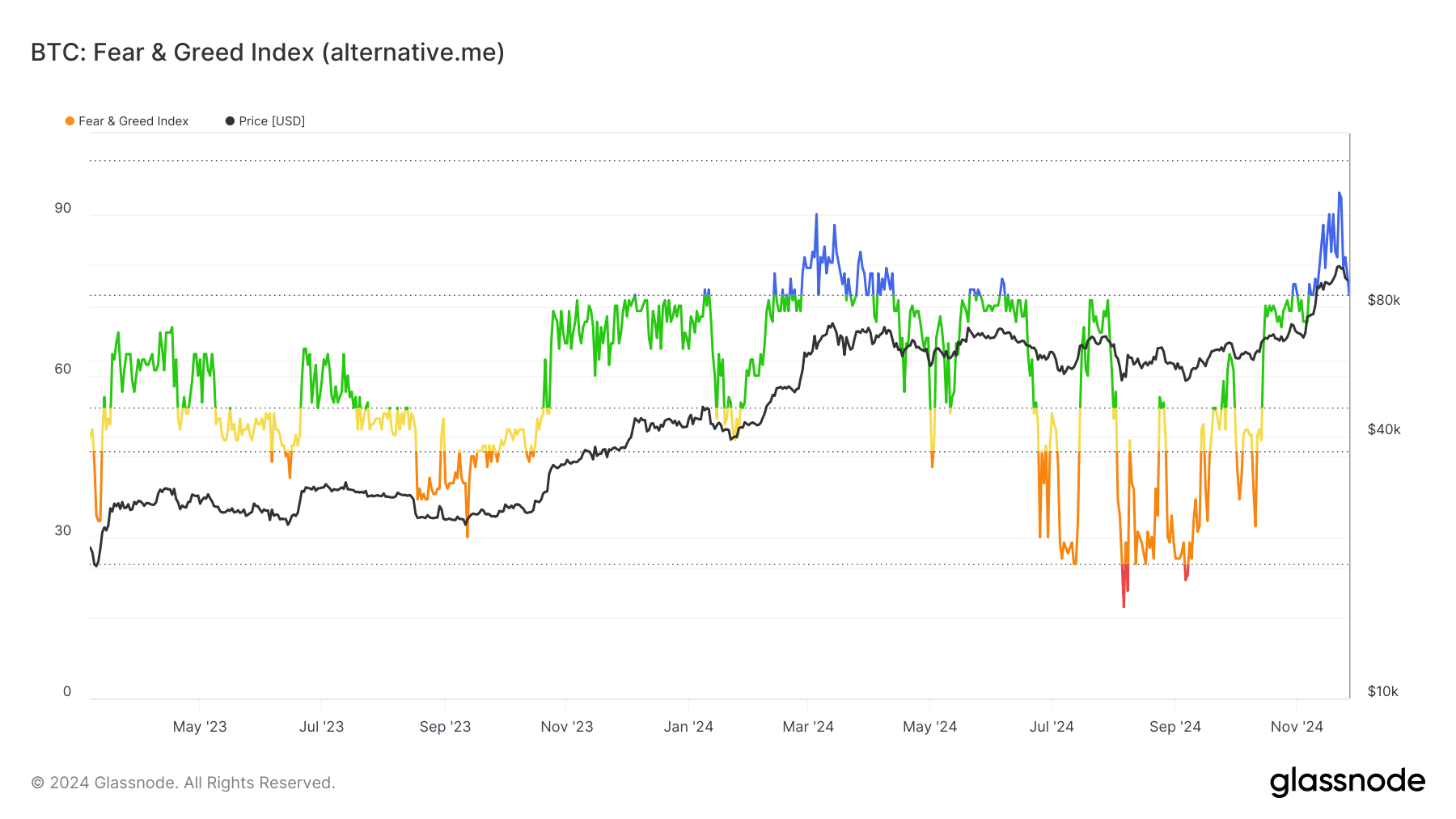

Another factor contributing to the story is the Bitcoin Fear & Greed Index, which currently shows a reading of around 75, reflecting “extreme greed” in the market. Such sentiment often precedes corrections, because overconfidence among investors can lead to unsustainable price movements.

The index, combined with the sell-off of long-term holders, suggests that near-term caution may be warranted.

Source: Glassnode

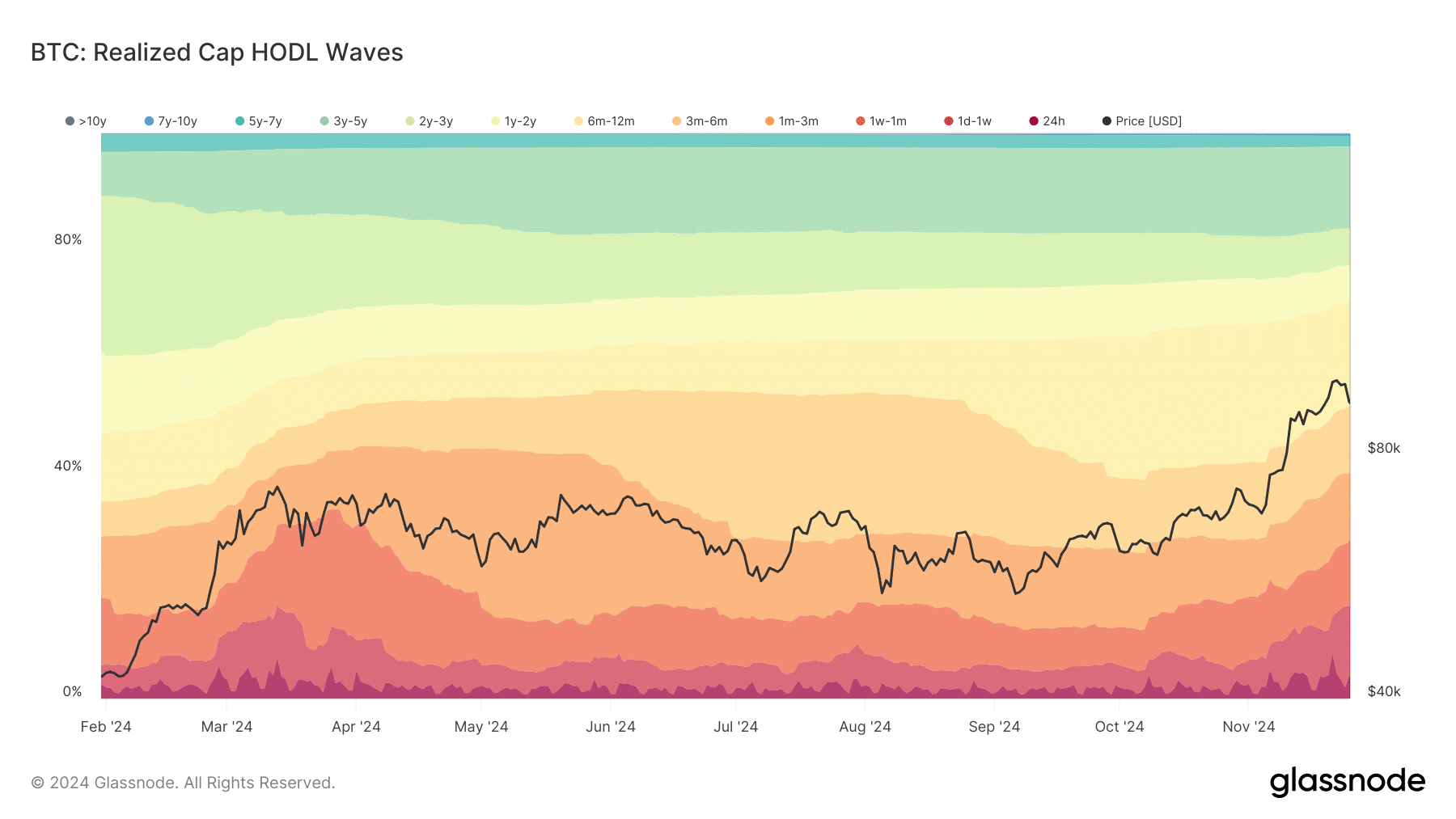

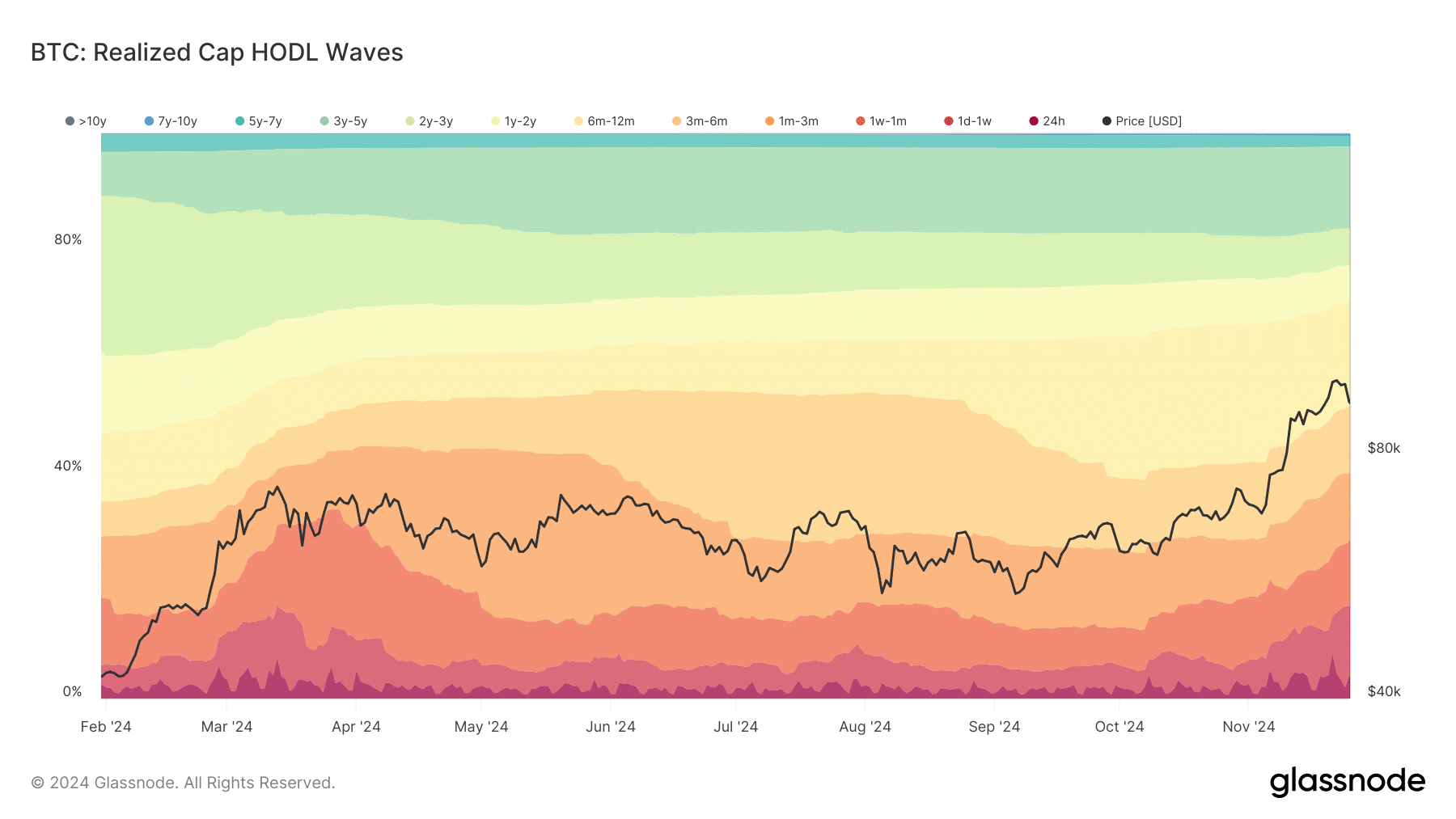

Younger coins dominate as HODL waves shift

Data from Glassnode’s Realized Cap HODL Waves indicates a significant shift in Bitcoin ownership, with younger coins – those held for less than six months – making up a larger share of the market. This suggests that new entrants or traders are absorbing selling pressure from long-term holders, stabilizing Bitcoin’s price for the time being.

However, the question remains whether these newer market participants will have the same conviction as volatility increases.

Source: Glassnode

Outlook: Caution or Optimism?

While the recent sell-off of Bitcoin by long-term holders is notable, it does not necessarily indicate a bearish trend. The market has shown resilience in holding key levels, with $90,000 acting as crucial support.

However, the confluence of extreme market greed and heavy profit-taking increases the risk of increased volatility.

The RSI (Relative Strength Index) for Bitcoin now stands at 61.44, indicating that the asset is approaching overbought levels. Historically, these measures often correspond to profit-taking behavior, especially when prices cross significant psychological thresholds.

Read Bitcoin (BTC) price prediction 2024-25

As Bitcoin moves closer to $100,000 – a psychological resistance level – investors should keep a close eye on the behavior of both long-term holders and newer participants.

Whether this is just a consolidation phase or a harbinger of a correction remains to be seen. For now, the Bitcoin market walks a fine line between bullish momentum and cautious retracement.