- Whales have started buying more Bitcoin and have spent tens of millions on acquisitions in recent months.

- Market sentiment shows that these whales may retain the active for the long term.

Bitcoin [BTC] Has maintained a steady threshold on the market, moved within a tight reach and do not yield a significant profit – only up to 1% in the past month.

New Market Insight suggests that sentiment could soon move, whereby Bitcoin may rise in value while whales continue to collect it actively.

Whale interest in Bitcoin rises

Whales, which is known to have a significant part of an active board, have shown renewed interest in Bitcoin in recent months.

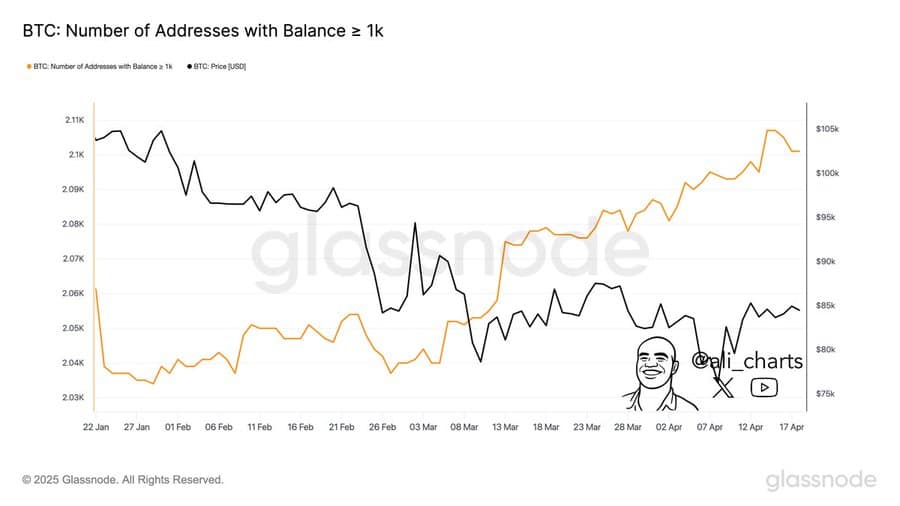

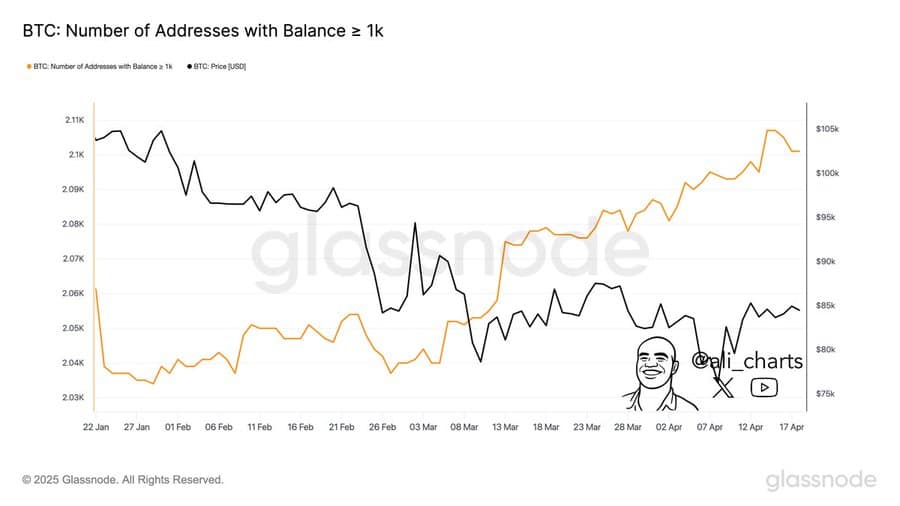

Since the beginning of March, analysis shows that new whales have entered the market and Bitcoin has started acquiring Bitcoin. So far, 60 of them investors each bought no less than 1,000 bitcoin, a total of around $ 85 million.

Source: Glassnode

Of course this inflow came while BTC was traded far below its all-time high, by pointing out undervaluation in the eyes of large investors.

This increase in whale participation is also remarkable considering the overall decline of the liquidity of the crypto market.

In the past two weeks, the capital inflow has fallen from $ 8.2 billion to $ 2.38 billion.

With shrinking funds that enter the market, assets that receive liquidity become more interesting because they probably perform better than others. Whale activity in BTC confirms that market profits can continue to lead.

Settings and important whales make movements

That said, it wasn’t just whales who bought the dip.

Ambcrypto -analysis identified one whale that benefited from the recent price fall in Bitcoin to collect a considerable amount of the asset.

According to insights from Arkham Intelligence, a whale identified Because “Abraxas Capital MGMT” has actively acquired Bitcoin.

Since the beginning of April, this whale has grown its Bitcoin interests from $ 2.8 million to $ 253 million, which confirms a strong investor advocate for actively.

Interesting is that this whale also applies under a different address another $ 43 million in LBTC, which means that the total comes to $ 296 million.

Source: Coinglass

Institutional investors have also delayed their sale and ended the week with inflow into Bitcoin ETFs (listed funds). Analysis shows that this group bought BTC before the end of the week for $ 106.90 million.

If the accumulation continues through whales and settings, the value of Bitcoin can rise, which may lead to a rally.

Buy traders in the long term

To determine whether this accumulation is temporary or sustainable, Ambcrypto investigated the behavior of long -term holders.

With the help of Bitcoin’s Coin Days destroyed (CDD) metric that indicates or long -term holders, Ambcrypto found the latter where.

Source: Cryptuquant

Currently, the CDD was drunk near Zero-the implicating long-term holders did not sell. In fact, they have continued to hold their positions, even by market head.

With the accumulation of whales, settings that turn back and hold holders in the long term, Bitcoin has emerged as the primary liquidity monitoring in a drying market.

If this ridge is persistent, BTC cannot only remain stable – it could prepare for the next rally.