Just as pioneers of old once cautiously navigated uncharted territories, today’s crypto enthusiasts must be wary of the pitfalls that lie ahead. As we delve into the world of digital currencies, it’s essential to be equipped with the right knowledge. Not every offer glitters with genuine promise, and caution is our best ally. Let’s explore the intricate maze of cryptocurrency scams and learn how to tread wisely.

Hello, my dear readers! I’m Zifa, a crypto enthusiast with over three years of diving deep into the world of virtual currencies. Today, I’ve curated a list of the most common cryptocurrency scams. As Halloween approaches, picture us around a campfire, sharing tales. But unlike typical ghost stories, these chilling accounts are all too real. So, gather close and listen well, for these stories are as real as the virtual coins we trade!

What Are Crypto Scams?

Crypto scams are fraudulent activities targeting individuals’ digital assets, especially cryptocurrencies. As crypto investments and digital wallet usage have grown, so have the tactics of scammers.

Common scams employ a range of methods, from fake celebrity endorsements on social media to phishing and giveaway scams, capitalizing on individuals’ trust and curiosity. Often, they entice victims into making payments or revealing sensitive information, such as crypto wallet details.

Types of Crypto Scams

Much like elusive shapeshifters in dark tales, crypto scams morph and adapt in countless ways. Scam artists, ever crafty, have devised numerous methods to prey on those navigating the crypto asset landscape. Below, we’ve outlined six of the most common crypto scam schemes, each paired with chilling accounts of real-life incidents. Venture forth with caution.

1. Rug Pull Scams

In the misty alleys of the cryptocurrency world, rug-pull scams are the goblins that haunt investors’ dreams. These mischievous creatures enthrall their victims with shiny new tokens or projects, only to vanish into the night, leaving behind worthless coins and shattered hopes.

Here’s how the trickery unfolds: scammers conjure an alluring investment opportunity, often riding the coattails of the latest trends like NFTs or DeFi. As the hype grows and investors pour in their funds, these goblins swiftly exit, selling their tokens or liquidating positions. The once-promising investment crashes, leaving investors with mere ghost tokens.

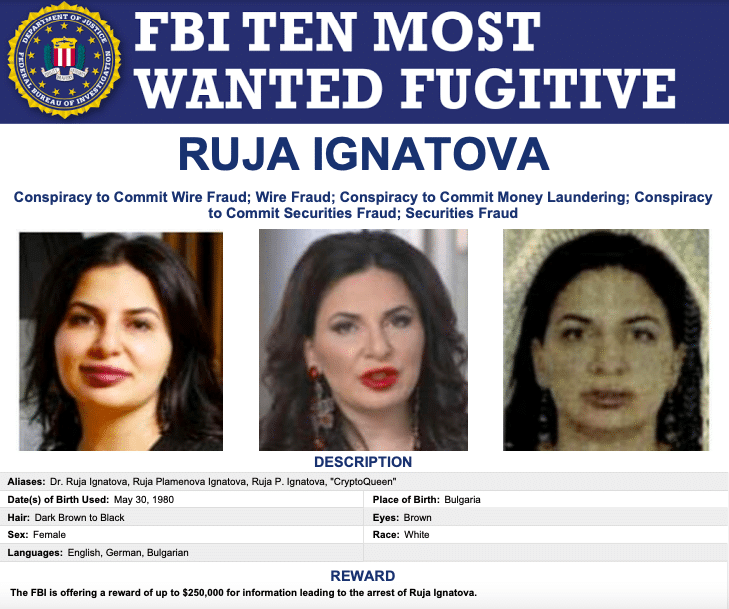

OneCoin

The tale of OneCoin is one of the most chilling in the crypto annals. Spearheaded by the enigmatic Ruja Ignatova, dubbed the “Crypto Queen,” OneCoin lured in a staggering $4 billion from unsuspecting victims. With grand events and persuasive pitches, Ruja painted a picture of legitimacy and prosperity. However, beneath the glitz and glamour, OneCoin was nothing but a mirage. Promising bountiful returns, it left a trail of financial devastation in its wake. As the scheme began to unravel, the Crypto Queen fled, leaving behind a legacy of deceit and countless defrauded investors.

Squid Game Token

Capitalizing on the fame of the Netflix series, the Squid Game token seemed like a golden goose. But, in a twist fit for a horror story, the developers drained its liquidity pools and took off with users’ funds. This notorious rug-pull was caught live by a Twitch streamer, showcasing the coin’s market cap plummeting from trillions to almost zero in a heartbeat.

Mutant Ape Planet

Mutant Ape Planet (MAP) NFTs, a shadowy reflection of the popular Mutant Ape Yacht Club, saw its developer vanish with $2.9 million. The mastermind, Aurelien Michel, was later captured, but not before leaving a trail of broken promises and empty wallets. He had promised rewards, raffles, and even the “metaverse land,” but like a mirage, they all faded away.

2. Bitcoin Investment Schemes

In the vast realm of cryptocurrency, certain investment schemes lurk, masquerading as legitimate opportunities. These schemes, often dressed up with polished websites and enticing promises, aim to deceive.

Investment scams can take various forms. Some are cloaked as groundbreaking opportunities in blockchain technology, while others might use the facade of new digital currencies launching in the market.

Plexcoin: The SEC’s First ICO Crackdown

Plexcoin, launched in August 2017, promised its investors a staggering 1,354% profit in less than 29 days. Riding the wave of the ICO (Initial Coin Offering) boom, its aggressive marketing strategies managed to attract a significant number of investments. However, such astronomical returns quickly raised suspicions.

The U.S. Securities and Exchange Commission (SEC) was swift to respond. In December 2017, the SEC’s newly formed Cyber Unit filed its first charges against the ICO, targeting Plexcoin’s organizers. The SEC froze all assets related to Plexcoin and charged Dominic Lacroix, the mastermind behind the scam, with defrauding investors. Lacroix and his partner, Sabrina Paradis-Royer, were found to have misappropriated investor funds and engaged in other deceptive practices.

Bitconnect: A Cautionary Tale

Emerging in the cryptocurrency scene around 2016, Bitconnect quickly gained traction with its aggressive marketing and alluring promises of high returns. The platform claimed a trading bot would buy and sell Bitcoin, generating substantial profits. Investors were tempted by daily returns of up to 1%, amounting to almost a 40% monthly return, and an even more impressive annual return when compounded.

However, there was a catch. Investors had to lock in their funds for periods ranging from 120 to 299 days, based on their investment amounts. Bitconnect also introduced a multi-level referral system, further accelerating its growth and showing classic signs of a Ponzi scheme.

The facade crumbled in January 2018 when Bitconnect abruptly shut down its lending and exchange services. They cited reasons like bad press, regulatory challenges, and cyber attacks. This shutdown left many investors stranded, unable to access their funds. It became evident that Bitconnect was using new investments to pay returns to earlier investors, a hallmark of Ponzi schemes.

Both Plexcoin and Bitconnect underscore the importance of due diligence and caution in the cryptocurrency domain. High returns might be enticing, but investors should always be skeptical and conduct thorough research.

3. Fake Cryptocurrency Exchanges

In the intricate maze of the cryptocurrency world, some exchanges stand as mirages, promising enticing rates and unmatched returns. These platforms, offering prices seemingly too good to resist, often have a hidden trapdoor.

These deceptive exchanges might ask for a significant upfront fee, showcasing impressive profits and testimonials from “successful” investors. But once funds are committed, they often evaporate, leaving investors at a loss.

The Mt. Gox Saga

Once a dominant force in Bitcoin exchanges, Mt. Gox met its downfall in 2014. An alarming 850,000 Bitcoins, valued at about $450 million at the time, went up in a puff of smoke. Theories suggest long-standing thefts that were concealed until the platform crumbled.

The Thodex Disappearance

Born in 2017, Turkish crypto exchange Thodex made headlines in 2021 when it disappeared with investors’ funds amounting to over $2 billion. Faruk Fatih Özer, the exchange’s founder, initially cited cyberattacks as a concern, assuring investors of their funds’ safety. However, he soon became elusive.

By 2022, authorities apprehended him in Albania. This online exchange’s debacle accounted for a significant portion of the total value lost to fraudulent activities in 2021. Legal proceedings are now underway, with a potential hefty sentence for Özer and his associates.

We also wrote about another controversial exchange – QuadrigaCX.

As you traverse the crypto landscape, exercise caution and due diligence. It’s always wise to tread carefully where promises seem too alluring.

4. Ponzi Schemes

Ponzi schemes are a concerning trend, offering high returns to attract new crypto investors. These schemes rely on funds from new participants to pay returns to earlier ones, creating a facade of profitability.

While the concept of Ponzi schemes is as old as haunted mansions, their adaptation to the cryptocurrency world brings new challenges. These platforms often promise substantial returns on crypto investments and may present themselves as legitimate through misleading testimonials or skewed statistics.

We’ve already touched upon the haunting tales of OneCoin and Bitconnect, both of which were crypto incarnations of Ponzi schemes. Here are other notable examples.

The PlusToken Phantom

Originating from China, PlusToken presented itself as a global cryptocurrency wallet that would reward users with high returns for depositing their assets. With promises of returns as high as 10% to 30% per month, it quickly attracted a vast number of investors.

PlusToken operated on a classic Ponzi structure. Early investors were paid using the funds of newer members. To sustain this mechanism, the platform needed a continuous influx of new investments.

By the time it was exposed, PlusToken had swindled about $6 billion out of more than 715,000 investors. It’s one of the largest cryptocurrency scams in history.

The scheme began to deteriorate when users experienced difficulties in withdrawing their funds. Chinese authorities acted swiftly, arresting 109 individuals associated with the scam in July. Six of them were charged with fraud.

WoToken’s Eerie Echo

WoToken, eerily reminiscent of PlusToken, was another Chinese-based Ponzi scheme that promised high returns on cryptocurrency investments.

Similar to PlusToken, WoToken lured investors with promises of high returns, specifically from its “intelligent trading system.” This system supposedly traded across various platforms and generated profits for investors.

WoToken successfully scammed its victims out of more than $1 billion. Court documents revealed that 715,249 investors were duped, investing a combined total of about 7.7 billion yuan ($1.15 billion).

The eerie similarities between WoToken and PlusToken weren’t just superficial. Investigations revealed that one of the key operators of PlusToken was deeply involved in WoToken, leading many to dub WoToken as ‘PlusToken 2.0.’

The scheme’s operators were arrested in 2020, putting an end to another massive crypto Ponzi scheme.

Both tales serve as cautionary reminders of the risks lurking in the crypto world. While the allure of high returns can be tempting, it’s crucial for investors to conduct thorough research and exercise caution.

5. Romance Scams

Romance scams are becoming a popular menace as they take on various guises. Crypto scammers, much like subtle sirens, use dating platforms to weave tales of affection, only to ensnare their victims in financial traps.

Crafting intriguing profiles, crypto scammers build trust and emotional bonds. As the relationship grows, they might plead for help with debts, ask for funds for a supposed trip to meet, or even introduce a dubious crypto investment. But once the funds are transferred, they vanish, leaving heartbreak and financial loss behind.

Several cases have made headlines:

- Loss of 600,000 AUD: In 2018, an Australian woman was convinced by a scammer, posing as a successful businessman, to invest in a fake cryptocurrency-related business.

- £1.2 Million Heartbreak in the UK: A UK woman was defrauded of £1.2 million over the course of two years. Starting in 2017, the scammer lured her into investing in a non-existent gold and diamond business and, later, cryptocurrency.

- Misadventure worth 340,000 CAD: In 2020, a Canadian woman was manipulated by a scammer, who posed as a wealthy businessman, into a fake cryptocurrency scheme.

As you navigate the crypto world, remember that not every heartfelt plea is genuine. Stay vigilant, and be wary of those who mix romance with financial requests.

6. Phishing Scams

Phishing scams are a lurking menace for cryptocurrency enthusiasts. Through deceptive tactics, scammers trick users into revealing crucial details, like private wallet keys.

A prevalent trick is sending fake emails or messages, mimicking genuine crypto platforms. These often come with urgent alerts, pushing users to act swiftly and leading them to inadvertently share their keys.

Once the scammer has the keys, the victim’s crypto assets can vanish, much like a ghost in the night. To shield oneself, it’s vital to use robust passwords, activate two-factor authentication, and critically assess every communication for authenticity.

The MyEtherWallet Incident

In 2018, a shadowy figure targeted MyEtherWallet users. Through a DNS attack, users were redirected to a malicious version of MEW. Unwittingly, many entered their private keys, giving attackers access to their funds. This incident underscores the importance of vigilance and the constant need to verify the security of online platforms.

Final Thoughts

In conclusion, as the growth of cryptocurrency continues to reshape the financial landscape, it’s imperative for individuals to remain alert. The allure of high investment returns can sometimes be as deceiving as a siren’s song or a witch’s spell.

Fraudulent schemes are becoming increasingly sophisticated, often leveraging social media platforms to spread their deceptive narratives. It’s crucial to approach offers demanding upfront payments with skepticism and to always conduct thorough research. While the digital age offers opportunities as vast as a night sky, it also requires us to keep our lanterns of caution burning bright, ensuring our investments aren’t spirited away by digital ghouls.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.