This article is available in Spanish.

The momentum is on Bitcoin and crypto’s side, and it wouldn’t be surprising if the price increase continues through the end of the year. One of the biggest drivers of Bitcoin’s current performance is the election of Republican Donald Trump.

Related reading

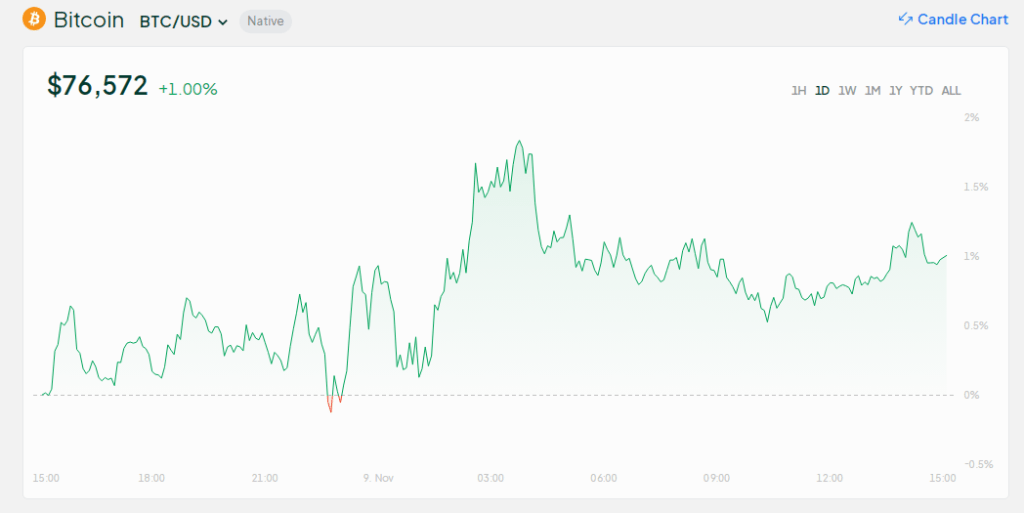

Trump’s rhetoric and friendly statement about crypto helped push the asset’s price higher past $76kbeating the record set in March this year.

Now, many market analysts remain optimistic days after the US elections. Thomas Lee, CNBC contributor and CIO of Fundstrat Capital, has made an even bolder claim, saying that Bitcoin could be trading in six figures by the end of the year. Lee states that the current market and political environment favors the top coin and expects more upside potential for digital assets.

Trump’s election boosts the crypto industry

Last Friday, Fundstrat Capital’s CIO shared his thoughts on Trump’s election and the future of BTC on CNBC’s Squawk Box. In the same discussion, Lee shared that Bitcoin and most altcoins will experience a price increase in the near term.

“It will be very difficult to solve the deficit with only changes in taxes and spending,” he says @fundstrat‘s Tom Lee. He says bitcoin is “potentially a treasury reserve. If Bitcoin rises in price, it actually helps offset the liabilities, the shortfall.” pic.twitter.com/tVrnE37dhS

— Squawk Box (@SquawkCNBC) November 8, 2024

Lee said that global markets were facing many uncertainties just before the elections. However, now that Trump is the American elections and its favorable proposed policies towards Bitcoin, the crypto industry can expect better days ahead.

Lee added that regulatory changes and pro-crypto policies could boost the short-term digital ownership boom. He also credits Trump for his experience as a former president, which can help him better meet future challenges. Of

Trump’s support and a favorable market environment, Lee looks back on his initial target of $150k for BTC, say this is possible.

Bitcoin and digital assets can help offset US debt

One of Trump’s campaign promises is to reduce the country’s growing budget deficit, which now stands at more than $35 trillion. Lee explained that it is difficult for Trump to cut taxes and spending to address the budget deficit.

Instead, Lee sees Bitcoin as the key to solving the country’s growing budget deficit. He sees BTC’s potential as a future treasury instrument and points to its rising market value over the years.

Interestingly, Trump has also explored the idea, saying that as president he can sort out the country’s budget problems by handing over “a Bitcoin check.”

Bitcoin Act Gains Strength After US Elections

Before Lee’s comments, there had been discussions about Bitcoin’s growing role in the country’s financial system. Senator Cynthia Lummis has introduced a bill Bitcoin law, to legitimize the crypto asset as an economic asset.

Related reading

According to Senator Lummis, Trump’s victory will further the push to make Bitcoin an asset to help combat economic uncertainties. One of the bill’s recommendations was to hold a maximum of 1 million BTC for five years as a hedge against inflation.

Featured image from UpFlip, chart from TradingView