- Within 72 hours, over 55,000 BTC were withdrawn from exchanges, highlighting strong accumulation and demand.

- Bitcoin’s ‘extreme greed’ signals caution as history shows a high risk of market corrections

Bitcoin [BTC] has once again captured the market’s attention with a colossal withdrawal of over 55,000 BTC from the exchanges in just 72 hours – a move worth $5.34 billion.

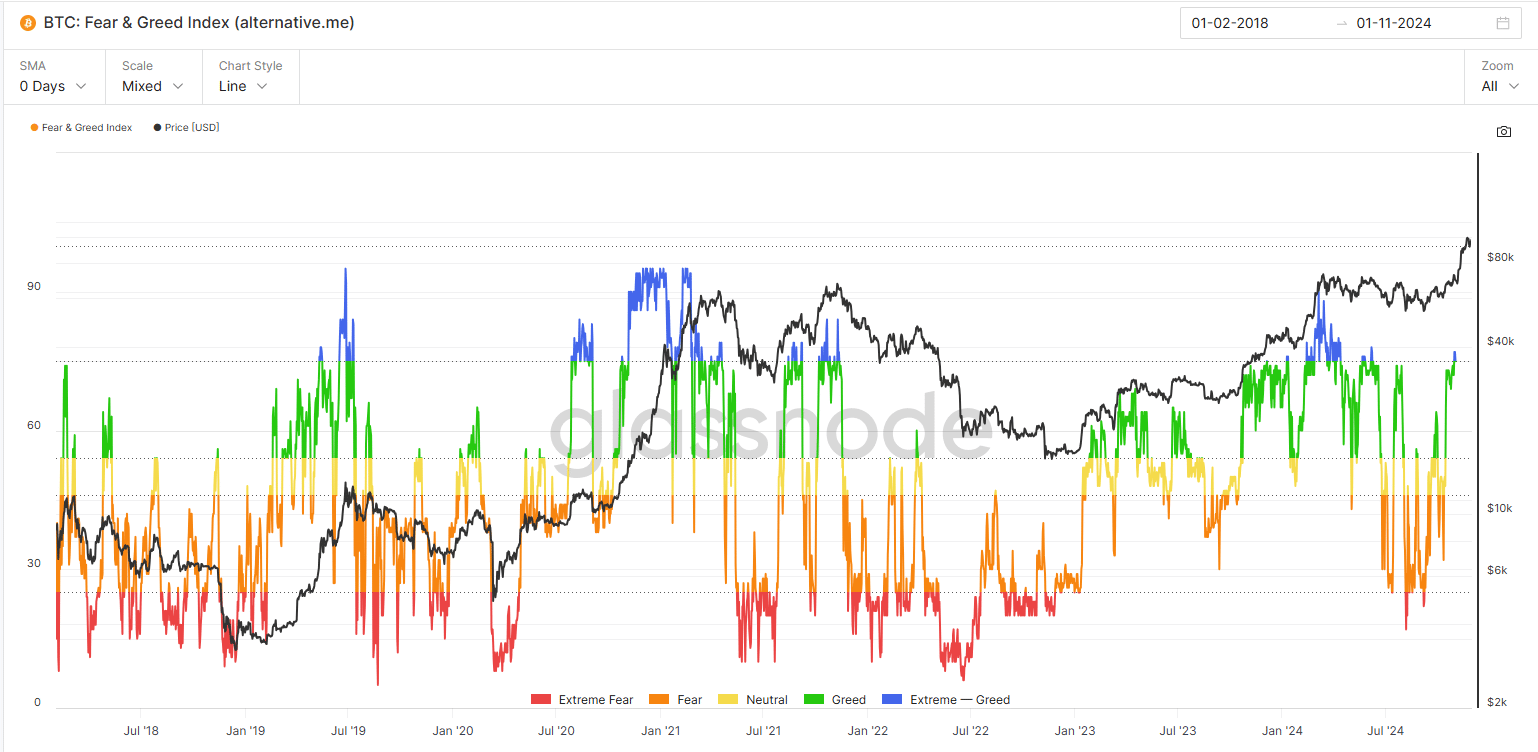

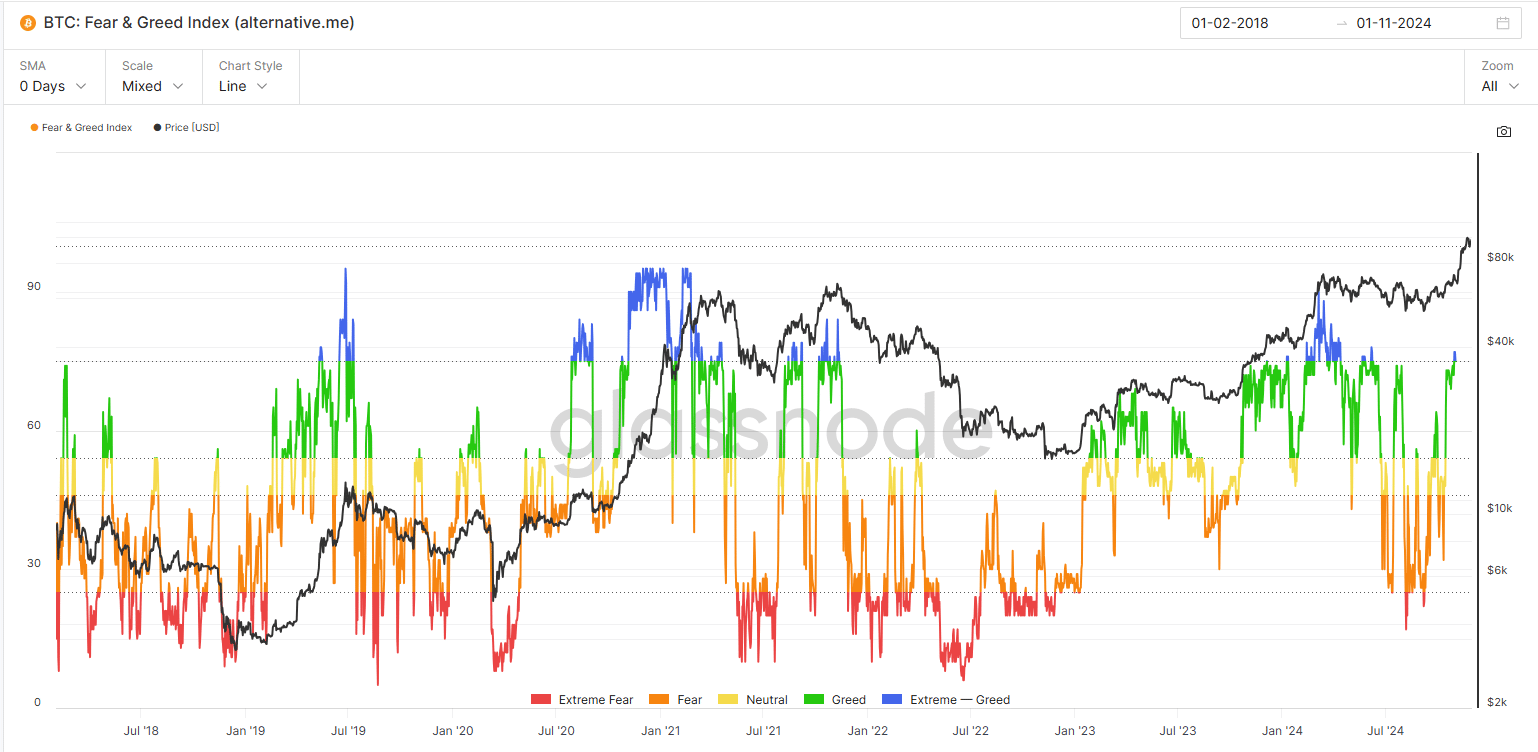

This exodus, combined with the Fear & Greed Index now recording “extreme greed,” has fueled speculation about the next big thing.

The sentiment reflects conditions during Bitcoin’s historic bull run, when euphoric optimism pushed the price from $15,000 to $57,000 between 2020 and 2021.

As the market grapples with this unprecedented activity, investors continue to wonder: are we on the verge of another explosive rally, or is a sharp correction looming?

The Bitcoin Exodus

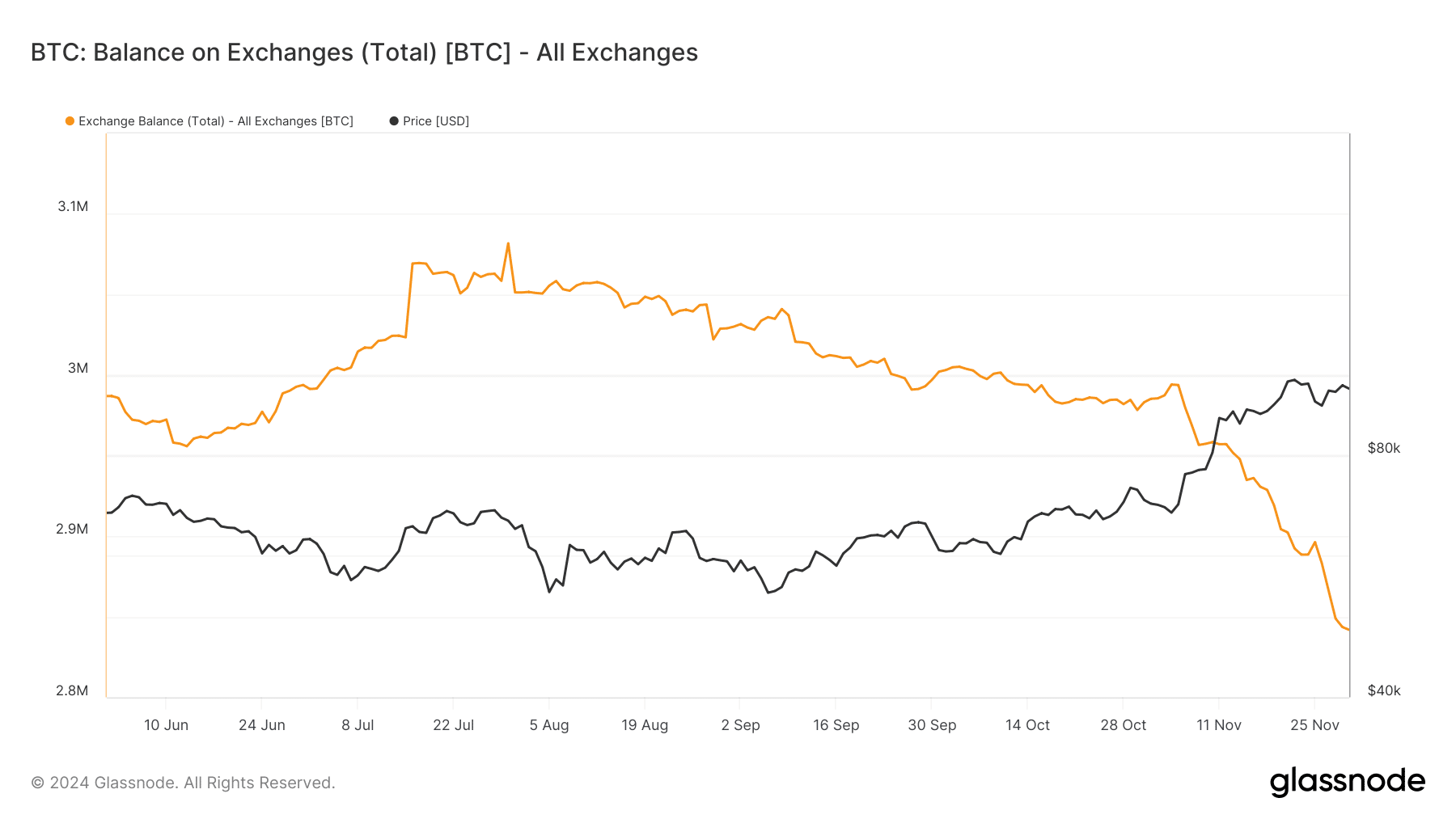

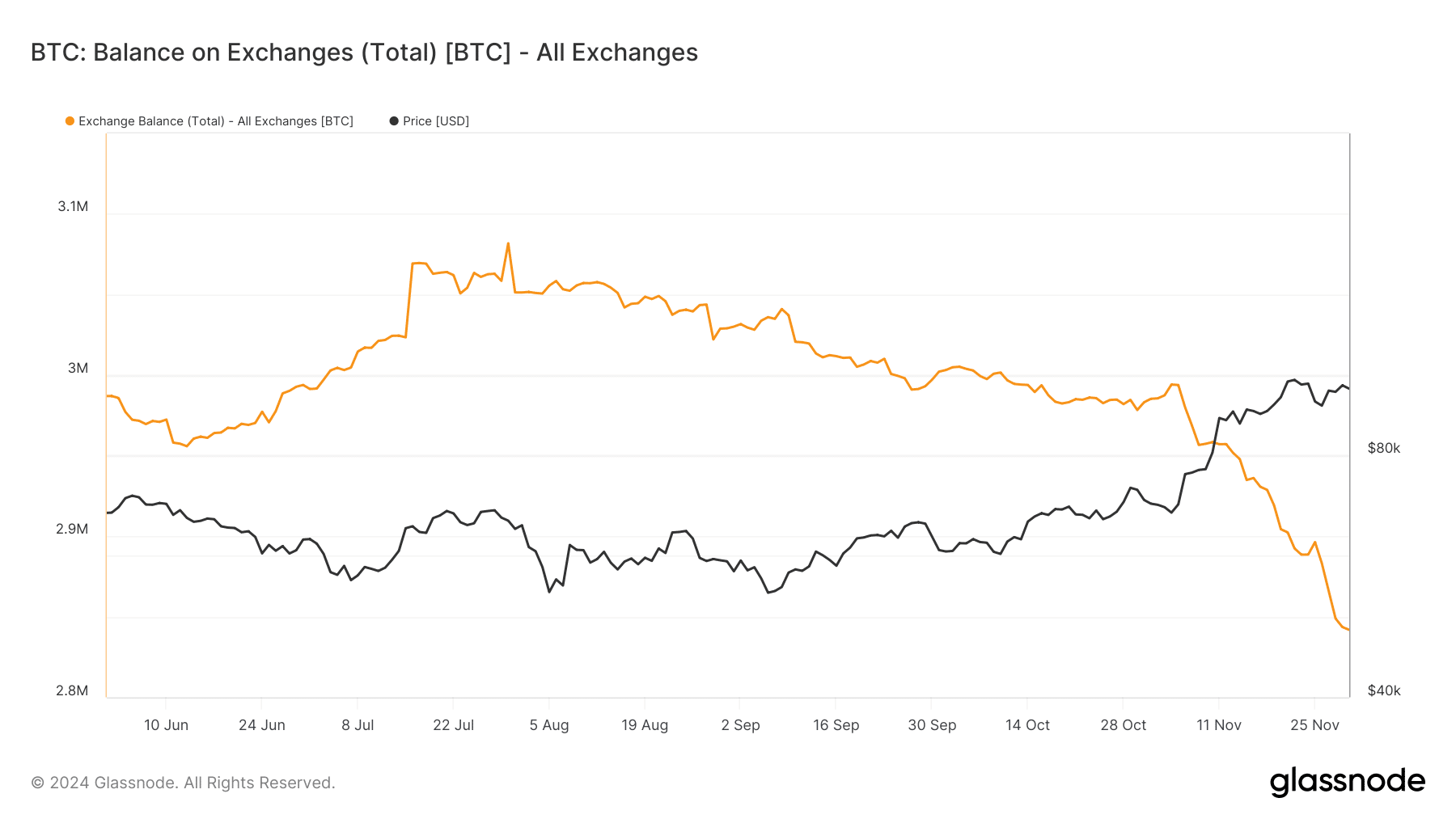

The sharp decline in Bitcoin’s exchange rate, which is now below 2.8 million BTC for the first time since 2018, reflects strategic moves by investors.

This exodus of 55,000 BTC corresponds to increased activity on the chain, indicating significant accumulation. The move coincides with increased demand for self-control as trust in centralized platforms declines.

Source: Glassnode

Moreover, the rising price trend points to a potential supply squeeze. Historically, such pullbacks have preceded bull runs, reducing immediate selling pressure on the stock markets while signaling a long-term strategy.

Riding the wave of ‘extreme greed’

The Bitcoin Fear & Greed Index has entered ‘extreme greed’ territory, reflecting increased optimism among investors.

This sentiment is above 80 at the time of writing, a level not seen since the 2021 bull run. This sentiment signals a potential rally, but also signals caution.

Historically, extreme greed has caused parabolic price movements, such as the climb from $15,000 to $57,000 in 2020-2021.

However, these periods often precede volatility, as exuberant sentiment increases the risk of over-leveraged positions and abrupt corrections.

Source: Glassnode

With Bitcoin passing $99,000 in November, the market is entering uncharted territory. Foreign exchange reserves have fallen to their lowest point in recent years, indicating a tight supply as long-term holders dominate.

However, the combination of extreme sentiment and overheated conditions warns of possible retracements – such as the most recent price correction this past week.

Bitcoin’s milestone reflects strong bullish momentum, but underlines the fragile balance between euphoria and caution as investors weigh their gains against further upside potential.

Catalysts, sustainability and risks

Bitcoin’s recent rally is the result of a trio of factors: tighter supply as foreign exchange reserves fall below 2.8 million BTC, increased institutional participation, and macroeconomic uncertainty driving demand for digital assets.

The continued supply contraction, combined with the strong increase in long-term holding activity, provides a strong foundation for continued upward momentum.

However, the risks are great. The “extreme greed” sentiment increases the likelihood of leveraged liquidations, which could lead to sharp corrections.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Furthermore, Bitcoin’s unprecedented growth is amplifying speculative activity, making it susceptible to profit-taking.

Continuing the rally depends on continued institutional inflows, stable macro conditions and the ability to weather volatile sentiment shifts without destabilizing the market.