From suspicious shillings to bad investments, several celebrities have ended up losing millions of dollars after trying to dabble in digital assets.

Table of contents

Celebrities and cryptocurrencies are never a good mix.

Several A-listers have found themselves in hot water after endorsing coins on social media, with some paying millions of dollars in fines and facing class action lawsuits.

Some have also burned their fingers after buying expensive NFTs, only to see their value plummet significantly. On the other hand, these losses were probably just a rounding error on their bulging bank accounts.

So without further ado, let’s take a look at five stars who might wish they never jumped into crypto.

Tom Brady

The NFL legend was a vocal brand ambassador for FTX, appearing in multiple advertisements touting it as a fast, easy and secure way to invest in crypto.

Unfortunately for the doomed exchange’s customers, this turned out to be anything but the case, and they ended up running out of their savings.

Brady also ultimately suffered a significant loss after Sam Bankman-Fried’s company went bankrupt, not least because his 1.1 million ordinary shares in the company had become worthless.

As if that weren’t enough, he and several others are being sued by aggrieved FTX users, who claim their endorsements were “responsible for the many billions of dollars in damages caused.”

That case continues to wind its way through the courts – and to add more salt to the wound, Sam Bankman-Fried is helping the plaintiffs. Ouch.

My three-step plan for CryptoZoo, including a $1.3 million rewards program for disappointed players.

Thanks, @coffeebreak_YT pic.twitter.com/xFX017UHoc

— Logan Paul (@LoganPaul) January 13, 2023

Logan Paul

YouTubers have also run into trouble after trying to launch crypto projects.

One of them was Logan Paul, the brains behind CryptoZoo – “a really fun game that makes you money.”

There was just one problem: the game never launched, despite fans spending millions of dollars on non-fungible tokens.

CryptoZoo also faced some brutal in-depth investigations from a rival YouTuber called Coffeezilla.

Paul eventually apologized — and a year later he started buying back NFTs from fans on the condition they wouldn’t sue him.

6/ Lindsay Lohan has promoted many crypto frauds and undisclosed NFTs for $20,000-35,000 per tweet

Daughter Doge: https://t.co/LMHY59b7SZ

Dog Cartelhttps://t.co/HmESepKwed

MetaNetflix: https://t.co/hUSFkayVU0 pic.twitter.com/qi6HI3xjma

— ZachXBT (@zachxbt) June 4, 2022

Lindsay Lohan

In a marked departure from her previous career as a child film star, Lindsay Lohan became an aggressive promoter of crypto projects and NFT collections on social media.

There was just one problem: she often didn’t reveal to her followers that she was being paid for it.

That led to some unwanted attention from the Securities and Exchange Commission, which accused her of boosting Justin Sun’s Tron and BitTorrent tokens.

She eventually settled the SEC charges and joined Ne-Yo and Akon in paying a combined $400,000.

Rather embarrassingly, a spreadsheet leaked to X by @zachXBT suggested that Lohan regularly charged $25,000 for projects – or $20,000 for a retweet.

Another painful reminder not to believe everything you see on social media.

You might also like: Memecoins will dominate 2024. What now?

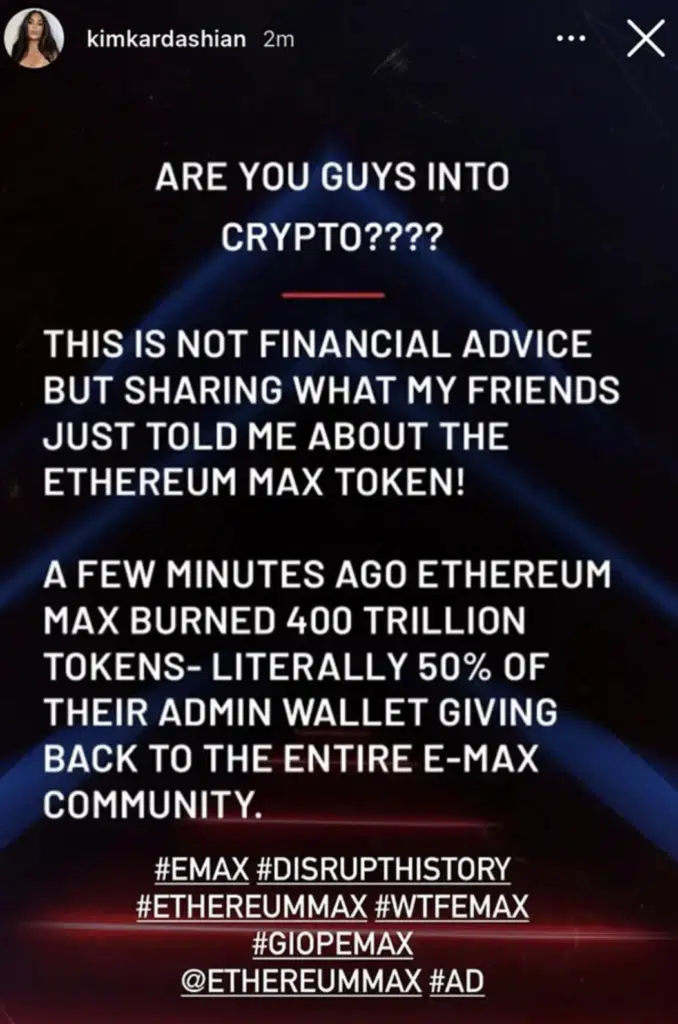

Kim Kardashian

Kim K has one enormous followed on Instagram and, like Lohan, used her immense public profile to endorse a little-known altcoin called Ethereum Max.

British officials claimed the post “may have been the financial promotion with the greatest public reach in history.”

The SEC managed to get her to pay a $1.26 million fine and agree not to endorse cryptocurrencies on social media for three years.

In that case, she was paid a staggering $250,000 to hook up EMAX.

The altcoin quickly lost 98% of its value after her post, leading to accusations that it was nothing more than a pump-and-dump scheme.

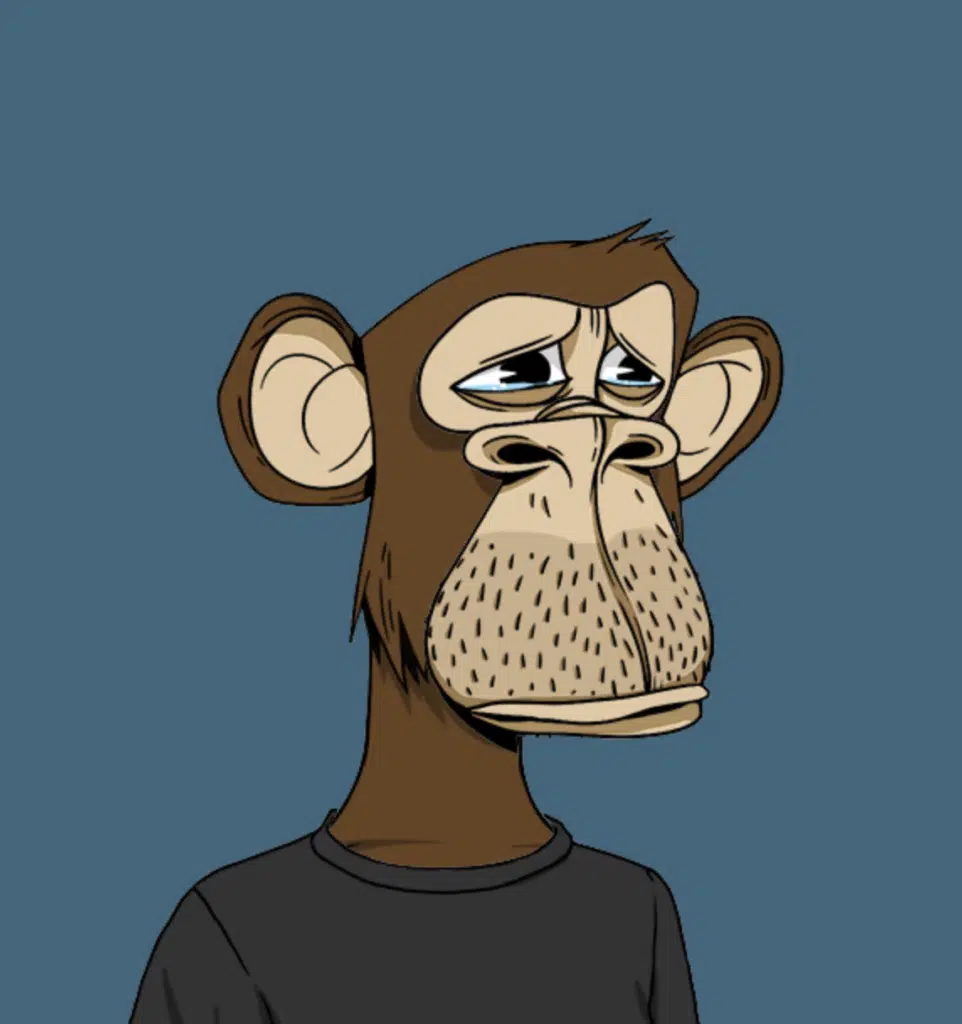

Source: OpenSea

Justin Bieber

Last, but certainly not least, we want to take a moment to acknowledge babyface crooner Justin Bieber.

He spent a whopping $1.3 million on a Bored Ape during the height of NFT mania, but the rock-bottom price of this collection has since plummeted in value.

It’s difficult to infer the exact value of his collectible at this point, especially considering it has some rare features, but the best offer currently on OpenSea is just 8,488 WETH. That’s just $28,500 at current market rates.

If he were crazy enough to accept such an offer, he would end up realizing a 97.8% loss.

You might also like: What can be done against crypto scam ads?