The United States Supreme Court has denied a case involving “stolen” BTC from the previously prosperous Silk Road market. The decision allows the state to sell the coins worth around $4 billion USD, but this news and that of a ‘Satoshi reveal’ on HBO still hasn’t stopped crypto OGs from relentlessly pursuing P2P (peer-to- peer) to develop use cases for bitcoin.

It should be noted right away: “Bitcoin” for the purposes of this article means the definition set out in Satoshi Nakamoto’s whitepaper. Namely: “A purely peer-to-peer version of electronic money [that allows] online payments that can be sent directly from one party to another, without the intervention of a financial institution.” A very punk rock concept, if you will.

“Purely peer-to-peer” is what created this whole disruption called Bitcoin that we love, and what allowed the Silk Road to grow so much in the first place. Suffice it to say for now that huge onchain fees that alienate the average user, custodial second layers, and government-backed ETFs will not be considered “bitcoin” for the purposes of this article. So if bitcoin cash you trigger, change the channel.

Ross Ulbricht

The Silk Road case will not be heard, the United States can sell a supply of $4 billion of BTC

A recent ruling by the United States Supreme Court has opened up the possibility of a new sale of bitcoins allegedly seized by the state through the now infamous online marketplace Silk Road. The Silk Road is back in the news these days with a popular call for heavily imprisoned founder Ross Ulbricht to give his life back, and overturn a double life sentence plus 40 years.

According to the plaintiffs, the coins, which the state considers a lawful asset forfeiture related to criminal activity, are nothing of the sort and have a legitimate and innocent owner.

“However, the government has never been required to prove these allegations, nor has it disclosed the identity of the mystery individual who allegedly voluntarily forfeited his interest in an asset now worth $4.4 billion, nor has it alleged that that asset has ever been used in any form. criminal activity,” states a petition for a writ of certiorari.

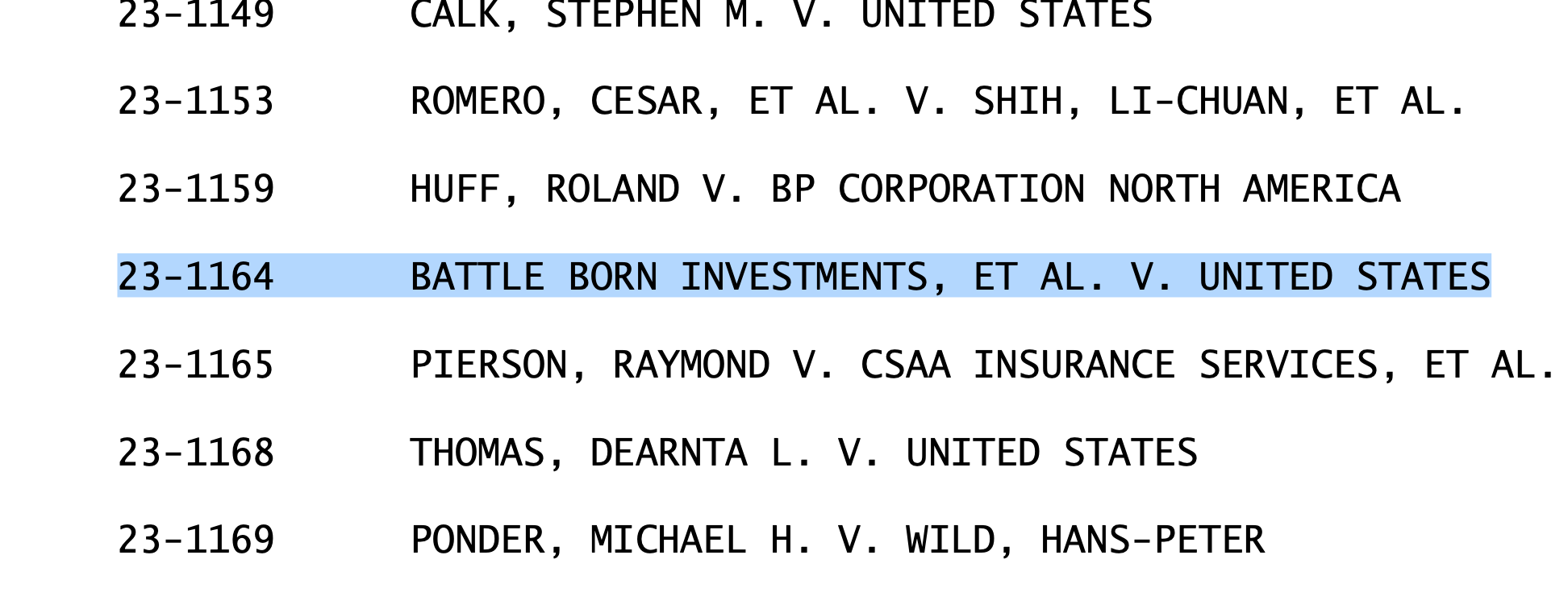

The plaintiff is a group called Battle Born Investments, which is now back up and running without any paddle over the coins. The theft was allegedly committed by the mysterious ‘Individual

There’s a lot of hype about HBO’s new Satoshi documentary

Speaking of mysterious individuals, the creator of Bitcoin, the pseudonymous Satoshi Nakamoto, has also been in the news again, along with the Silk Road. It’s like we’re cycling back to the real ‘OG’ days of Bitcoin, before the days of Blackrock exchange-traded funds and limitless draconian ‘rules’. Yet speculation about Nakamoto’s identity is as old as Bitcoin itself, and terribly played out.

As one Redditor noted, “The truth is, there is a lot of circumstantial evidence pointing to multiple people. Who they reveal depends entirely on the motivations of HBO and/or the director.” The user continued, claiming that mentioning someone alive could have negative consequences.

“It concerns me that they reportedly spoke to the man personally. If they mentioned Finney or Sassman that would be fine because they are dead. But when I mention someone who is still alive, I think their goal is to stir up controversy and FUD,” they said.

“Jessica” NFT on BCH’s UTXO-based smart contract system.

UTXO smart contracts, NFTs, block size adjustment algorithms and more: chain development continues on Bitcoin Cash

Well, here’s the part that will trigger many. But it’s sad that it has to be this way. Amid all the news about a Satoshi revelation and the bickering over who owns bitcoins that the state usually steals, onchain development continues on a fork of BTC – bitcoin cash.

BCH is still used peer-to-peer and is not forced to rely on second-tier or custodial add-ons to escape heavenly transaction fees. Plus, a lot has happened under the radar for ownership in recent years. Interestingly, mainstream crypto news has been almost dead silent on these innovations. So what are they?

Well, unused transaction output-based (UTXO-based) smart contracts for one, resulting in smart contracts similar to those on Ethereum. Because the contracts are based on UTXO, this means that the contract system is baked directly into the chain itself. The capability is active and working since the 2023 upgrade, and specifically allows for the easy creation of non-fungible tokens (NFTs) at a negligible cost.

BCH developer Jason Dreyzehner also just published his Bitcoin Cash Improvement Proposals for 2025, in an effort to further streamline the new capabilities. In May 2024, a new upgrade was added called ABLA (adaptive blocksize limit algorithm), which allows the BCH block size to automatically adapt to network usage. Of course, there are concerns about any network. So shilling is not the true target here.

Suffice to say, no matter what HBO says, and no matter how much the government immorally confiscates, as far as I know, Bitcoin still functions as peer-to-peer electronic money, with the goal of being a global reserve currency for a more peaceful world. That’s a big “W” for the punks, and something worth talking about.