NFT

NFTs from bankrupt crypto hedge fund Three Arrows Capital (3AC) have been sold by New York-based Sotheby’s.

In an auction on Friday, the first lot of 3AC NFTs was sold for a total amount of more than USD 2,482,850. The money will be used to repay the company’s creditors.

Cryptopunks and BAYC NFTs Among Three Arrows Collection

Prior to filing for bankruptcy in July 2022, 3AC had amassed an impressive collection of NFTs.

In February, the liquidator of the insolvent fund, Teneo, released a full list of the non-fungible tokens it plans to sell. Items held by the fund included rare digital artwork by Joshua Bagley, Dmitri Cherniak, and Tyler Hobbs. It also owned several Cryptopunks, a Cryptokitty, and a Bored Ape Yacht Club (BAYC) NFT.

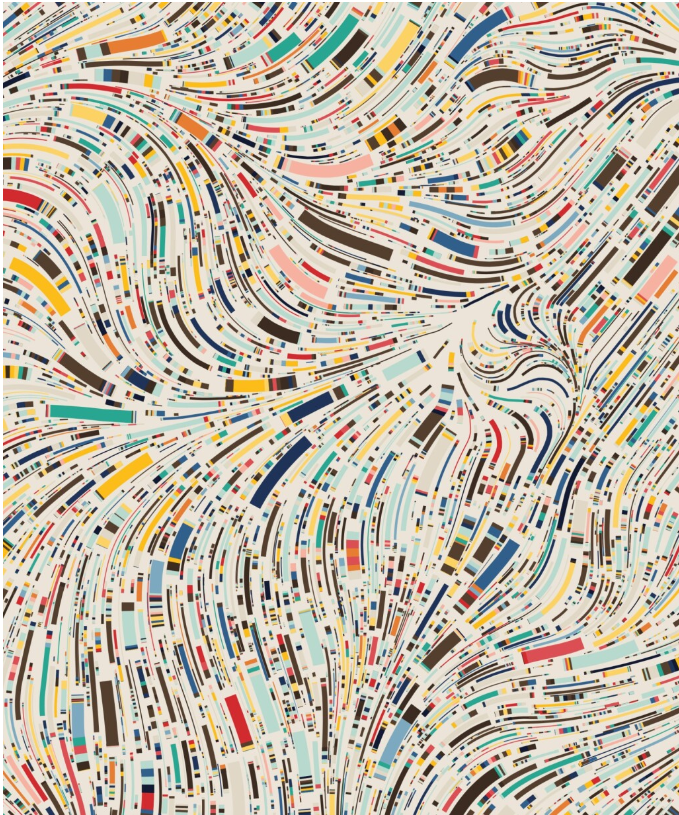

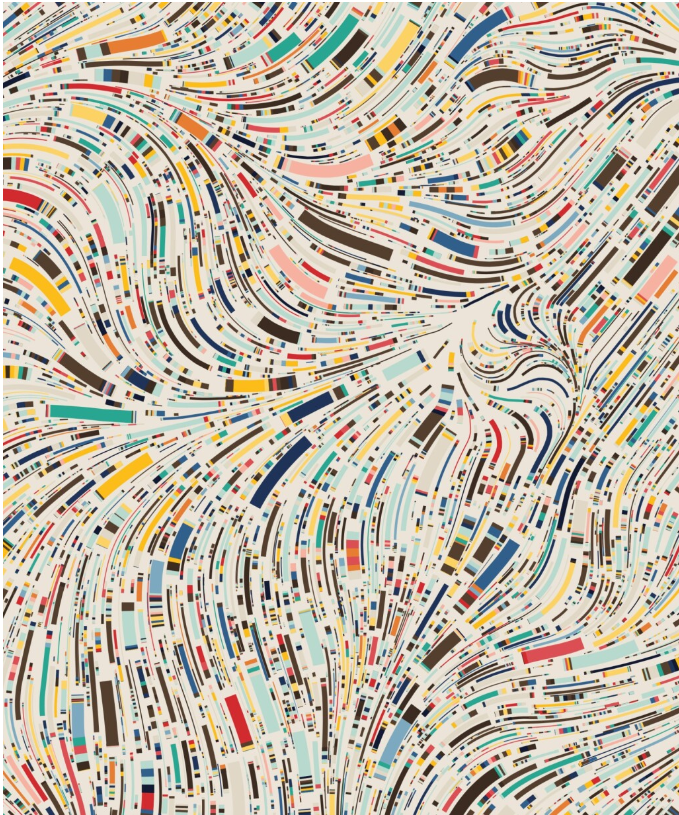

At Friday’s auction, Sotheby’s curated a collection of artwork from Hobbs’ Fidenza project, Cherniak’s Ringers collection, and Larva Labs’ groundbreaking NFTs, including Autoglyph #187 and Cryptopunk #1326. A total of seven generative works of art were included in the lot.

In a catalog for the “GRAILS” collection, Sotheby’s stated that it “represents a fascinating exploration of the intersection of art and technology, offering a unique perspective on the potential of algorithmic art to push the boundaries of creativity in the digital age.” “

The most expensive NFT from the first installation of the Grails collection was Fidenza #725. The piece sold for $1,016,000, well above the $120,000-$180,000 estimate.

Fidenza #725 by Tyler Hobs (Source: Sotheby’s)

Going forward, Sotheby’s will continue to assist Teneo in offloading 3AC’s NFT assets.

As the auction house states on its website, the collection will be released in chapters in a variety of sales formats, ranging from private sales to auctions. These will take place in multiple locations worldwide.

Sotheby’s doubles NFT sales

While rival art auction house Christie’s may have beaten it with its groundbreaking NFT auction of Beeple’s The First 5000 Days, Sotheby’s isn’t exactly resting on its laurels.

Following the first NFT sale in April 2021, Sotheby’s has become increasingly involved in the world’s high-end NFT market. And the auctioneer was a logical choice for the liquidators of 3AC.

Earlier this month, Sotheby’s announced its intention to expand its own dedicated NFT marketplace.

In a move that sees the nearly 280-year-old institution go into direct competition with native digital platforms like OpenSea, the new marketplace will enable peer-to-peer NFT sales conducted on Ethereum and Polygon.

In addition, Sotheby’s will use smart contracts to ensure artists generate resale royalties for every secondary sale.

Starry Night portfolio will remain off the market for now

In addition to the digital artworks in the GRAIL collection, Three Arrows also had NFTs through Starry Night Capital.

Launched in mid-2021 during the peak of the early NFT boom, Starry Night was a dedicated NFT fund. It partnered with collector and influencer Vincent Van Dough to secure prized pieces. By one estimate, the fund had spent more than $21 million in its short time in operation.

However, as 3AC’s insolvency proceedings unfold, the liquidation of the Starry Night portfolio has proven complex. So far, only NFTs held directly by the Singaporean hedge fund have been approved for sale.

According to blockchain analytics company Nansen.ai, NFTs collected by Starry Night were moved to a Gnosis Safe address in November 2022. This suggests they are being kept safe pending a court order allowing Teneo to sell them.

In addition, the trustee has stated that the future of the Starry Night collection is subject to a high court in the British Virgin Islands.