The Bitcoin community is currently buzzing with discussions about an impending supply shock, a market phenomenon where demand exceeds supply, potentially leading to a substantial price increase. Indicators from different sectors within the market are currently converging, suggesting that such an event could be closer than many expect. Here’s an in-depth look at three signals of an impending supply shock:

#1 Rising Demand for Bitcoin ETFs

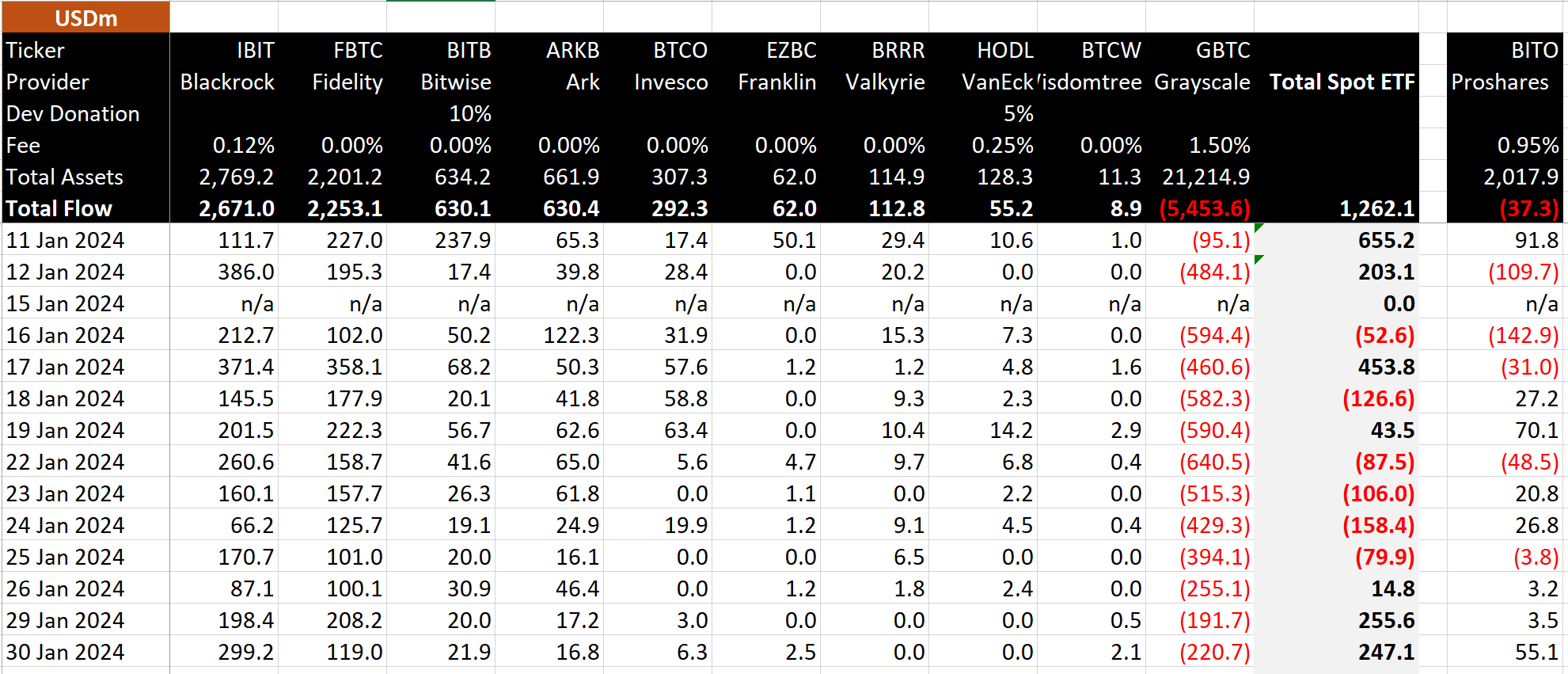

Bitcoin ETFs have created exceptionally high demand since their launch. Initially, this increase in demand was somewhat moderated due to significant outflows from the Grayscale Bitcoin ETF (GBTC). However, Day 13 of Bitcoin ETFs once again showed Grayscale outflows slowly declining (yesterday: $220.7 million, previously $191.7 million), while the past two trading days have seen net inflows of around $250 million for all ETF issuers. was to see.

Dan Ripoll, managing director at Swan, provided a detailed overview analysis about the enormous scale of this. “The Bitcoin spot ETFs have already gained 150,500 BTC in just 13 trading days. They buy at a rate of 12,000 BTC per day. Now let’s KISS (keep it simple, stupid). Only 900 BTC are issued per day. BTC is being bought at a rate of 13x the daily issuance. Within three months, issuance will be halved, increasing the supply/demand imbalance to a staggering 26x daily issuance!”

Additionally, Alessandro Ottaviani, a respected Bitcoin analyst, said underlined the potential market shift, stating: “With Bitcoin ETF inflows always going to be higher than grayscale outflows, the only way to meet that demand will be a price increase. Once we hit $60,000 and even more after the new ATH, institutional FOMO will officially be activated, and it will be something unlike anything human has ever experienced.”

WhalePanda, a renowned crypto analyst, highlighted recent activity and added credence to the mounting supply shock: “Just yesterday, net inflows of ~$250 million into Bitcoin ETFs, while Blackrock did a solid $300 million on its own. Two days of $250 million inflows, the price didn’t rise much yesterday, but a few days like this and you’ll see what kind of supply shock this will have on BTC.”

#2 Massive Bitcoin Miner Sales Absorbed

Despite a significant flow of coins from miners’ wallets to spot exchanges, the market has shown remarkable resilience. According to a report from Cryptoquant:

“Yesterday, the flow of coins in miner wallets to spot exchanges recorded the highest value since May 16, 2023. In total, more than 4,000 Bitcoins flowed to spot exchanges, representing approximately $173 million in selling pressure. However, this selling pressure was calmly absorbed by the market.”

It is critical to note that despite these interactions, reserves in mining portfolios have remained consistent since early January, indicating that the market has effectively absorbed the selling pressure without significant price decline.

#3 Stablecoins or “Dry Powder” on the rise

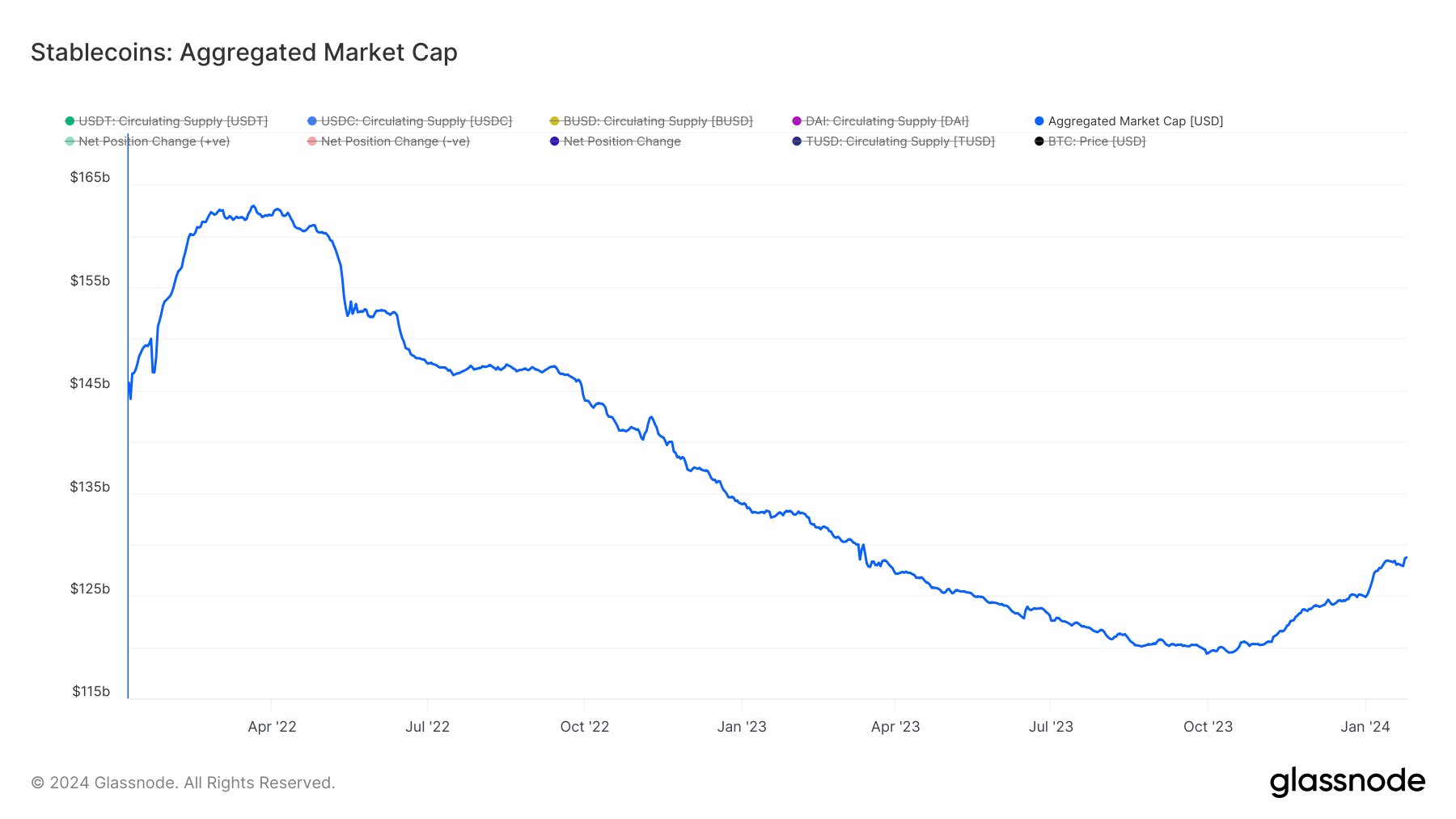

Aggregate stablecoin market capitalization serves as a precursor to potential market movements. Recently, the aggregate stablecoin market capitalization has shown a significant recovery, from a low of $119.5 billion in mid-October 2023 to almost $130 billion.

This surge in stablecoin reserves is often interpreted as “dry powder,” ready to be deployed into assets like Bitcoin, potentially further accelerating supply/demand mechanisms. Alex Svanevik, founder of on-chain analytics platform Nansen, commented on the correlation between stablecoin reserves and the BTC price: “When the stables on exchanges spiked, the BTC price spiked.”

At the time of writing, BTC was trading at $42,848.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.