Binance’s Navigating the Inscription Landscape report discusses three protocols that could further expand Bitcoin’s (BTC) footprint into non-fungible token (NFT), decentralized finance (DeFi), and tooling sectors.

In 2023, the Bitcoin ecosystem experienced transformative growth via the rise of inscriptions and BRC-20 tokens, which redefined the network’s capabilities. These developments sparked a market revival and created a speculative frenzy reminiscent of meme coins, significantly impacting transaction activity and fees on the Bitcoin network.

3 protocols can transform the Bitcoin network

While Bitcoin inscriptions are still emerging, they have expanded into several sectors including DeFi, NFTs, and tooling. According to Binance, this is evident from several innovative projects that have emerged.

bitSmiley, for example, represents a pivotal development in Bitcoin’s DeFi infrastructure, combining stablecoin, lending, and derivatives into a cohesive protocol. The launch of bitUSD, a BTC-backed stablecoin, underlines a significant step toward integrating conventional financial instruments within the Bitcoin ecosystem.

On the other hand, Liquidium is a new peer-to-peer lending protocol. It allows loans using Bitcoin assets such as inscriptions and BRC-20s as collateral. This shows the rising demand for the Bitcoin network in DeFi. It also highlights the economic potential of inscriptions.

“Similar to the operating model of other peer-to-peer lending platforms, Liquidium allows borrowers to collateralize their ordinal assets on terms they find acceptable, while lenders make BTC loans that match their risk-reward preferences,” explains Binance.

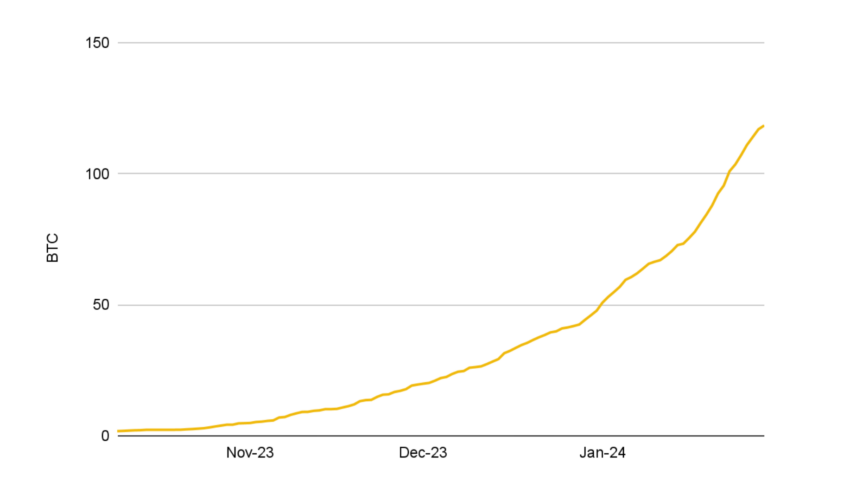

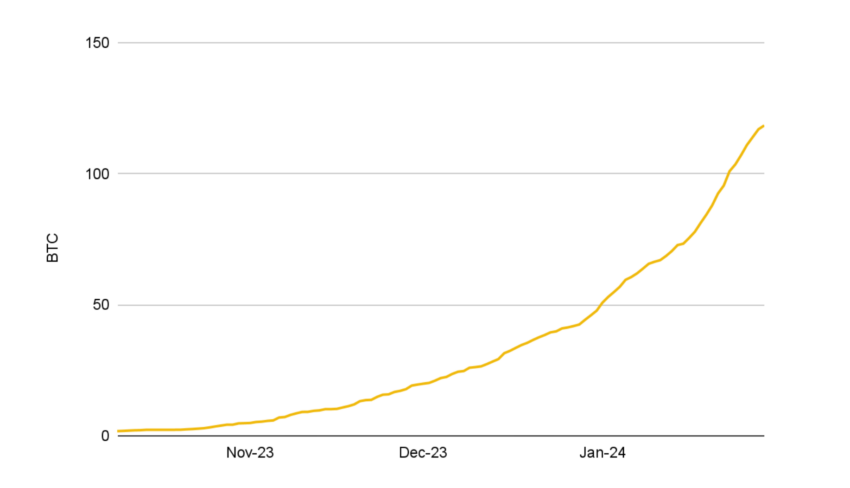

Furthermore, Binance revealed that Liquidium has facilitated transactions of over 118 BTC. Since its inception, it has processed more than 2,700 loans that have been completed or are currently active.

Read more: What are BRC-20 tokens? Everything you need to know

Liquidium Bitcoin Loan Volume. Source: Binance

Finally, Portal stands out as a cross-chain liquidity solution focused on decentralized exchange and wallet services. By facilitating BRC-20 swaps to other chains, Portal underlines the potential for Bitcoin’s integration into the broader blockchain ecosystem, increasing its utility and accessibility.

The impact of inscriptions and BRC-20s extends beyond Bitcoin, with several EVM-compatible chains using similar protocols. Despite the inherent capabilities of these chains for handling fungible and non-fungible tokens, inscriptions have witnessed significant transaction activity, driven in part by speculative interests.

Read more: Bitcoin NFTs: Everything you need to know about ordinal numbers

However, critics and proponents of inscriptions and BRC-20s offer differing views, with the former pointing to network congestion and higher fees, while the latter see them as a golden opportunity for Bitcoin’s evolution, especially in improving the scalability and security of the ecosystem .