- Bitcoin could start October bullish, supported by a hidden pattern.

- The probability leans heavily in favor of this scenario.

Bitcoin [BTC] had a bullish weekend, briefly testing the $60,000 mark before pulling back. At the time of writing, the stock was trading at $58,272, reflecting a temporary pullback after the surge.

As prices recover, hopes hinge on the Fed’s upcoming rate cut, but that’s not the only factor. As BTC enters its 148th day after the halving, a hidden pattern suggests the breakout may be closer than expected.

History points to the possibility of a rebound

The chart highlights a recurring trend in the Bitcoin cycle that emerges after each halving season. For context, Bitcoin halving is a deflationary model that occurs every four years, reducing Bitcoin supply by half.

Source:

From an economic point of view, reduced supply increases the value of each coin. Consequently, each cycle typically begins an uptrend after an average of 170 days.

For example, after the halving on May 11, four years ago, BTC tested the $40,000 ceiling on the daily price chart for the first time about 170 days later. A more significant spike pushed BTC above $50,000 about 480 days later, around early August.

A similar pattern has been observed after each half-life. If this trend continues, BTC could reach $70,000 in the first week of October before resistance emerges. Moreover, the upcoming FOMC meeting could further influence this hypothesis.

Although the historical trend seems promising, the reality must be taken into account. So is a potential rebound just 23 days away?

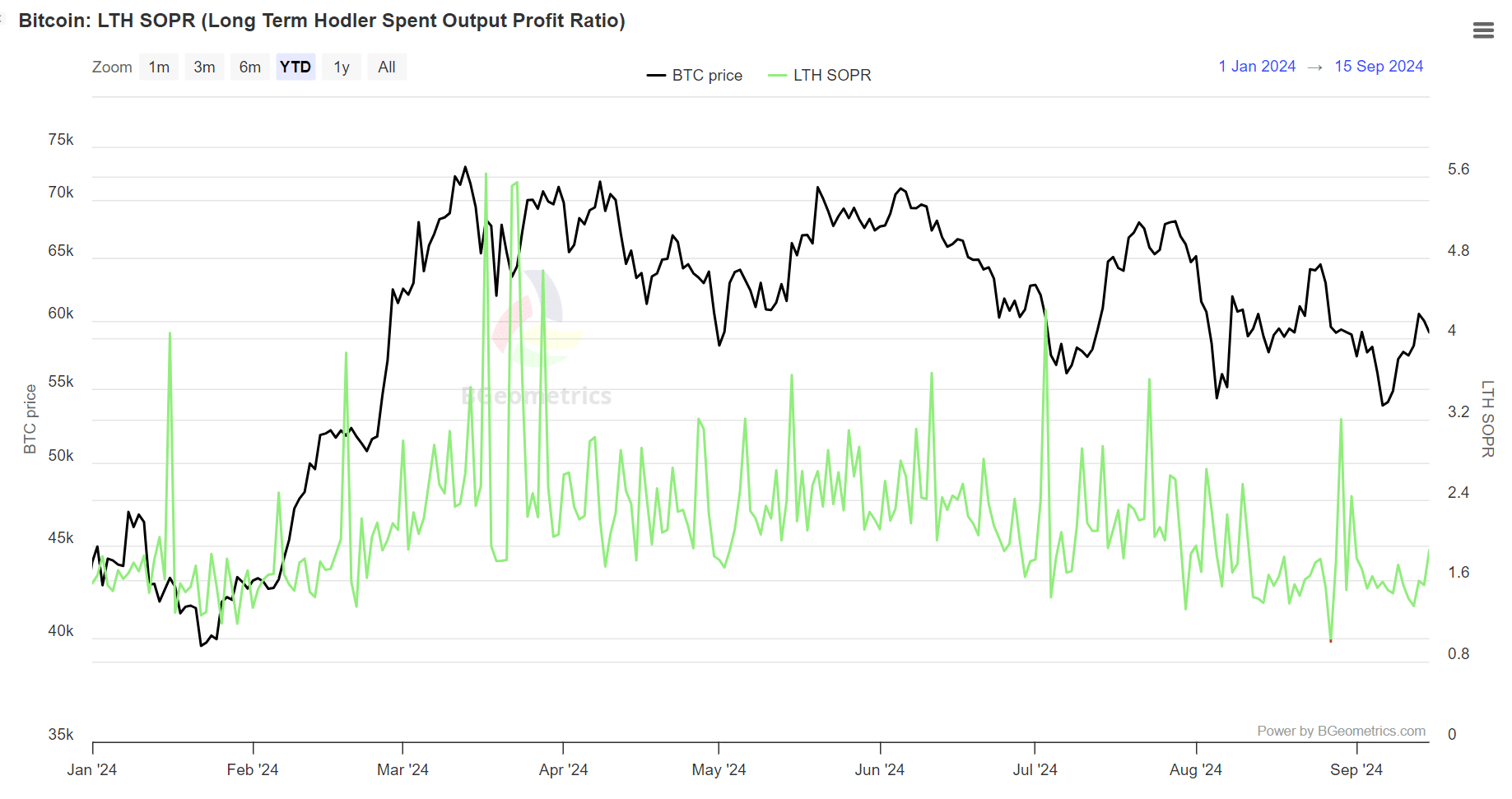

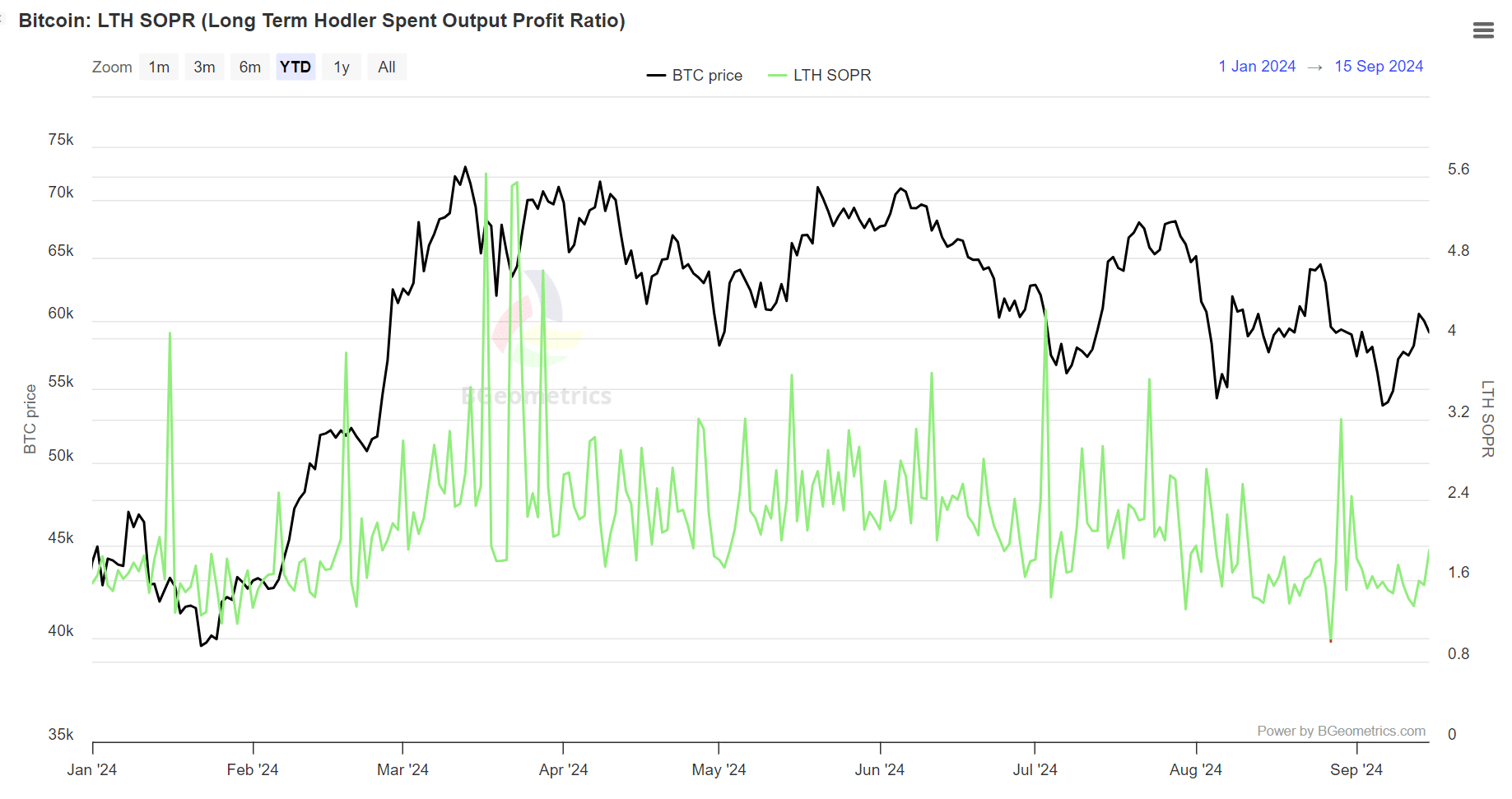

LTH strengthened their support for Bitcoin

Seasoned investors are confident about a possible price correction. Historically, a rising LTH SOPR supports any bull rally, indicating long-term holders are realizing gains.

Source: BGeometrics

While the rebound is a sign of optimism, the expected correction could be undermined if the price does not match the rise. This may encourage long-term holders to sell for a profit rather than risk losses.

Simply put, long-term holders realizing gains indicate a strong position in Bitcoin’s current market value. If this trend continues, a reversal may be imminent. However, a price recovery below $57,000 could be a sign of concern.

LTHs represent a significant portion of investors, but on their own they cannot fully reflect the market’s confidence in an uptrend in October.

That said, analyzing futures traders can provide better insights.

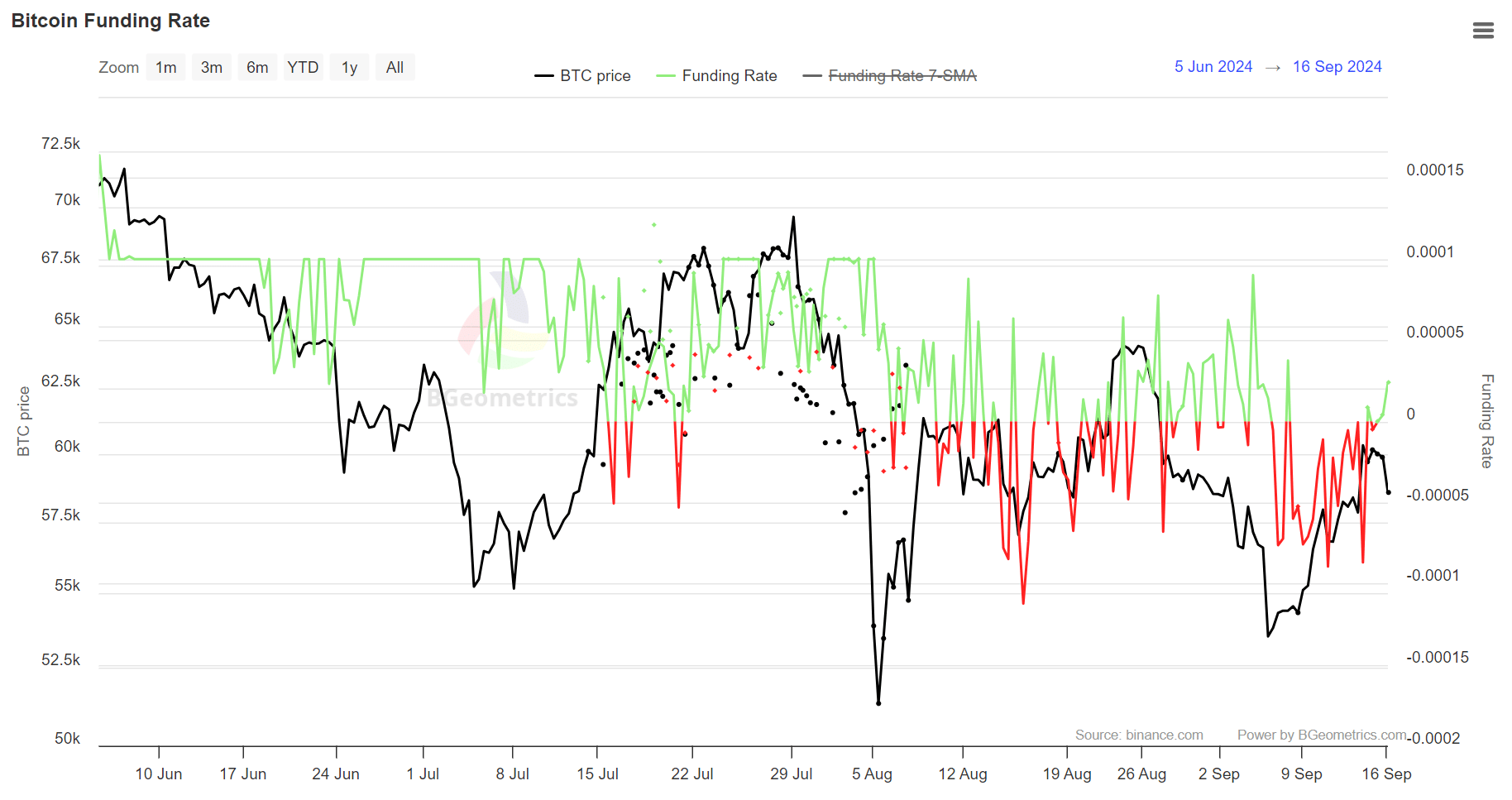

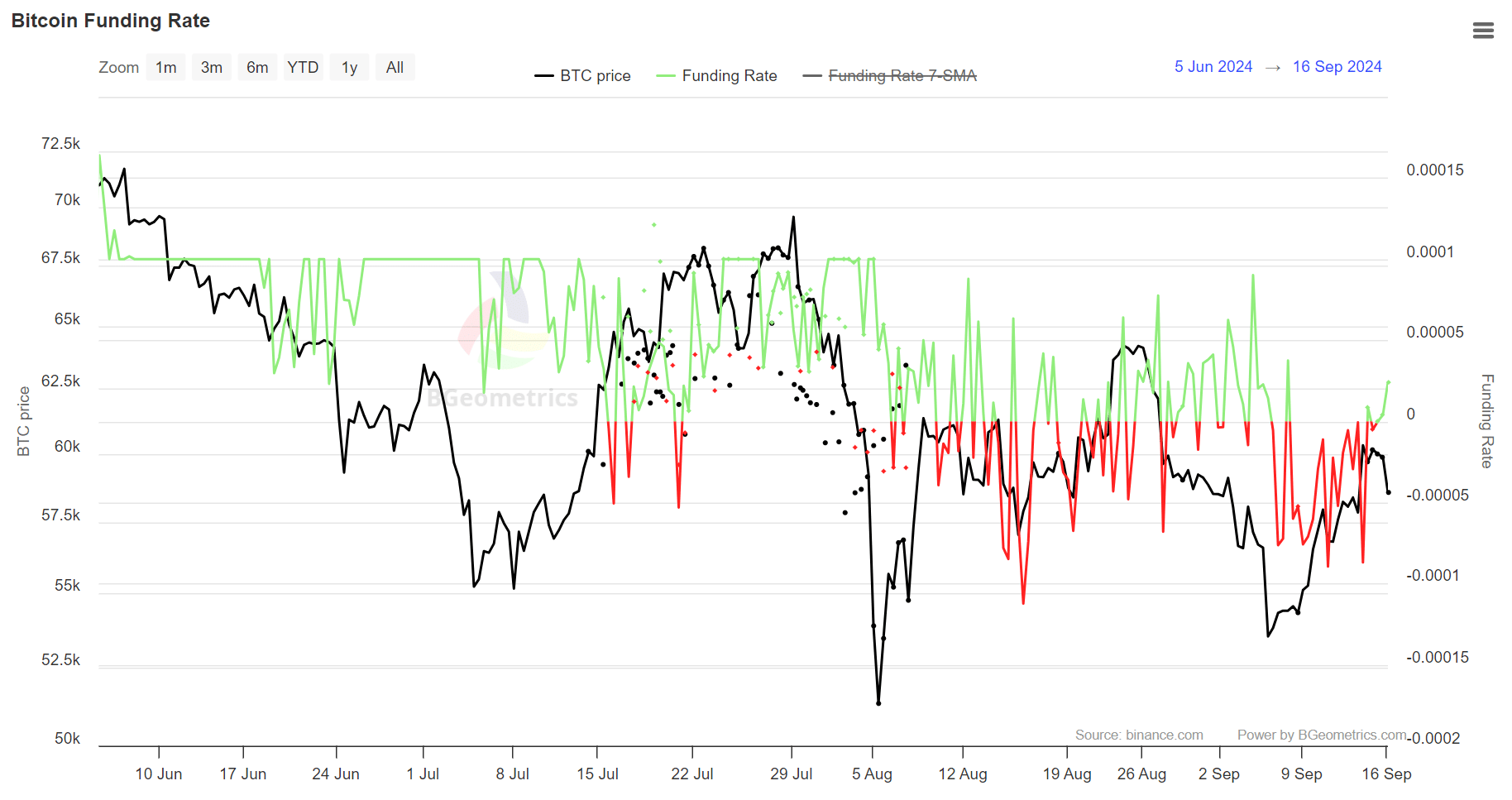

Renewed confidence among prospective Bitcoin traders

While shorts have dominated derivatives trading for a while, longs have recently increased their presence, as evidenced by positive funding rates. Historically, a positive funding rate indicates confidence among futures traders, indicating that they expect BTC prices to rise.

Source: BGeometrics

Additionally, this aligns with AMBCrypto’s previous projections, which noted that positive sentiment often precedes BTC testing crucial price ranges.

While this is appreciated, a more consistently positive funding rate could increase Bitcoin’s chances of a recovery in the next two weeks.

Surprisingly, despite its newfound dominance, BTC fell below $60,000, indicating potential third party involvement.

While this indicates a small difference, other factors can neutralize its long-term impact. The question remains: will the downward trend hold?

What now?

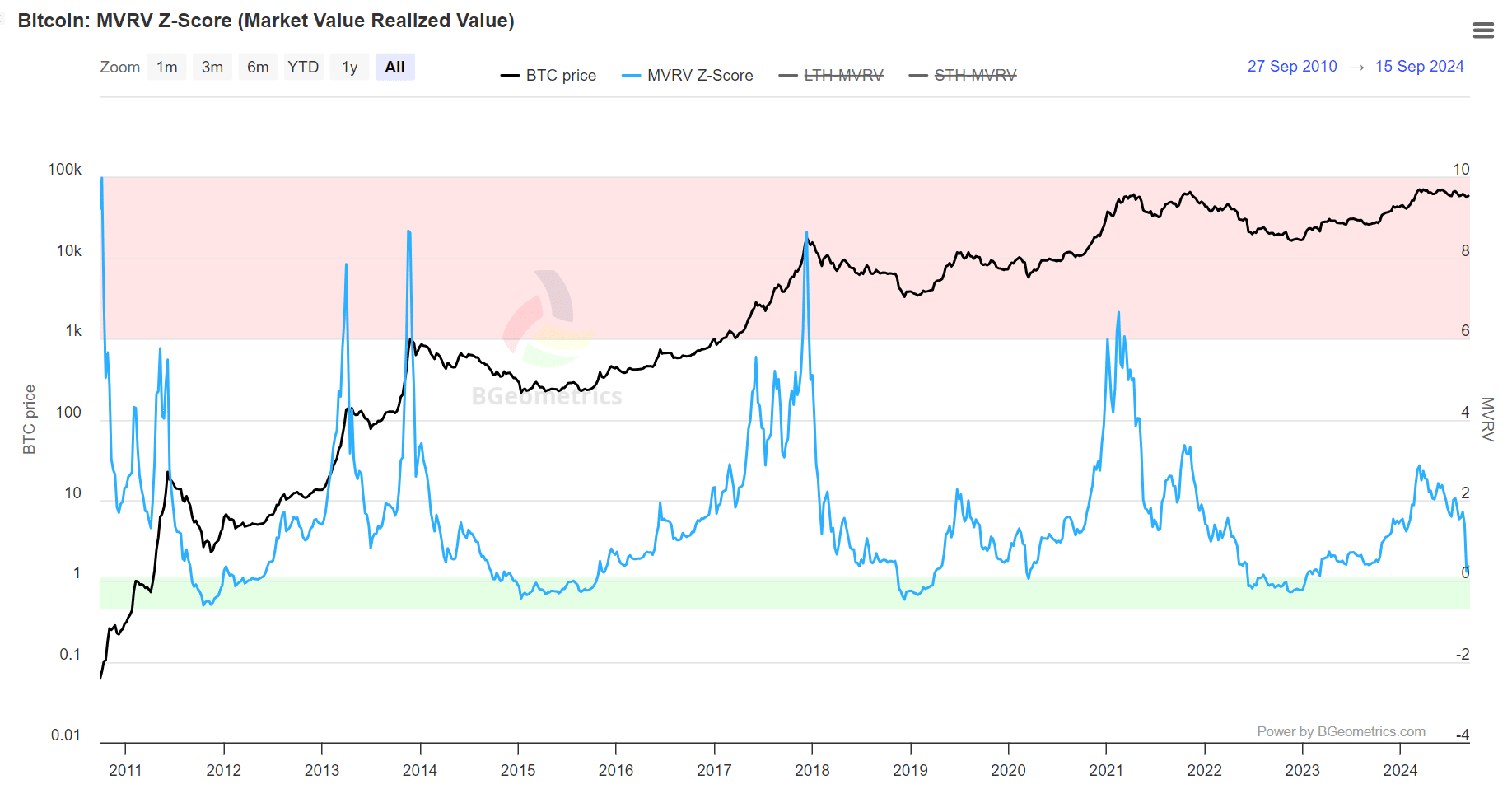

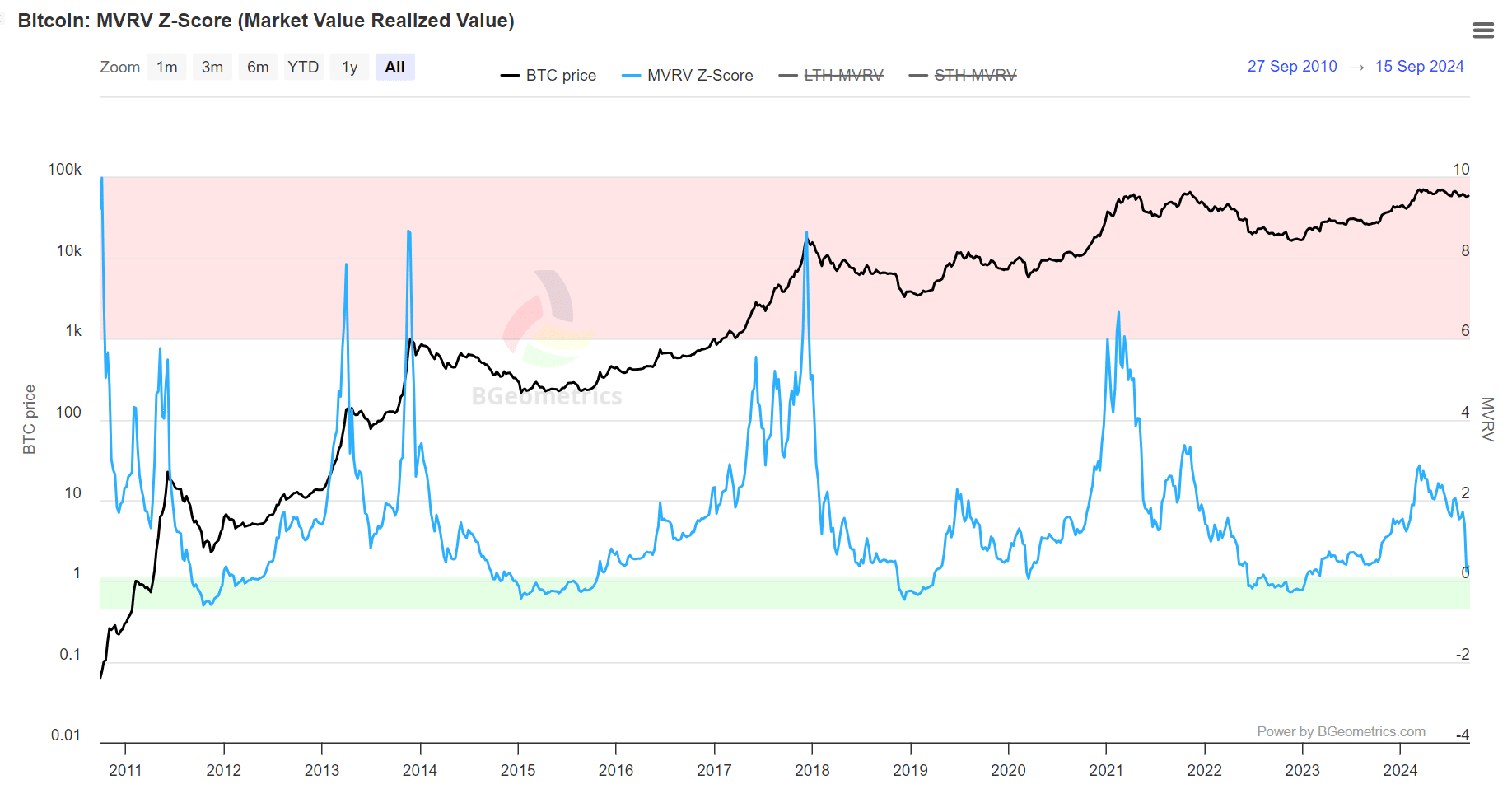

The chart below shows the MVRV-Z score approaching the green box, a zone that historically indicates undervaluation. Buying Bitcoin during these periods has typically resulted in outsized returns, with BTC prices rising again afterwards.

Source: Bitcoin Magazine Pro

However, if the halving trend holds true, the current MVRV will reflect its mid-September value four years ago – just before the Z-score entered the pink box, marking the top of the market cycle. The above graphs support this scenario.

Read Bitcoin (BTC) price prediction 2024-25

According to AMBCrypto, October could start with Bitcoin testing the market top around $70,000, provided recent profit takers refrain from selling, LTH continues to hold and maintain dominance in the perpetual market for a long time.

If successful, the halving effect hypothesis would be confirmed as “true”.