The crypto industry went through a period of evolution in 2023 to reiterate its position in the global market. This evolution was mainly led by Bitcoin’s dominancewith the crypto posting gains in the last quarter that were virtually absent in the early parts of the year.

All the signs are there; The interest is increasing, great money from institutions is sniffing around again, several key technical and on-chain pricing models this year have been confirmed, and the dust appears to have finally settled from the long-running 2022 bear market.

Total market cap at $1.59 trillion | Source: Crypto Total Market Cap on Tradingview.com

The Crypto Winter Thaws: Signs of Life in 2023

2023 was largely a year of correction before the extended bear market in 2022, which saw Bitcoin fall 76% from its all-time high to a low of $15,883. According to a report from Glass junctionMajor shifts in market structure are now taking place within the crypto industry to reflect the growing optimism.

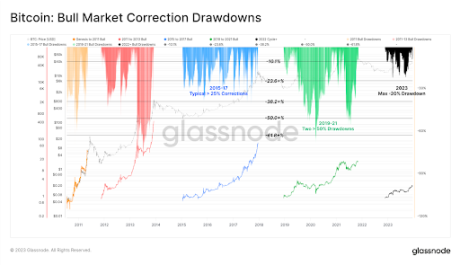

Bitcoin, for example, is showing strong interest from its long-term holders as the industry waits for the future launch of spot Bitcoin ETFs in the U.S. A particular feature of the year that indicated strong bullish momentum was the shallow depth of the market correction, indicating that the sector is evolving into a more stable market in terms of price volatility.

Bitcoin’s deepest correction in 2023 closed just -20% below the local high, better than historical pullbacks of at least -25% to -50%.

Source: Glassnode

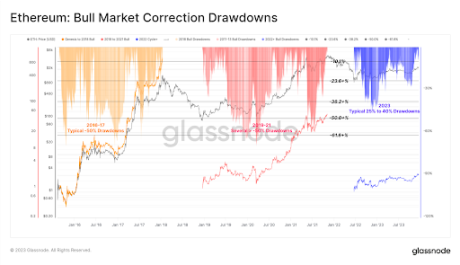

Ethereum also saw superficial corrections, with the deepest reaching -40% in early January.

Source: Glassnode

From an on-chain perspective, the realized limit in the 2022 bear market for both assets showed a net capital outflow of -18% for BTC and -30% for ETH. The momentum picked up in October, when news of various applications of spot Bitcoin ETFs put the crypto market on its heels. As a result, Bitcoin finally broke above the $30,000 level it had been trading below for most of the year.

This flowed into the altcoin market, with Solana, Cardano and Ethereum all seeing renewed interest and growth in prices and DeFi TVL. According to Glassnode, the total value committed to Ethereum’s layer 2 blockchains has increased by 60%, with more than $12 billion now locked in bridges.

According to Coin sharesBullish sentiment has also flowed into institutions. October’s rally led to an 11-week influx into digital asset mutual funds. At the time of writing, annual inflows now stand at $1.86 billion.

The crypto industry, especially Bitcoinis poised for astonishing growth in 2024, with several price catalysts such as the SEC approval of spot Bitcoin and Ethereum ETFs in the US, and the next Bitcoin halving. The altcoin market should also follow suit, led by Ethereum.

At the time of writing, Bitcoin is up 159% this year, outperforming other asset classes. On the other hand, Ethereum And Solana have dominated the altcoin market, increasing 82% and 616% respectively.

Featured image from CNBC, chart from Tradingview.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.