- Bitcoin is now fighting an obstacle around $ 95k in the middle of the walk in the sale of retail

- The most important price and validation models projected BTC could hit $ 150k $ 200k in 2025

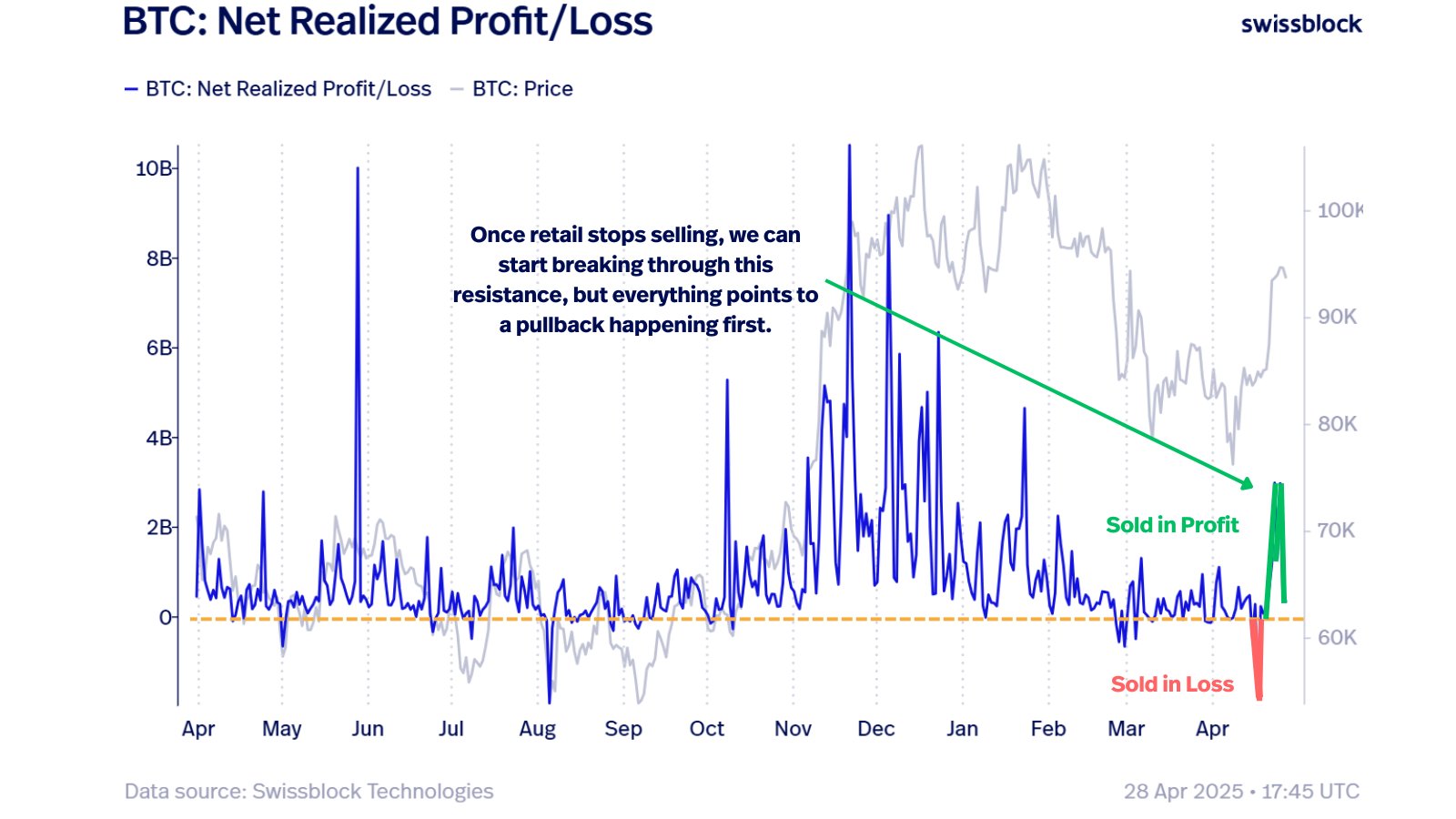

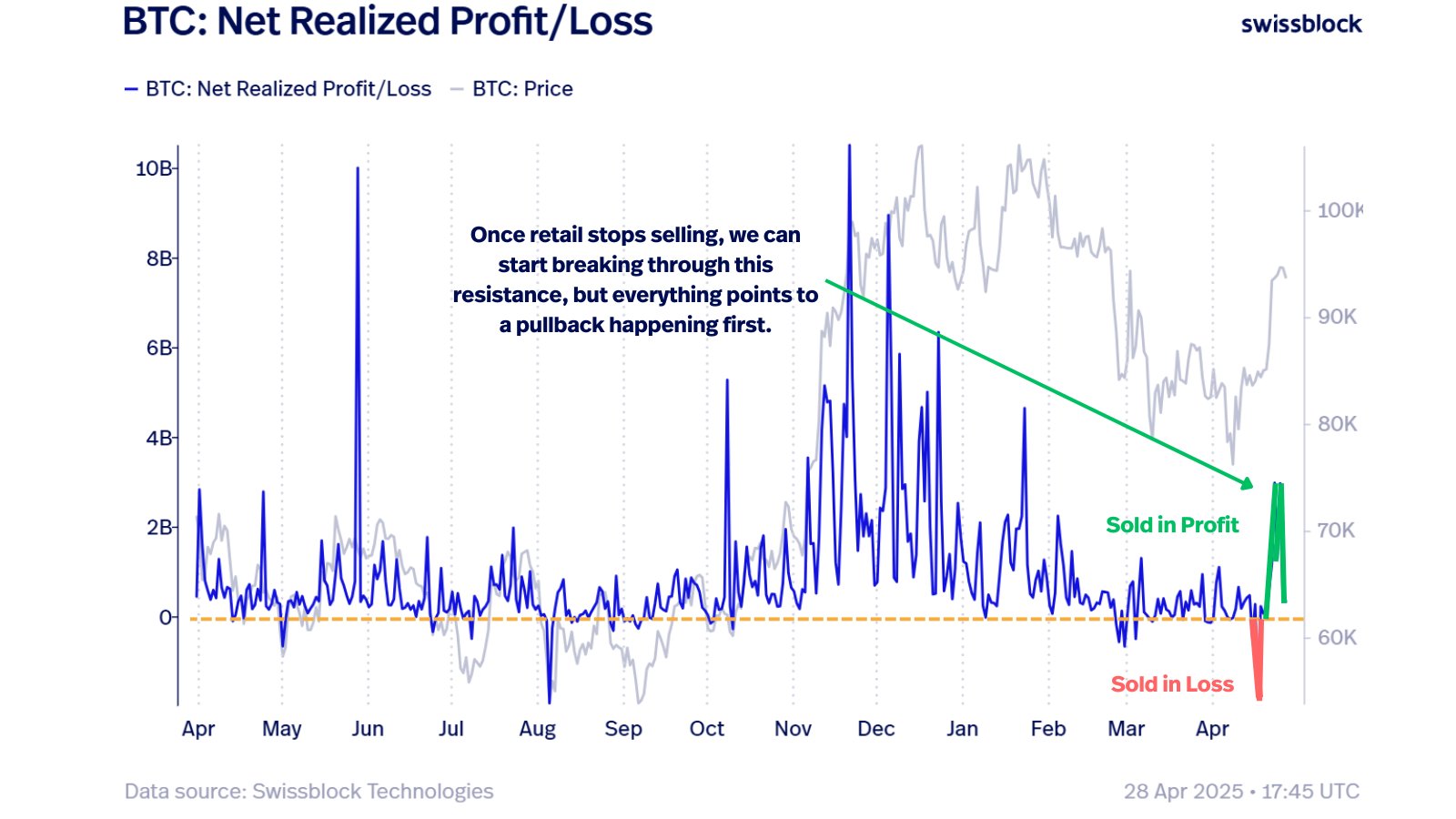

Bitcoin [BTC] has expanded its price consolidation about a week so far. According to Swissblock analysts, the $ 95k road block is even a break-even level for most stores, and they can also just cash in.

“The $ 94k – $ 95k wall contains $ BTC. A withdrawal looms up, but as soon as the retail trade stops, we will break through”

Source: Swissblock

On the contrary, most analysts such as Mathew Hyland to believe The bulls of that bitcoin have more market lever. He called the weekly candlesticks on the daily price diagram, which was above the previous $ 92k range.

Now, assuming they are right, how far can BTC climb in 2025?

BTS BTC’s next peak

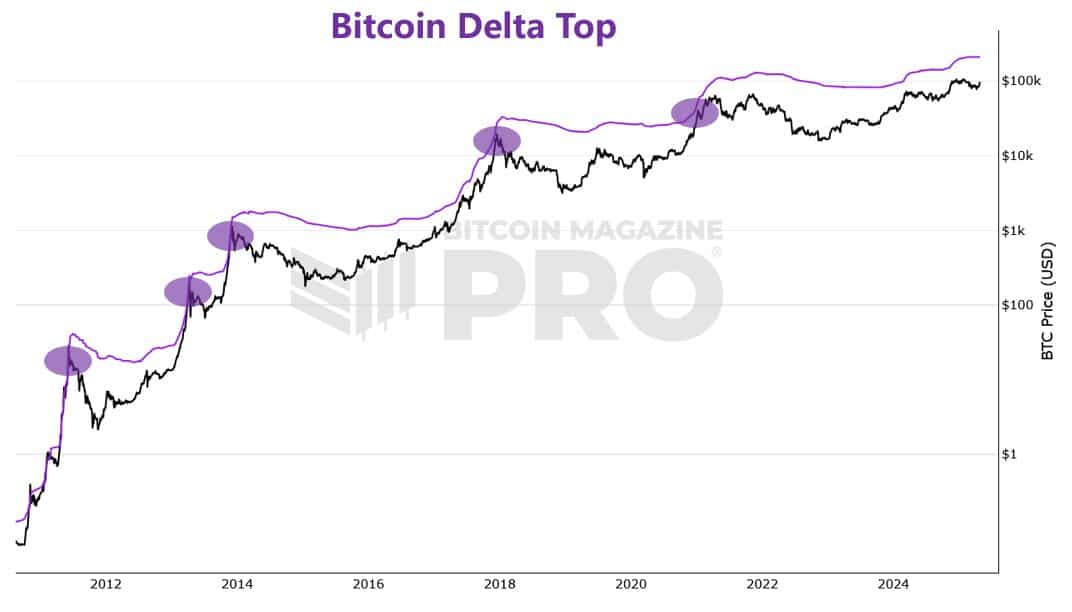

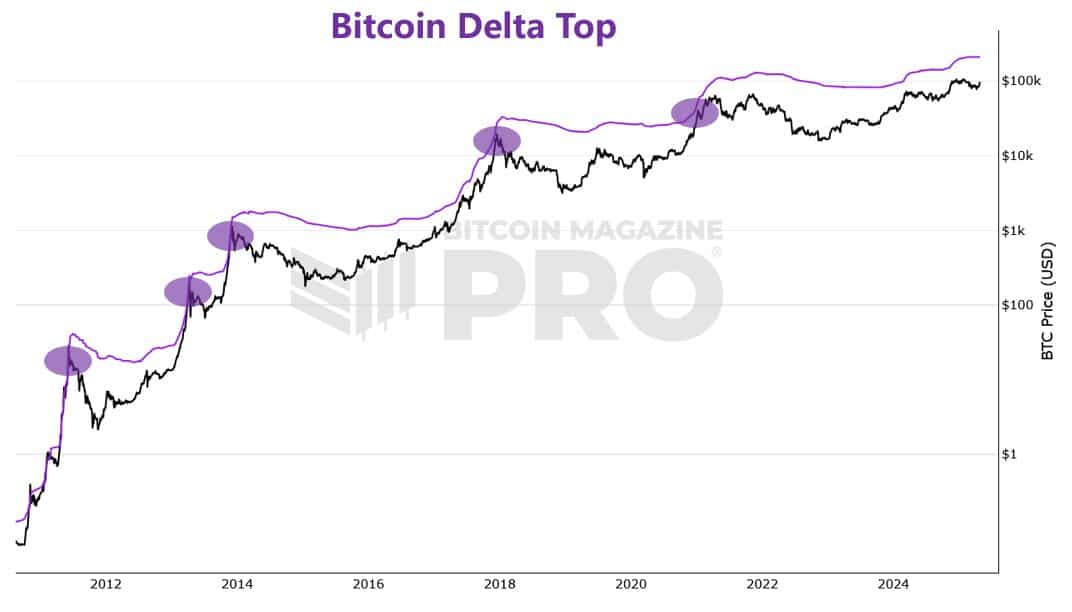

According to a pseudonymous analyst Onchain College, BTC’s Rally was able to extend Up to more than $ 200k per Bitcoin Delta cap. This metric uses historical, on-chain and technical data to probably project market tops in the charts.

Source: BM Pro

It has marked earlier cycles tops with fair accuracy. If history repeats itself, the next cyclespiek can be around $ 210k.

Other valuation models, including the Bitcoin Kantiel, projected A similar scenario of a price target of +$ 200k.

For the Pi-Cyclus topicator, however, the potential market top can be around $ 150k $ 180k if the current cycle peaks towards the end of 2025.

Source: BM Pro

Despite the difference in goals, the models tended to potential growth for BTC. A similar insight was seen on a different valuation meter – BTC True MVRV.

The metric withdrew after touching a local peak around 2, which coincided with the price of BTC at $ 109k. The same level marked the local Top 2024.

Interestingly, Bitcoin’s recent recovery followed on the Rebound of the Metric at 1.4, similar to the relocation of September.

Source: Cryptuquant

However, cycles are always marked by a real MVRV value of 3 and higher. The press time of the press was 1.6, which means that BTC has more room to expand based on trends from the past.

It is worth mentioning, however, that some analysts still believe that the four -year cycle of BTC can be distorted, given the pace of institutional acceptance in the market. If so, the projections that are shared by the aforementioned models must be taken with a grain of salt.