- Crypto shorts suffered a massive loss of $147 million when Bitcoin hit $63K.

- However, its revival is not off the table.

Bitcoin [BTC] Bulls have staged a breakout, reaching $63,000 after weeks of consolidation spurred by Fed rate cuts.

Next to macroeconomic factors have confirmed a tight squeeze in the BTC derivatives markets, resulting in $147 million in losses for crypto shorts.

With BTC approaching the highs of USD 64,000, stakeholders must devise a strategy to push it past the key resistance at USD 70,000 as this will not be an easy task. Why? AMBCrypto investigates.

Unfolding the pinch

Historically, bulls have tested the $71,000 level four times in the last 180 days since BTC last reached its ATH of $73,000 in March. Each time, strong resistance held, preventing another ATH.

According to AMBCrypto, Bitcoin needs to hold $64,000 to target the next resistance at $68,000 – tested twice since June. If the bulls succeed, $71,000 could be within reach.

Source: Coinglass

Meanwhile, a significant spike in Open Interest (OI) likely contributed to the increase, prompting crypto shorts to close their positions, resulting in $147 million in losses.

Notably, the current OI move mirrors the trend from late August, when Bitcoin tested $64K, indicating that BTC may approach that price again.

However, if a similar trend occurs, the chances of a breakout decrease as BTC bears could re-enter the market, thwarting another attempt at a breakout.

Simply put, despite the rate cut, Bitcoin still faces significant challenges in testing $64,000 before a broader breakout can be expected. So were the losses from crypto shorts due to a “short” squeeze?

Stakeholders in the net profit

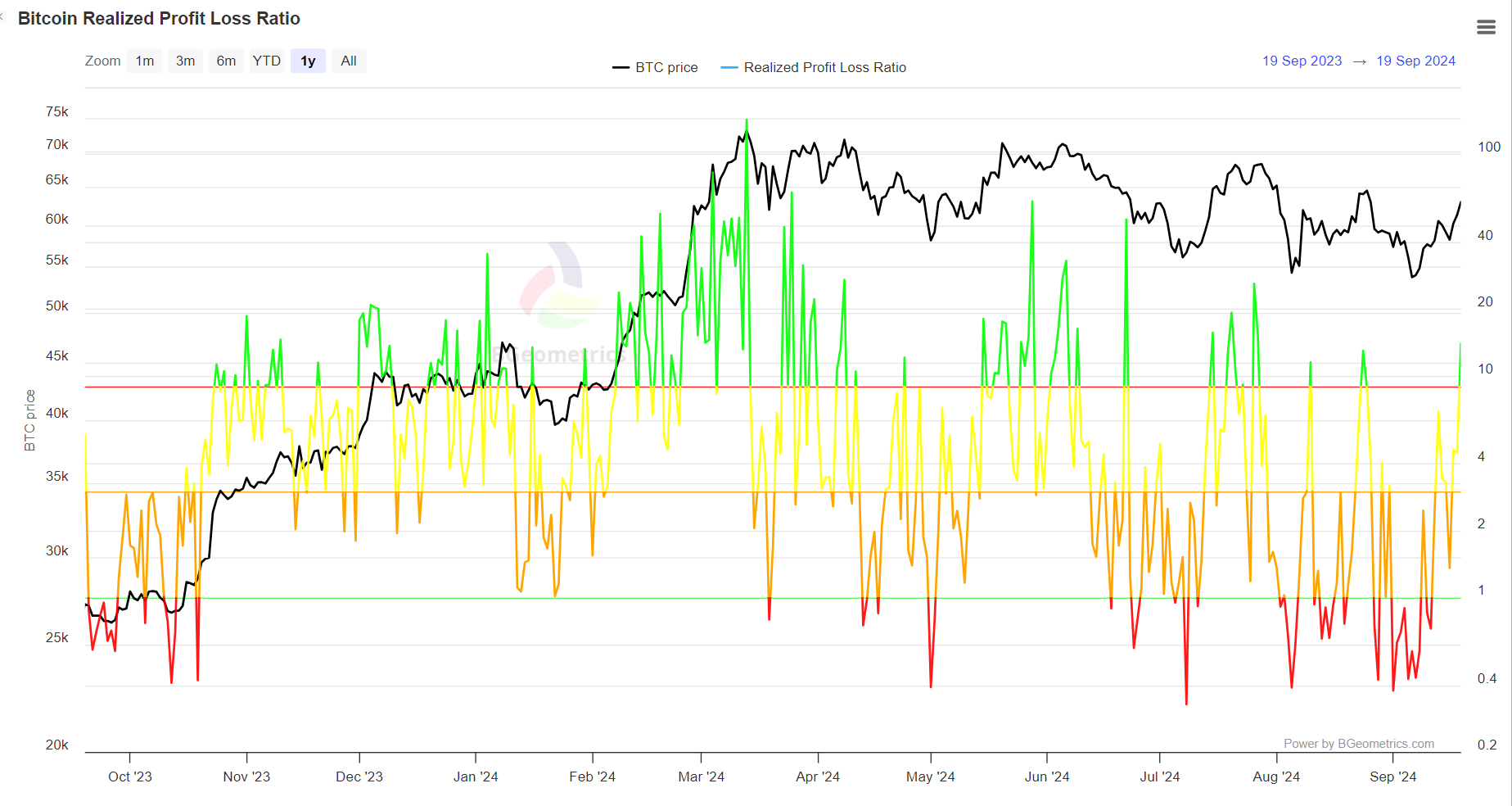

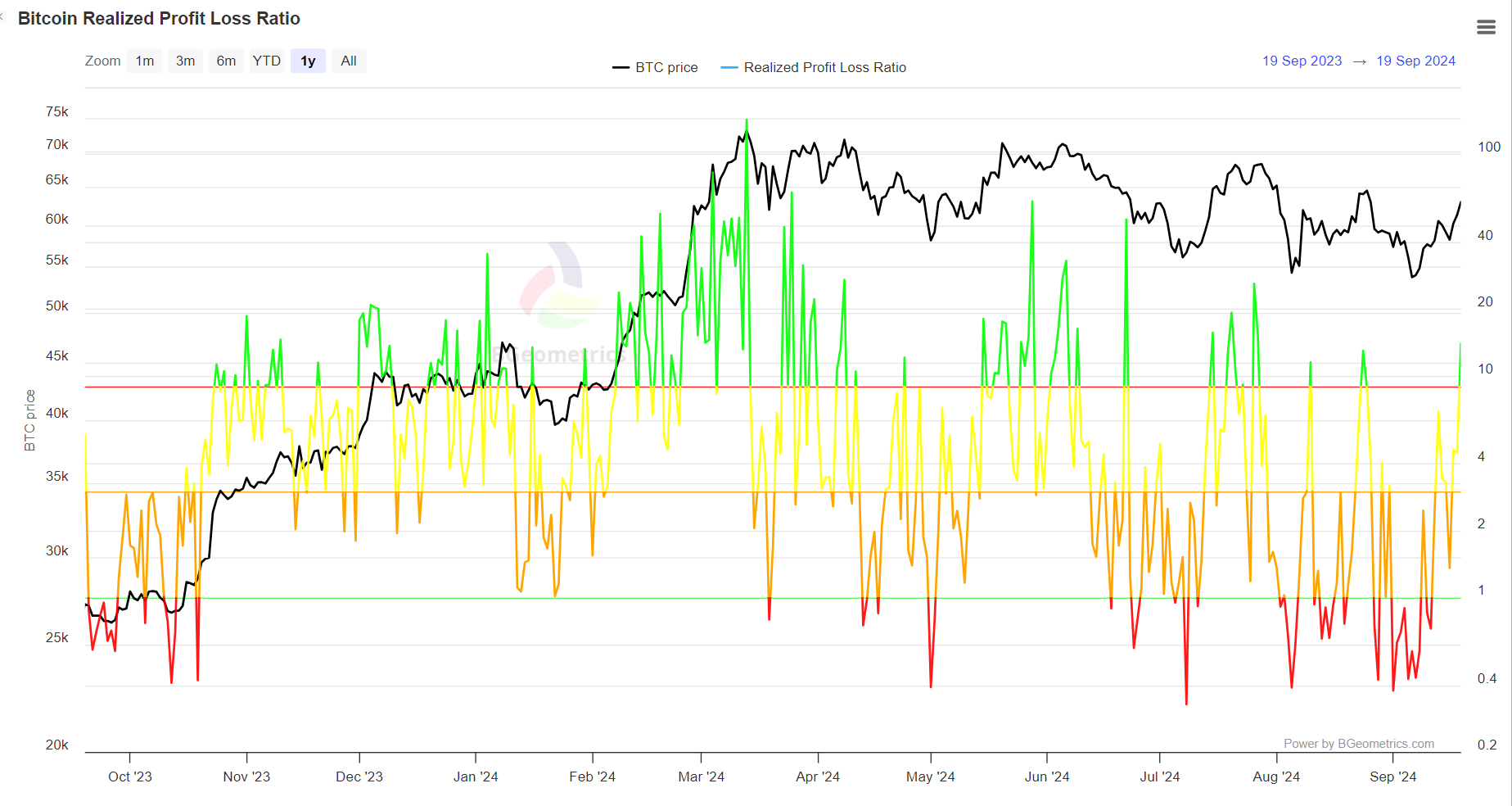

The graph below shows the positions of stakeholders in response to price changes. Currently, a significant portion of buyers are in the profit zone, marked by the green wig.

Source: BGeometrics

Historically, increases in this ratio have coincided with market tops. However, during the last peak of $64,000, the spike was short-lived as crypto shorts quickly cashed in on their gains.

If this trend repeats, a breakout could stall if traders exit before the rally dissipates, reinforcing the short squeeze hypothesis.

Furthermore, if crypto shorts resurface, bulls may need to seize another opportunity to push BTC towards $70,000.

BTC could come back if crypto shorts regain control

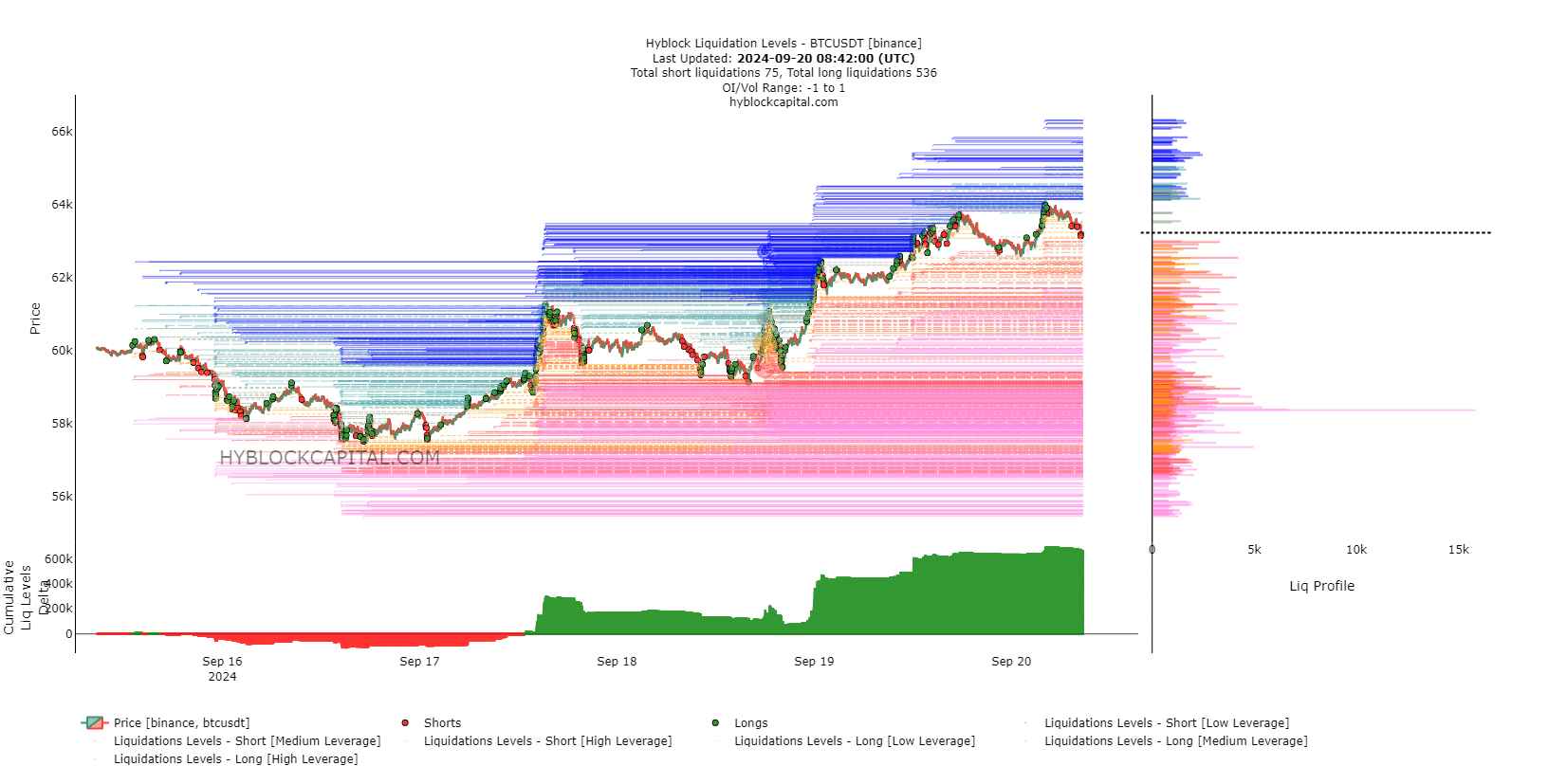

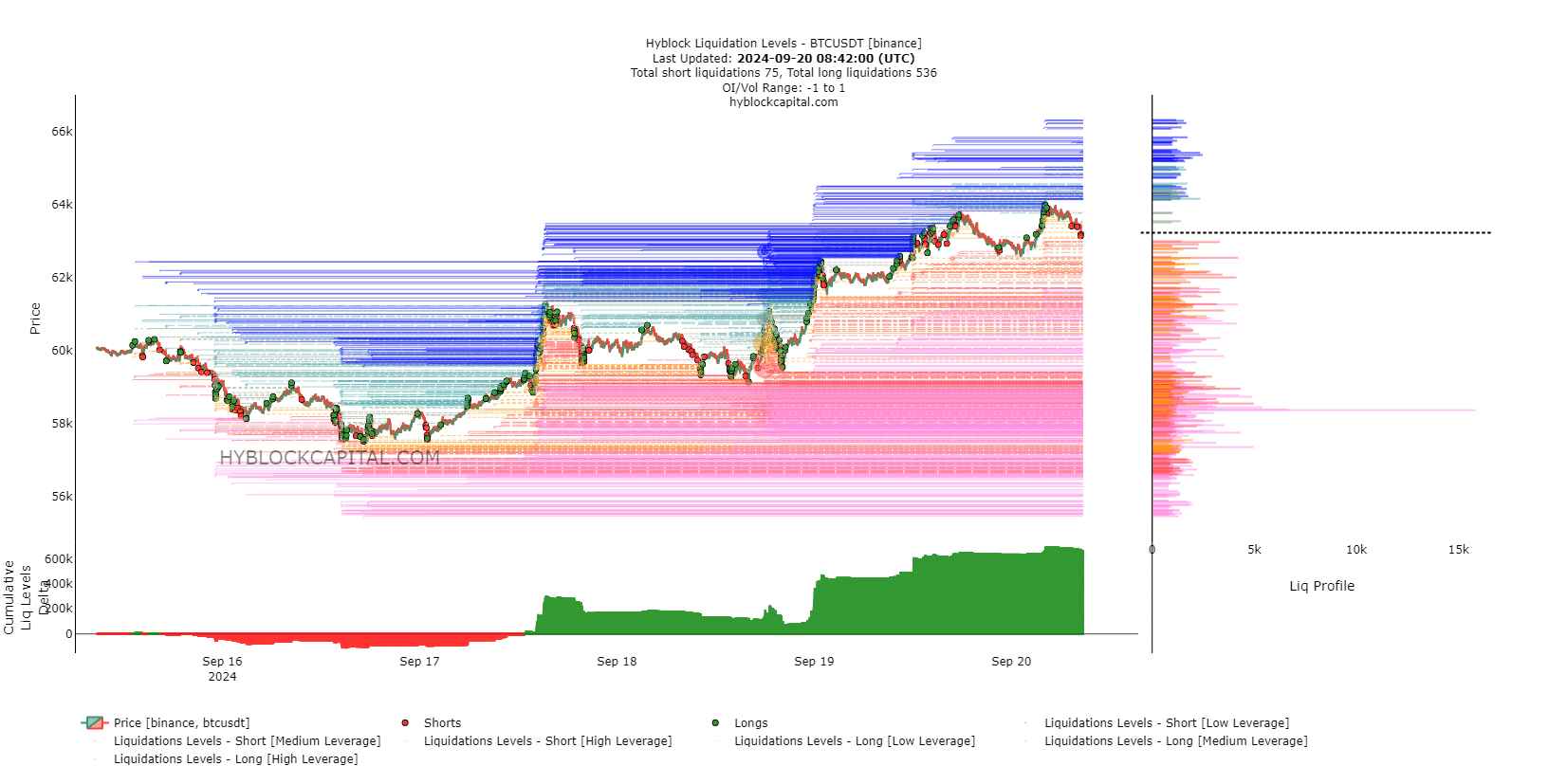

Over the past three days, as BTC rose above $60,000, crypto shorts have retreated, allowing for a significant influx of long positions.

Source: HyblockCapital

Read Bitcoin’s [BTC] Price forecast 2024-25

However, a slight downtrend could lead to massive liquidations if the bulls fail to maintain support. If traders exit and the bulls retreat, a resurgence in crypto shorts could push Bitcoin back below $60,000.

Historically, $64,000 has acted as both resistance and support, and the possibility of a breakout depends on investor strategy. If BTC fails to take advantage of the $147 million crypto shorts squeeze, it could lead to a return of BTC to $55K.