Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

The Solana price action in the last 24 hours is characterized by a decisive movement above the level of $ 135, a development that can indicate growing bullish momentum. This outbreak follows a few days of lateral movement, where the Solana price within a narrow range was traded between $ 124 and $ 135.

Related lecture

Although the recent step Above this consolidation zone Hints on a potential upward continuation, according to data about the chains that a considerable resistance is waiting in almost $ 144, which can serve as the next important test for bulls.

Levels that will define the next Solana outbreak

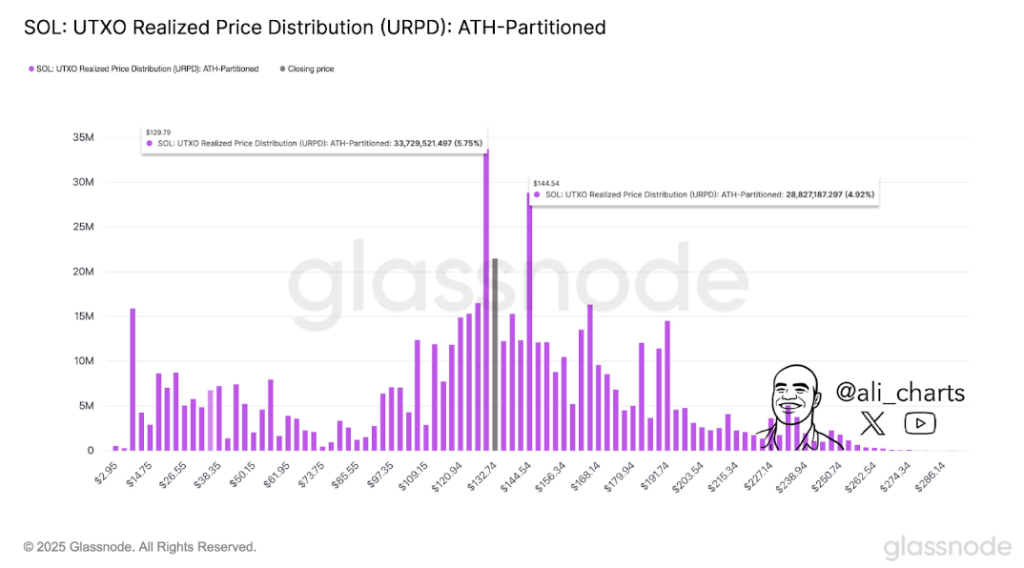

According to to a post on Social Media Platform X by crypto analyst Ali Martinez, the current trade range of Solana between $ 129 and $ 144 is very important for how things are going from here. In particular, Martinez noted that the most important support for the Solana price is $ 129, while the most important resistance to look at $ 144 is.

This comment is closely used for the data shown in a graph that is shared by the analyst from Glassnode’s Utxo Realized Price Distribution (URPD): ATH-PARTITIONED Model.

The volume staves that are shown in the URPD data below indicate that the price of Solana is in boxes between dense clusters of buying and selling activities. The highest concentration is currently around the region from $ 129 to $ 144.

The graph emphasizes that around 5.75% of all current volume realized for SOL took place near the price of $ 129, making this level a strong support zone. Interesting that its importance was strengthened on April 17, When the price of Solana recovered Sharp after short to this level.

Similarly, the level of $ 144 also has around 5% of the volume, act like a resistance Ceiling in the short term. This price zone previously rejected Bullish attempts in the last week of March and confirmed it as a ceiling in the short term for an up -like momentum.

Together these two levels form a tightly disputed range, and a breakout outside both boundaries will probably dictate whether Solana enters a new bullish leg or will be retraded.

Image From X: Ali_charts

The UTXO Realized Price Distribution (URPD): ATH-PARTITIONED Model

The UTXO realized price distribution (URPD): ATH-PARTITIONS is an advanced on-chain statistics that maps out where current coins holders have acquired their tokens with regard to all time High (ATH). When a price level shows a high concentration of realized volume, this means that a considerable number of tokens was purchased at that level.

These clusters tend to act as psychological support or resistance, because holders are more inclined to defend breakage zones (support) or to close it with earlier loss zones (resistance), depending on the market sentiment.

Related lecture

In terms of market sentiment, the current market sentiment is gradually bullish for Solana, and the recent break above $ 135 puts the level of $ 144 in focus, At least in the short term. The price could reach this new week, or a drawing in sentiment can focus the $ 129 as the level to hold on.

At the time of writing, Solana traded at $ 139, an increase of 3.6% in the last 24 hours.

Featured image of Mudrex, Graph of TradingView