Blockchain data and research firm Nansen says hundreds of millions of dollars have left the Coinbase group in the wake of a lawsuit filed by the US Securities and Exchange Commission (SEC).

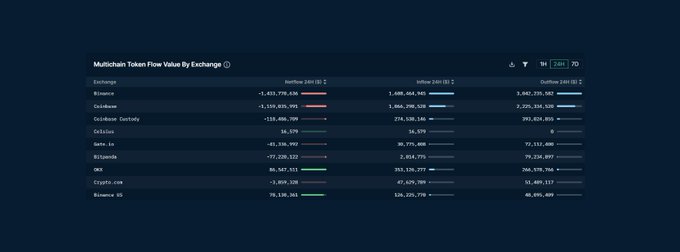

According to Nansen, Coinbase and the exchange’s custodial department included negative net flows, the sum of deposits and withdrawals, of about $1.28 billion after the SEC move.

“As we write this, the SEC has announced that it is suing Coinbase. Looking at on-chain centralized exchange data, it shows that Coinbase + Coinbase custody has negative net flow of $1.28 billion.

The Blockchain data and research agency say that among the top three wallets that pulled out of Coinbase were two addresses of two institutional investors.

“The top three wallets in terms of net withdrawals in the last 24 hours belong to Cumberland and Brevan Howard Digital, two leading institutional investors.”

As for Binance, Nansen say that the world’s largest crypto exchange by volume has also recorded negative net flows amid a previously filed SEC lawsuit.

Nansen says about $1.43 billion, less than 10% of the exchange’s total funds at known addresses, left Binance in the 24 hours following the announcement of the SEC lawsuit.

“It has been 24 hours since the SEC sued Binance. Binance users have withdrawn more than $3 billion across multiple chains since the announcement, resulting in a negative net flow of $1.43 billion as of 15:00 UTC today…

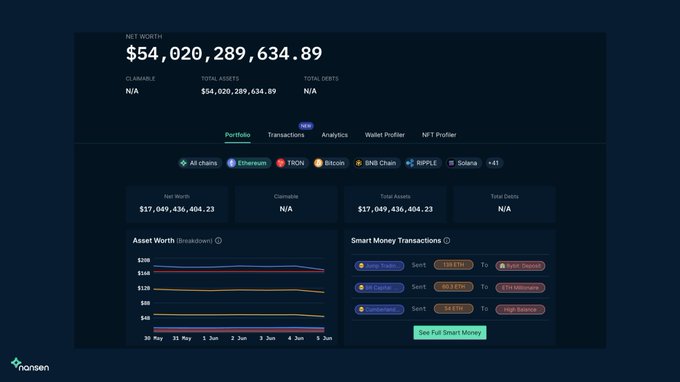

While the sum of the negative net flow is high, Binance still has over $54 billion in their well-known wallet and $17 billion on Ethereum. Ethereum withdrawals represent <10% of total funds in known wallets, but this number is lower when other chains and addresses are taken into account.

Don’t Miss Out – Subscribe to receive crypto email alerts delivered straight to your inbox

Check price action

follow us on Twitter, Facebook And Telegram

Surf the Daily Hodl mix

Image generated: Midway through the journey