- High net flows from Bitcoin spot ETFs demonstrated the bullish belief.

- BTC’s weekly price action remained solidly bullish.

Bitcoin [BTC] saw its spot ETF approved in the US on January 10, 2024.

The US Securities and Exchanges Commission has approved trading of the first 11 Bitcoin spot ETFs, marking a major milestone in Bitcoin history.

Source: Mint glass

Originally conceived as a decentralized, trusted, peer-to-peer network, cryptocurrency has changed tremendously over the past fifteen years.

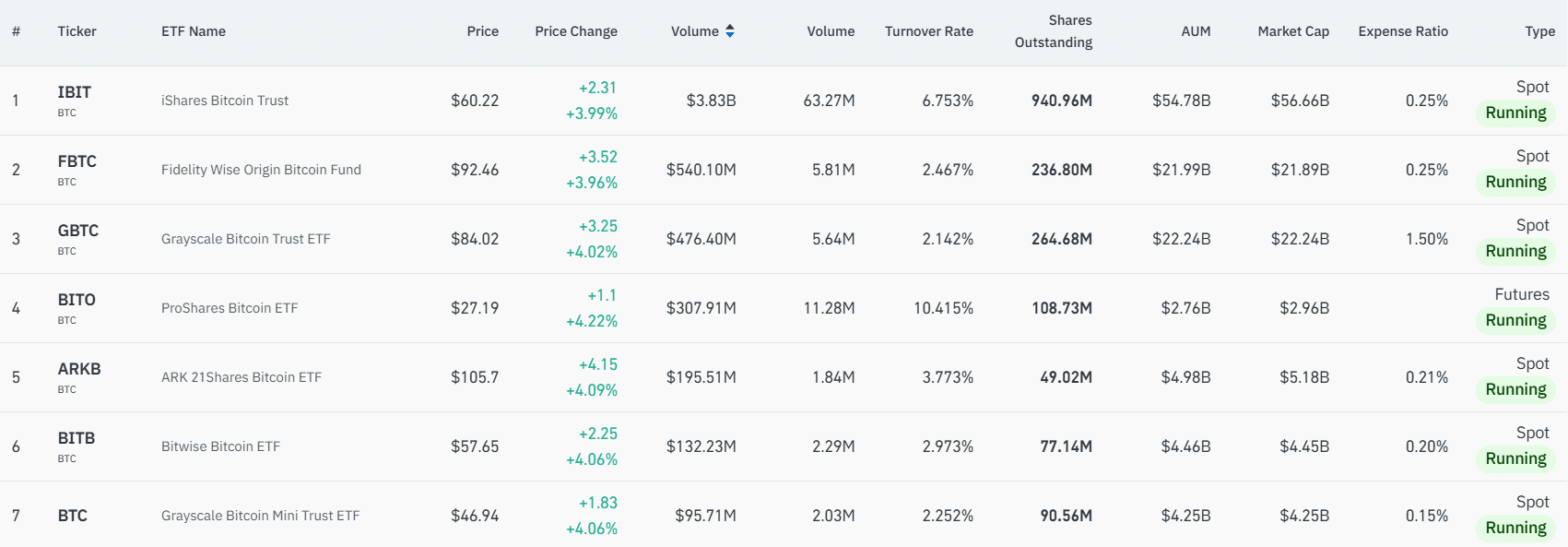

The largest BTC spot ETF, IBIT, has a market cap of $56.66 billion (price x shares outstanding).

The spot ETF netflow table showed that BlackRock’s iShares Bitcoin Trust saw consistent inflows over the past two trading weeks. Overall, this inflow showed that sentiment was strongly positive.

Bitcoin ETF investors are making a big profit

Since it is the largest spot ETF, we can use IBIT’s price chart. The above data showed that trading started on January 11 and reached a high of $30 on that day.

If an investor had previously bought €1000 worth of shares, how much profit would he have made by now?

Without taking into account trading commissions, taxes or maintenance fees, shares purchased at the January 11 peak would have increased in value by 100.7% and would be worth $2,007.

If they were purchased at $22.02, the low on January 23, the investor would be up 173.46% before fees. The $1000 would now have been $2,734.6.

The weekly chart indicates $152k

Source: BTC/USDT on TradingView

The Fibonacci retracement levels showed that more gains were likely. On the weekly chart the market structure was strongly bullish. Nearly a month of consolidation took place below the $100,000 mark.

Read Bitcoin’s [BTC] Price forecast 2024-25

Over the past week, BTC has climbed higher and appeared to reverse the $103.8k level in support. A weekly session close to this point would be a strong bullish sign.

The next bullish targets were $122.4k, $133.9k and $152.5k. Bitcoin investors, whether in spot ETFs or the coin itself, would likely be even more excited in the coming months.