According to on-chain data, the net worth of Ethereum removed from staking is worth more than $1 billion in the past 24 hours, again showing the network’s ability to perform live network-wide updates without any issues.

ETH withdrawals in action

Since the Shanghai and Capella upgrades went live, a total of $1.7 billion has been withdrawn. However, if round 2 of withdrawals began, the value of Ethereum recorded increased. Round 1 took 4.14 days to complete as validators were processed in the queue.

There are currently 18,442,455 ETH wagered, worth $38.5 billion at the time of writing. As a result,

staked ETH makes up 15.32% of the total supply, with 33% staked with Lido.

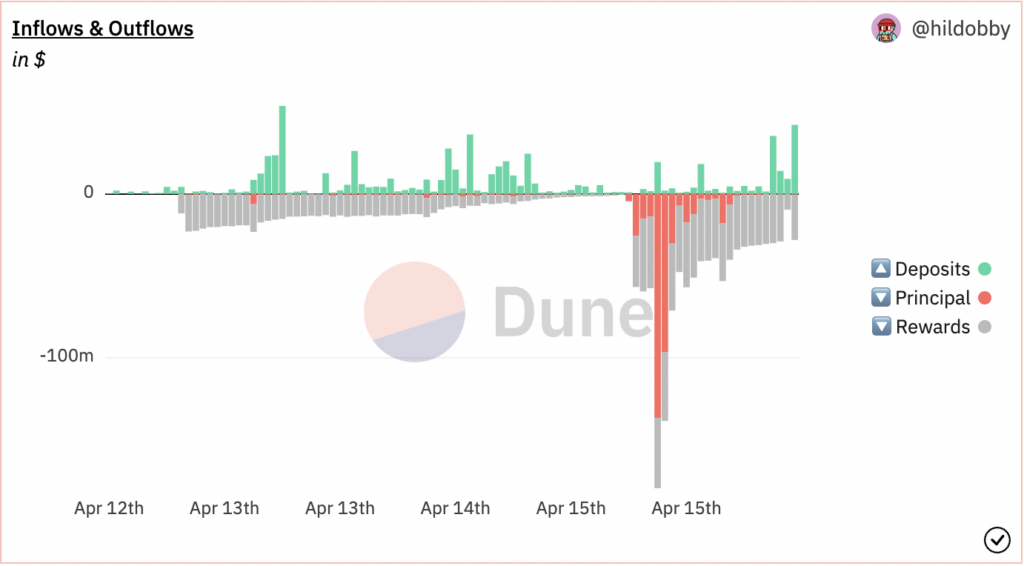

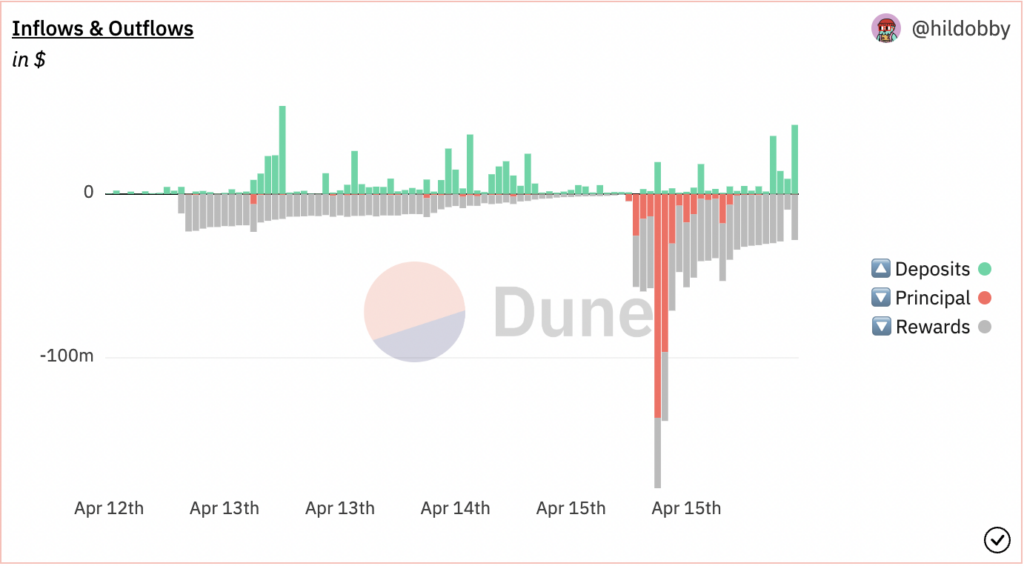

Now that withdrawals are open, investors have withdrawn their initial capital and the rewards earned. Staked Ethereum earns interest over time, and when a validator earns more than 32 ETH through rewards, the excess amount does not add to their first name. Instead, it is automatically withdrawn as a reward every few days.

The chart below shows the huge difference between deposits and withdrawals (rewards and principal funds) since the upgrade.

Rewards

Staking rewards started at around 15% and were placed on a predefined descending curve relative to the number of validator participants until the merge when the network took over. The current validator reward is 4.33%, including consensus rewards and transaction fees. These rewards peaked at around 5.2% in the days leading up to the upgrade, but have since returned to their downward trajectory. Total wagers are down 1.4% since last September’s merge, when they rose from 4.3% to 5.8%.

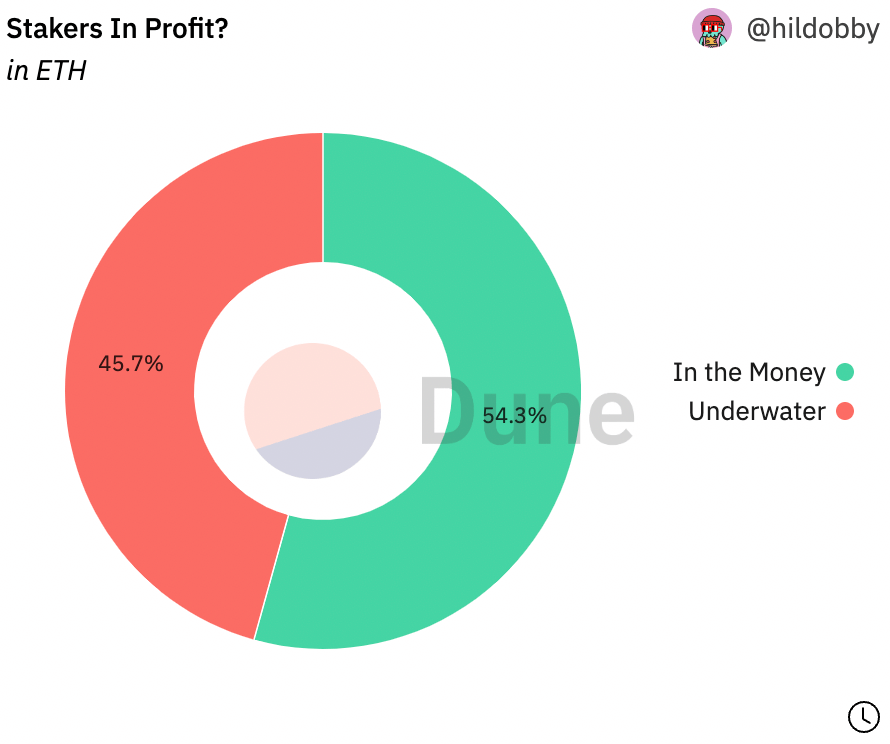

In addition to the change in deposits, withdrawals and rewards, the average value of Ethereum wagered at validators has decreased since withdrawals opened. As a result, 54.3% of stakers are now making profits with ETH around $2,000.

bullish momentum

In the end, both the Shanghai and Capella upgrades appear to have been a success as the network processes new deposits, principal withdrawals and reward payments without any significant issues. Moreover, these actions are performed daily on a volume of billions of dollars worth of Ethereum.

While blockchain networks can certainly still be considered beta in many ways, Ethereum’s ability to smoothly pull off such massive undertakings of live network upgrades is very encouraging for our fast-growing industry.