- Since September, a persistent imbalance in the buy-to-sell ratio has reinforced BTC’s bullish outlook.

- Investors are acquiring $80 billion worth of BTC every month, underscoring demand and growing confidence in the asset.

Bitcoins [BTC] the uptrend could continue despite minor retracements, as observed in the daily time frame. The asset recently saw a decline of 0.28%, which appears to be a natural pullback within its broader rally.

AMBCrypto highlights these price swings as part of BTC’s extended rally, which is analyzed in more detail below.

Short-term holders will avoid a major drop in BTC prices

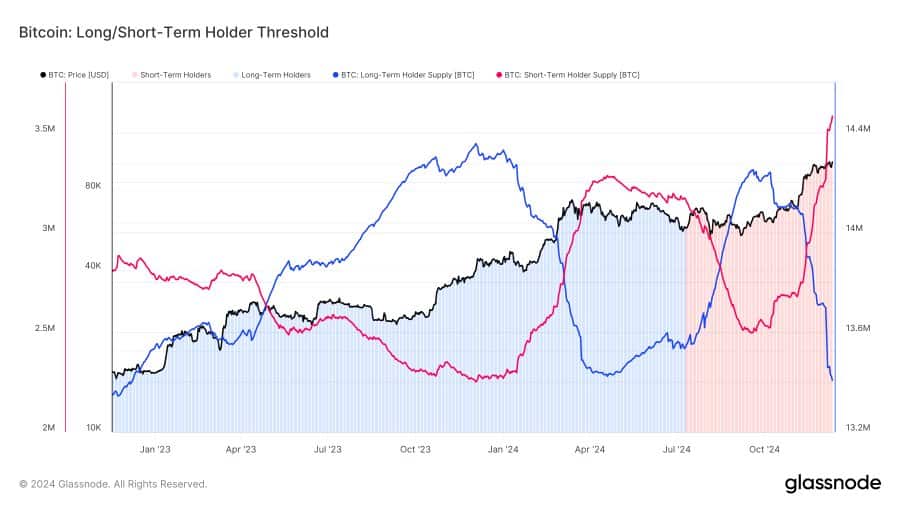

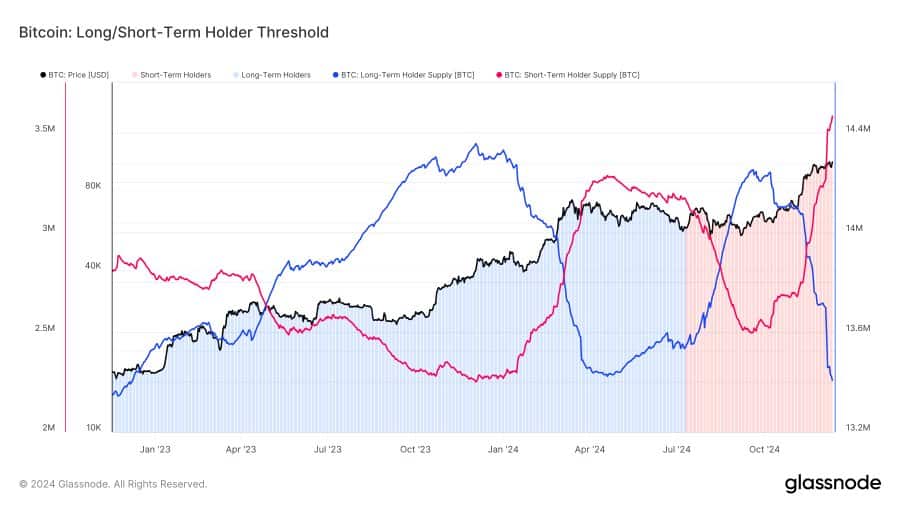

A recent one report by analyst James Van Straten reveals significant trading activity in the BTC market since September, helping to stabilize the price of BTC. The threshold for long/short term holders is currently 1.28, indicating a strong preference for accumulation.

This means that for every BTC sold, buyers purchase approximately 1.28 BTC, which is indicative of continued demand.

Further analysis shows that long-term holders (LTH) – addresses that held BTC for more than two years without transacting – were responsible for most of the sell-off. Meanwhile, it was the short-term holders (STH) or early investors who were actively driving the buying activity.

Source:

Between September and now, a total of 843,113 BTC have been sold, while 1,081,633 BTC has been collected. Daily, buyers acquired 12,432 BTC, compared to 9,690 BTC sold.

This imbalance in favor of buying reflects bullish market sentiment, as increased accumulation prevents BTC from experiencing a sharp price drop. Sustained demand has likely helped BTC maintain its position above $90,000 after its recent all-time high.

Historic moment for BTC

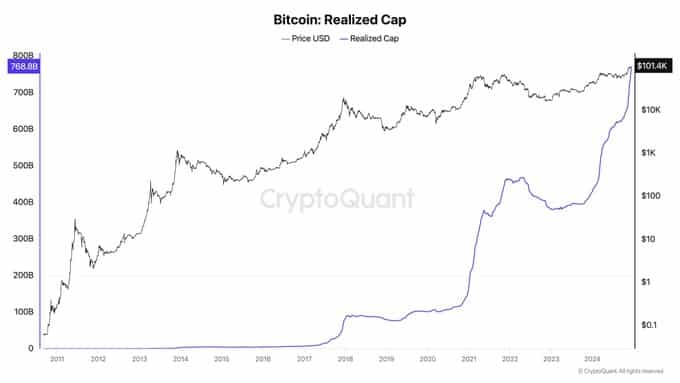

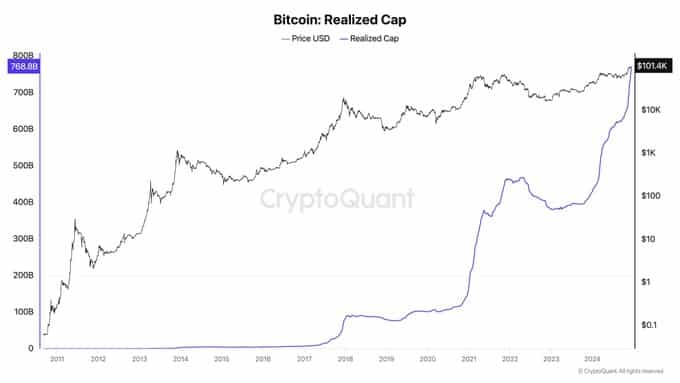

According to analyst Ki Young Ju, Bitcoin has seen a significant influx of funds, with buying activity reaching $80 billion per month.

This development is a very bullish indicator for BTC, indicating that adoption is steadily increasing. More and more retail investors are entering the market and purchasing BTC in larger quantities than ever before.

Ki Young Ju highlighted this momentum and said:

“Nearly half of the capital that entered the Bitcoin market over the past fifteen years was added this year.”

Source:

If this trend continues, BTC’s long-term prospects remain strong, positioning the asset for continued upward movement.

AMBCrypto also analyzed BTC’s immediate market activity to assess its short-term prospects.

BTC maintains bullish momentum

Despite a 0.28% decline in the price of BTC over the past 24 hours, market indicators continue to indicate a bullish outlook.

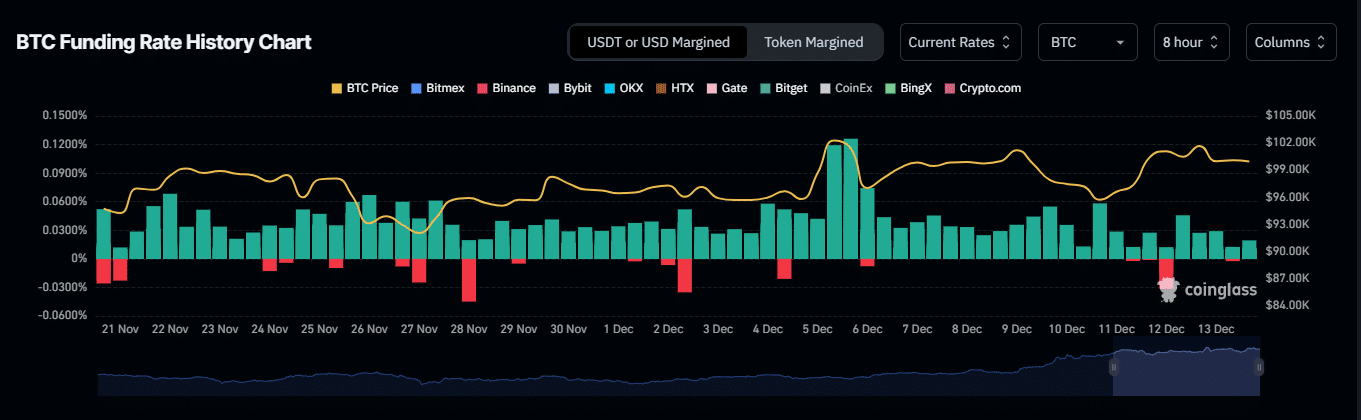

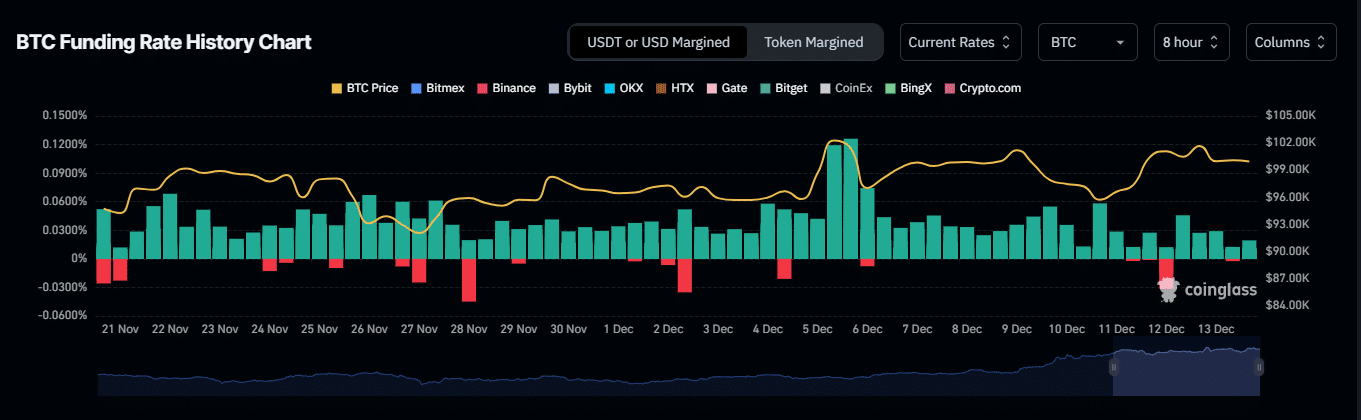

At the time of writing, BTC’s funding rate remains positive at 0.0100% for the past eight hours, according to data from Coinglass.

A positive funding rate indicates that long traders are maintaining price stability in both the spot and futures markets, reflecting overall bullish sentiment and creating opportunities for further price growth.

Source: Coinglass

Read Bitcoin’s [BTC] Price forecast 2024–2025

Furthermore, an analysis of BTC’s long-to-short contract ratio shows that it remains neutral at 1. A move above or below this level could determine the market’s next directional bias.

Given BTC’s long-term prospects and positive funding rate, the current fluctuation appears to be a minor retracement, with the bulls maintaining their advantage.