Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Ethereum again wins at Momentum after tagging the $ 2,739 level and setting a new local high high, reaching prices that have not been seen since the end of February. The rally marks a strong comeback for ETH, which is under considerable pressure earlier this year. Now Bulls seem to be strong in control when the wider crypto market wakes up and capital flows return to Altcoins.

Related lecture

Analysts ask for a potentially altern season, fueled by the relative power of Ethereum against Bitcoin and the growing trust of investors. Because Bitcoin consolidates almost all time, Ethereum has taken the opportunity to perform better and with conviction by pushing important resistance levels.

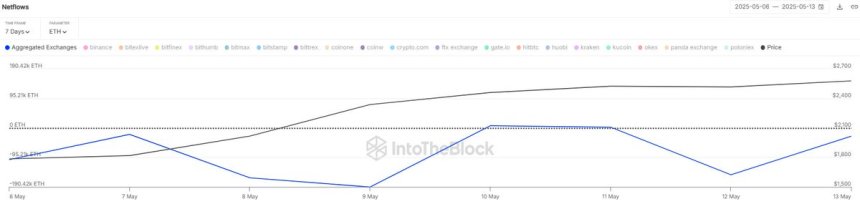

In support of this story, data from Sentora (formerly Intotheblock) reveals that $ 1.2 billion in ETH has been withdrawn from centralized stock exchanges in the last seven days. This persistent trend of net outcomes suggests continuous accumulation and reduced sales-side pressure, both strong signals for long-term bullish momentum.

With the warming of price action and shifting investors, Ethereum could prepare for a large outbreak. If Bulls maintains control, the region of $ 3,000 – $ 3,100 can be tested as the next major resistance zone in the coming days. All eyes are now focused on ETH because the Altcoin market shows signs of life.

Ethereum builds Momentum as an exchange outflow signal accumulation

Ethereum acts above critical levels while the speculation of a persistent rally continues to grow. After weeks of slow movement, ETH has been blunted again and has won more than 50% in value since last week. This sharp step to the advantage has hosted hope for an altiation season, in which many analysts regard Ethereum’s outbreak as the potential trigger for wider Altcoin market strength.

Ethereum now keeps firm above $ 2,600 marking, a level that had been acting as strong resistance for months. This outbreak, in combination with increasing momentum against Bitcoin, suggests that bulls regain control. Traders look closely near the next large resistance zone between $ 2,900 and $ 3,100, which could serve as an important test for the upward trend from Ethereum.

Add to the bullish case, Data from Sentora It appears that the $ 1.2 billion in ETH has been withdrawn from centralized fairs in the last 7 days. This trend has been intensified since the beginning of May, indicating the increased accumulation of investors and reduced sales side. Large exchange outflows are often seen as a sign that holders are planning to store ETH off-exchange, reducing immediate delivery and supporting upward price movement.

Because market sentiment becomes Bullish and Ethereum that leads the leadership, all eyes are now about whether ETH can keep its momentum and the Altcoin market can float in a new growth phase. If accumulation trends persist and bulls contain important levels, the path from Ethereum to $ 3,100 can open the door for a wider markettrally.

Related lecture

Price promotion Details: ETH Testing Key levels

The weekly graph of Ethereum shows a powerful outbreak after weeks of Beerarish, with ETH now being traded around $ 2,599.14. The recent increase pushed the price above both the EMA of 200 weeks ($ 2,259.65) and the 200 weeks SMA ($ 2,451.55), two critical long -term trend indicators. Retaining these levels of signals renewed bullish momentum and a strong shift in sentiment.

The Breakout -candles itself is one of the largest weekly green candles in more than a year, which reflects a sharp intake of the interest of buyers and possibly marks an important reversal point after months. In particular, this step brings ETH to levels that have not been seen since February, with the local high reaching $ 2,739.05 for the week.

The volume has increased considerably during this movement, which confirms the strength behind the rally. However, Ethereum is now confronted with overhead resistance near $ 2,800 – $ 2,900, a zone that previously acted as support at the beginning of 2024 before the breakdown. If Bull’s Momentum retains and this week closes above $ 2,600, this can open the door for a test of the $ 3,100 resistance zone.

Related lecture

On the other hand, the most important support for viewing is around $ 2,450, tailored to the 200 weeks SMA. An absence to maintain that level can invite a retest of $ 2,250. For now the trend is bullish, but next week will be crucial next week.

Featured image of Dall-E, graph of TradingView